Bank Risks

A bank has many risks that must be managed carefully, especially since a bank uses a large amount of leverage. Without effective management of its risks, it could very easily become insolvent. If a bank is perceived to be in a financially weak position, depositors will withdraw their funds, other banks won't lend to it nor will the bank be able to sell debt securities, such as bonds or commercial paper, in the financial markets, which will exacerbate the bank's financial condition. The fear of bank failure was one of the major causes of the 2007 - 2009 Great Recession and of other financial panics in the past. For instance, in 2008, the Royal Bank of Scotland, then the largest bank in the world, with assets of £2.4 trillion, was taken down by a loss of a mere £8 billion pounds, which represented 0.3% of its assets because it was leveraged to the hilt.

Although banks share many of the same risks as other businesses, the major risks that especially affect banks are liquidity risk, interest rate risks, credit default risks, and trading risks.

Liquidity Risk

Liquidity is the ability to pay on demand. A liquid asset is either a means of payment, such as money, or can easily be converted into a means of payment, such as transferring money from a savings account to a checking account. A basic expectation of any bank is to provide funds on demand, such as when a depositor withdraws money from a savings account, or a business presents a check for payment, or borrowers want to draw on their credit lines. Another need for liquidity is simply to pay bills as they come due.

The main problem in liquidity management for a bank is that, while bills are mostly predictable, both in timing and amount, customer demands for funds are highly unpredictable, especially demand deposits (checking accounts).

Another major liquidity risk is off-balance sheet risks, such as loan commitments, letters of credit, and derivatives. A loan commitment is a line of credit that a bank provides on demand. Letters of credit include commercial letters of credit, where the bank guarantees that an importer will pay the exporter for imports and a standby letter of credit which guarantees that an issuer of commercial paper or bonds will repay the principal.

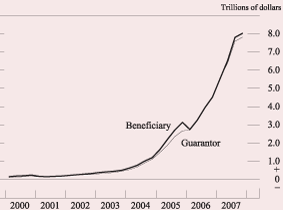

Derivatives are a significant off-balance sheet risk, as evidenced by the collapse of American International Group (AIG) in 2008. Banks participate in 2 major types of derivatives: interest rate swaps and credit default swaps. Interest rate swaps are agreements where one party exchanges fixed interest rate payments for floating rates from another party. Credit default swaps (CDSs) are agreements where one party guarantees the principal payment of a bond to the bondholder.

Liquidity management is achieved by asset and liability management. Asset management requires keeping cash and keeping liquid assets that can be sold quickly at little cost. Liability management is borrowing wisely.

Asset Management

The primary key to using asset management to provide liquidity is to keep both cash and liquid assets. Liquid assets can be sold quickly for what they are worth minus a transaction cost or bid/ask spread. Hence, liquid assets can be converted into a means of payment for little cost.

The primary liquidity solution for banks is to have reserves, which are also required by law. Reserves are the amount of money held either as vault cash or as cash held in the bank's account at the Federal Reserve, called federal funds. It can also include cash that a bank has in an account at a correspondent bank. In the United States, the Federal Reserve determines the amount of required reserves (aka legal reserves, primary reserves), which is expressed as a required reserve ratio, equal to the amount of reserves as a percentage of the bank's demand deposits. A bank may even keep excess reserves in its Federal Reserve account for greater liquidity, especially since the Federal Reserve has started paying interest on these accounts since October, 2008.

Although reserves provide liquidity, they earn little or no money. Vault cash pays no interest at all and Federal Reserve accounts have paid 1% or less. By buying liquid assets, a bank can earn money while maintaining liquidity. The most liquid — and safest — asset is United States Treasuries, of which banks are major buyers.

Banks can also sell loans, especially those that are regularly securitized, such as mortgages, credit card and auto loan receivables.

A bank can also increase liquidity by not renewing loans. Many loans are short-term loans that are constantly renewed, such as when a bank buys commercial paper from a business. By not renewing the loan, the bank receives the principal. However, most banks do not want to use this method because most short-term borrowers are business customers, and not renewing a loan could alienate the customer, prompting them to take their business elsewhere.

Liability Management

A bank can increase liquidity by borrowing, either by taking out a loan or by issuing securities. Banks predominantly borrow from each other in an interbank market known as the federal funds market where banks with excess reserves loan to banks with insufficient reserves. Banks can also borrow directly from the Federal Reserve, but they only do so as a last resort.

Banks are big users of a debt instrument known as a repurchase agreement (aka repo), which is a short-term collateralized loan where the borrower exchanges collateral for the loan with the intent of reversing the transaction at a specified time, along with the payment of interest. Most repos are overnight loans, and the most common collateral is Treasury bills. Repos are usually made with institutional investors, such as investment and pension funds, who often have cash to invest.

