Money in Colonial America

There were no banks in Colonial America. Not until after the beginning of the United States would banks become prevalent, starting with the Bank of North America in 1781, chartered by the state of Pennsylvania. The main concern of the colonists, in the beginning, was finding a means of payment for transactions: money.

At first, the American colonists used the same types of money as the American Indians: wampum, which were decorative shells strung together, and furs. Barter was also used, especially specific items that had a well-known intrinsic value and where the amount could easily be varied, such as crops and nails, or items brought when they immigrated from Europe and other countries.

Later, silver and gold coins, otherwise known as specie, were the main types of commodity money used in Colonial America. Since silver and gold are limited in quantity, and new sources are not easily found nor easily mined, specie could not be counterfeited and their quantity could not be easily increased, so they kept their store of value. However, the colonial economy soon outgrew its supply of specie.

Unlike in Spanish America, there was little gold or silver found in the original 13 colonies. What little commodity money existed in colonial America came from Great Britain and from trading with the Spanish colonies in the Caribbean and Central America, but it was not enough for the colonial economy. Because British currency was required to pay for British imports, the main type of money used in the colonial economy was the Spanish dollar coin, which could be subdivided into 8 pieces or bits, to pay for lower-priced items. (So a "quarter" of a Spanish dollar was 2 bits.)

Word Origins — Dollars, Bucks, Quarters, and Bits

During the colonial era, the 2 major types of specie circulating in the colonies were the British pound and the Spanish dollar. So why is the currency in America, a British colony, called a dollar instead of a pound?

Colonial America had a trade deficit with England and a trade surplus with Spain and its colonies to the south. America had to pay for its trade deficit to England with pounds, naturally, since the British exporters wanted to be paid in pounds. So there were more Spanish dollars circulating in America than British pounds; hence, Spanish dollars were the main coins used as currency in colonial America. To make change, the Spanish dollar was cut into 8 pieces, or bits, and, thus, a quarter was often called two bits. A dollar was called a buck because in the 18th century, a buckskin, which is the hide of a male deer, was worth 1 dollar.

Credit was provided by other colonists, from merchants, and from banks in Great Britain. Colonial money was multifarious: commodity money, foreign currencies and coins, barter, and currency issued by Colonial governments, where the governments stipulated the exchange rate between their currency and another form of money, usually commodity money. Foreign currencies were mainly British and Spanish currencies. Although barter was never a good form of money, certain products, such as tobacco, were prevalent enough and had a well-known value, especially in the southern colonies, to serve as an adequate form of money.

Paper Currency

But the economy grew, increasing the demand for money, which was not easily available in colonial America. As Benjamin Franklin noted, much of the gold and silver was used to pay for British imports, thus lowering the quantity of money in the local economy, depressing local businesses and trade. Colonial governments alleviated the shortage of money by printing paper money, and most of these paper currencies were called dollars, after the most common form of commodity money in the colonial colonies. The term dollar originated from German and was applied to coins of any country that could be exchanged for their weight in silver. Although the colonists had some British pounds, British currency was needed to pay for British imports, which depleted the colonial economy of that currency. Through extensive trades with the Spanish, the colonists accumulated many more Spanish dollars than British pounds, so Spanish dollars were the main form of commodity money in the colonies.

The Massachusetts Bay colony issued the 1st paper currency to pay soldiers fighting against the French in Canada. Each of the other colonies also started to issue their own currency later. The money had no uniform value, and some colonies issued more paper currency than they could redeem, thus foreshadowing what early banks would do in the United States. The Carolinas, New Jersey, and New York issued paper currency before 1720. These early currencies were mostly used to finance wars, but by the 1720s, colonial governments were issuing paper money for the general economy. These early forms of paper money were called bills of credit, which could be used to pay taxes and other government expenses, thus giving it real value in that respect.

The Pennsylvania legislature issued its 1st paper money in 1723, equivalent to 15,000 pounds or 48,000 Spanish silver dollars. More was issued in 1724, equivalent to 30,000 pounds. Although this early currency was not backed by gold or silver, holders of these notes could pay government taxes. However, this early paper money usually had an expiration date, so the currency could only be used to pay the government with their currency within that time, allowing the government to somewhat control the supply of money.

The Need for Paper Currency

There was much debate about using paper currency, since it often lost value. Many colonial legislatures often issued large amounts of currency, promising to back the currency in the future. But since the legislatures did not really know how much money the economy required and probably didn't care, it was easy to simply issue the currency to pay their debts or to finance their operations, especially military operations. Moreover, because the currency was not standardized, each of the 13 colonies issued currency that varied in appearance and value and was often counterfeited, making it difficult for the people to determine legitimate currency. Furthermore, because British merchants could not be sure which currencies were issued by colonial governments, the British Parliament passed the Currency Act in 1764 prohibiting the colonies from issuing any more American paper money, which, like the Stamp Act, would became another factor in motivating the colonists to secede from the British Empire.

Many people had argued that paper currency was necessary, and 1 of the strongest proponents of paper currency was Benjamin Franklin, who also had a printing press to publish his arguments.

Franklin argued in favor of paper currency in 1729 with his anonymously published treatise: "A Modest Inquiry into the Nature and Necessity of a Paper Currency". So that paper money can keep its value, Franklin argued that legal tender laws, which require that creditors accept the money as settlement of all debts and obligations, or fixed exchange rates between paper money and commodity money, such as gold or silver coins, is not what guarantees the value of money, but that the quantity of paper money relative to the volume of business within the colonies is what determines its value. Excess money over what the economy requires will cause the value of the paper currency to decline. Hence, to maintain value, the quantity of the currency must be carefully controlled so as to maintain monetary equilibrium, when the supply of money equals its demand.

Franklin buttressed his support for paper currency by alluding to the fluctuation of gold and silver itself, such as when large amounts of gold and silver were discovered by the Spanish in Central America, thus causing the value of those commodities to decline because they increased faster than what the economy required. He also argued that silver and gold had greatly increased in value during the colonial period because most of it was exported to England to pay for British goods. The best way to steady the value of paper money is by basing it on land, because the value of land does not fluctuate as easily as commodities or paper currency nor can it be exported to a foreign country. So, he argued, the legislature should issue currency through a loan office where the people who acquire the money pledge land as collateral for the loans.

In colonial times, people bought land from the government, often in the form mortgages. So Franklin argued that basing paper currency on land would keep the supply of money close to the needs of the economy. If there is not enough money, then people would borrow more money to lower the transaction costs, to avoid the inconvenience of barter. If there is too much paper money, then people would use the money to pay off their mortgages to the government, thus reducing the quantity of money in circulation. This automatic stabilization of the paper currency value stabilizes the price level within the colonies.

Thwarting Counterfeiting

Because currency was not standardized, printers could make counterfeit bills. To thwart counterfeiting, some