The major security that banks sell is the large certificate of deposit (CD), which is highly negotiable, and can be easily sold in the money markets. A large CD is a time deposit of $100,000 or more. (Banks also sell small CDs to retail customers, but these can't be sold in the financial markets.) Other major securities sold by banks include commercial paper and bonds.

Credit Risks

Credit default risk occurs when a borrower cannot repay the loan. Eventually, usually after a period of 90 days of nonpayment, the loan is written off. Banks are required by law to maintain an account for loan loss reserves to cover these losses.

Banks reduce credit risk by screening loan applicants, requiring collateral for a loan, performing a credit risk analysis, and by diversification of risks.

Banks can substantially reduce their credit risk by lending to their customers, since they have much more information about them than about others, which helps to reduce adverse selection. Checking and savings accounts can reveal how well the customer handles money, their minimum income and monthly expenses, and the amount of their reserves to hold them over financially stressful times. Banks will also verify incomes and employment history, and get credit reports and credit scores from credit reporting agencies.

Collateral for a loan greatly reduces credit risk not only because the borrower has greater motivation to repay the loan, but also because the collateral can be sold to repay the debt in case of default.

When banks make loans to others who are not customers, then the bank must rely more on credit risk analysis to determine the credit risk of the loan applicant. Credit risk analysis is the determination of how much risk a potential borrower poses and what interest rate should be charged. The potential risk of a borrower is quantified into a credit rating that depends on information about the borrower as well as statistical models of the business or individual applicant. There are credit rating agencies for businesses, such as Moody's or Standard & Poor for larger entities and Dun & Bradstreet for smaller businesses and Experian, TransUnion, and Equifax for individuals. Most of these credit reporting agencies assign a number or other code that signifies the potential risk of the borrower. A bank will also look at other information, such as the borrower's income and history.

Diversification can also reduce credit risk — making loans to businesses in different industries or to borrowers in different locations.

Interest Rate Risk

A bank's main source of profit is converting the liabilities of deposits and borrowings into assets of loans and securities. It profits by paying a lower interest on its liabilities than it earns on its assets — the difference in these rates is the net interest margin or the net interest income.

However, the terms of its liabilities are usually shorter than the terms of its assets. In other words, the interest rate paid on deposits and short-term borrowings are sensitive to short-term rates, while the interest rate earned on long-term liabilities is fixed. This creates interest rate risk, which, in the case of banks, is the risk that interest rates will rise, causing the bank to pay more for its liabilities, and, thus, reducing its profits.

For instance, if a bank has a loan for $100 for which it receives $7 annually in interest, and a deposit of $100 for which it pays $3 per year in interest, that is a net interest margin of $4. But if current market interest rates for deposits rises to 4%, then the bank must start paying $4 for the $100 deposit while still receiving 7% on the long-term loan, decreasing its profit by 25%.

All short-term and floating-rate assets and liabilities are interest-rate sensitive — the interest received on assets and paid on liabilities changes with market rates. Long-term and fixed-rate assets and liabilities are not interest-rate sensitive. Interest-rate sensitive assets include savings deposits and interest-paying checking accounts. Long-term CDs are not interest-rate sensitive.

So for a bank to determine its overall risk to changing interest rates, it must determine how its income will change when interest rates change. Gap analysis and duration gap analysis are 2 common tools for measuring the interest rate risk of bank portfolios.

Gap Analysis

Gap analysis provides an overall look of how income or net worth of a financial institution might change with interest rates. However, it is impossible to forecast prepayments, changes in deposits, and changes in other cash flows, so gap analysis is generally supplemented with more sophisticated tools, such as scenario analysis and value at risk. Gap analysis is the difference between the value of the interest rate sensitive assets minus the value of the interest rate sensitive liabilities (the gap) multiplied by a 1% change in interest rates.

Gap = Value of Interest Rate Sensitive Assets − Value of Interest Rate Sensitive Liabilities.

Change in Bank's Profit = Gap × Change in Interest Rate

Example: Gap Analysis - Calculating the Change in a Bank's Profit After a Change in the Market Interest Rate

Consider $100 of the bank's assets bought with $100 worth of liabilities. How much will a bank's profit decline if the interest rate on both assets and liabilities that are interest rate sensitive increases by 1% and if:

- Value of Interest Rate Sensitive Assets = $20

- Bank has $80 worth of assets that are not interest rate sensitive, but we won't consider either the assets or liabilities that are not interest rate sensitive, since they will not be affected by a change in interest rates.

- Bank receives 7% interest on the $20.

- $20 × 7% = $1.40

- After interest rate rises by 1%, revenue increases to:

- $20 × 8% = $1.60

- Value of Interest Rate Sensitive Liabilities = $60

- Bank initially pays 3% on its liabilities.

- $60 × 3% = $1.80

- Although this is more than what it is earning on its interest rate sensitive assets, it is making a lot more on its assets that aren't interest rate sensitive. Remember, we are only interested in the change in profits.

- After the interest rate rises by 1%, the equation becomes:

- $60 × 4% = $2.40

- Bank initially pays 3% on its liabilities.

- Originally, the difference in revenue was:

- $1.40 - $1.80 = - $0.40

- After the interest rate increase, the revenue becomes:

- $1.60 - $2.40 = - $0.80

- Thus, the profit declines by $0.40 from -$0.40 to - $0.80 for every $100 in assets.

But there is a much simpler way to calculate the change in profits. Since the gap in interest rate sensitive assets and liabilities is -$40, we simply multiply this gap by the change in interest rate to obtain the same result as above:

- Gap = $20 - $60 = -$40

- Change in Profit = -$40 × 1% = -$0.40.

Remember, this profit is negative because the value of the interest rate sensitive liabilities is much larger than the value of the interest rate sensitive assets. The bank is, however, making much more profit overall because the proportion of assets that are not sensitive to interest rates is twice as large as the corresponding liabilities. So considering only the assets and liabilities that are not interest rate sensitive, we have:

- Interest received on assets = $80 × 7% = $5.60

- Interest paid on liabilities = $40 × 3% = $1.20

- Profit on assets which aren't interest rate sensitive to corresponding liabilities: $5.60 - $1.20 = $4.40

When the interest rate margin is added from both categories of assets and liabilities, then, before the interest rate change:

- Profit = $4.40 - $0.40 = $4.00

After the interest rate rises by 1%:

- Profit = $4.40 - $0.80 = $3.60

So the bank's overall profit decreases by 40¢ for every $100 in assets, which is a change of 40 basis points (1 basis point = 0.01%).

More sophisticated gap analysis takes into account the different terms of the different assets and also convexity, but the calculations are far more complicated.

Duration Gap Analysis

Since interest rates affect the prices of bank assets and liabilities in the same way that they affect bonds, bankers also use a tool commonly used in bond portfolio analysis — duration gap analysis. Duration gap analysis measures the sensitivity of a financial institution's net worth to changes in interest rates. Pension funds, insurance companies, and banks use immunization strategies to match income to payouts. Usually, these institutions have an economic surplus, which is the difference in the market value of the assets minus the present value of the liabilities.

The economic surplus will vary with interest rates, depending on the duration gap, which is the difference between the duration of assets and of liabilities. Duration measures the change in asset prices or the cost of liabilities when the interest rate changes by 1%. Duration is additive, in that the duration of a portfolio = the average duration of the underlying assets weighted by the proportion of each asset in the portfolio. Therefore, analyzing the average duration of portfolios of both assets and liabilities is generally easier than measuring how each asset or liability will change in response to changing interest rates. Thus, duration gap analysis is forecasting how the portfolio will change as interest rates change. Like duration, the duration gap is measured in years:

| Duration Gap | = | Average Duration of Assets | − | Market Value of Assets Market Value of Liabilities | x | Average Duration of Liabilities |

If the duration of assets exceeds the duration of liabilities, then the economic surplus will vary inversely to interest rates, increasing if rates decrease and decreasing if rates rise. If the duration of the assets is shorter than the liability duration, then the surplus will vary with interest rates. If the durations of assets and of liabilities are the same and the market value of the assets = the market value of the liabilities, then the interest rate will have little or no effect on the economic surplus.

Like duration, duration gap analysis is accurate for only small changes in the interest rate. Furthermore, a flat yield curve is assumed, with all maturities having the same interest rate. Since flat yield curves are uncommon, duration gap analysis is not the best tool to measure interest rate risk, but it does give a first-order indication of how a bank's net worth will change in response to changing interest rates.

After the duration gap is calculated, the percentage change in the net worth of a bank for a given change in interest rates can be calculated with the following equation:

| Net Worth Change Market Value of Assets | = | − | Duration Gap | × | Interest Rate Change 1 + Interest Rate |

Example: Calculating the Change in Net Worth from the Duration Gap

A bank with $100 million worth of assets, with an average duration of 2.5 years, has $90 million worth of liabilities, with an average duration of 3.5 years. Calculate the duration gap, then calculate how much the net worth of the bank would change if interest rates increased from 10% to 11%.

| Average Duration of Assets | 2.5 | |

| Average Duration of Liabilities | 3.5 | |

| Market Value of Assets (Million) | 100 | |

| Market Value of Liabilities (Million) | 90 | |

| Duration Gap | -1.39 | = Asset Duration − Asset Market Value / Liability Market Value × Liability Duration |

| Interest Rate | 10% | |

| Changing Interest Rate | 1% | |

| Net Worth Change as a Percentage of Assets | 1.3% | = -Duration Gap × Interest Rate Change / (1 + Interest Rate) |

Note that because the average duration of liabilities exceeds the average duration of assets, net worth increases as the interest rate increases.

Reducing Interest Rate Risk

Banks could reduce interest rate risk by matching the terms of its interest rate sensitive assets to it liabilities, but this would reduce profits. It could also make long-term loans based on a floating rate, but many borrowers demand a fixed rate to lower their own risks. In addition, floating-rate loans increase credit risk when rates rise because the borrowers have to pay more each month on their loans, and, thus, may not be able to afford it. This is best exemplified by the many homeowners who defaulted because of rising interest rates on their adjustable rate mortgages (ARMs) during the 2007 – 2009 Great Recession.

Increasingly, banks are using interest rate swaps to reduce their credit risk, where banks pay the fixed interest rate they receive on their assets to a counterparty in exchange for a floating rate payment.

Trading Risk

Generally, greater profits can be made by taking greater risks. A bank's leverage ratio is limited by law, but it can try to earn greater profits by trading securities. Although United States banks cannot, by law, own stocks, they can buy debt securities and derivatives. For this, banks hire traders for a separate department that specializes in trading securities.

The risk of trades is measured by standard statistical tools for measuring investment risk: standard deviations and value at risk (VaR). However, many banks use more sophisticated financial models to gauge risk and to increase their profits, but the 2007 – 2009 Great Recession showed that many of these models were faulty.

Also, rogue traders can cause stupendous losses for banks, even causing their bankruptcy. Consider Barings Bank that started in 1762, and was considered the most stable and safest bank for centuries. In 1995, Nick Leeson lost more than 860 million pounds trading Japanese equities in Singapore. Barings was unable to provide the cash to cover the losses, so it collapsed.

The 2007 - 2009 Great Recession has also shown the tremendous risks presented by derivatives, which are securities whose value depends on an underlying asset or index. The most common derivatives bought and sold by banks are mortgage-backed securities (MBS), interest-rate swaps, and credit default swaps (aka credit derivatives).

Foreign Exchange Risk

International banks trade large amounts of currencies, which introduces foreign exchange risk, when the value of a currency falls with respect to another. A bank may hold assets denominated in a foreign currency while holding liabilities in their own currency. If the exchange rate of the foreign currency falls, then both the interest payments and the principal repayment will be worth less than when the loan was given, which reduces a bank's profits.

Banks can hedge this risk with forward contracts, futures, or currency derivatives which will guarantee an exchange rate at some future date or provide a payment to compensate for losses arising from an adverse move in currency exchange rates. A bank, with a foreign branch or subsidiary in the country, can also take deposits in the foreign currency, which will match their assets with their liabilities.

Sovereign Risk

Many foreign loans are paid in U.S. dollars and repaid with dollars. Some of these foreign loans are to countries with unstable governments. If political problems arise in the country that threatens investments, investors will pull their money out to prevent losses arising from sovereign risk (aka political risk). In this scenario, the native currency declines rapidly compared to other currencies, and governments will often impose capital controls to prevent more capital from leaving the country. It also increases the value of the foreign currency held in the country; hence, domestic borrowers are often prohibited from using foreign currency, such as U.S. dollars, to repay loans to foreign lenders, to try to conserve the more valuable currency when the native currency is declining in value.

Operational Risk

Operational risk arises from faulty business practices or when buildings, equipment, and other property required to run the business are damaged or destroyed. For instance, banks in the vicinity of the World Trade Center suffered considerable losses as a result of the terrorist attacks on September, 11, 2001, which knocked out power and communications in the surrounding area. Barings Bank collapsed because its audit controls did not detect the calamitous losses suffered by its rogue trader, Nick Leeson, early enough to prevent its collapse.

Another result of operational risk is the $6.2 billion loss suffered by J.P. Morgan Chase Bank in 2012 because of the so-called "London Whale" trades in a synthetic credit portfolio managed by its traders in its Chief Investment Office (CIO) in London. There was a failure to accurately monitor the increasing risk of the portfolio, and when the risk became known to upper management, the response to the risk was inadequate. The CIO had too much control over their own operations, allowing them to hide the increasing risk by changing their risk models and by marking the portfolio to market in a way that favored the traders' position, but did not reflect the true risk. A detailed account of what happened is provided in a report by the Financial Conduct Authority.

Many types of operational risk, such as the destruction of property, are covered by insurance. However, good management is required to prevent losses due to faulty business practices, since such losses are not insurable.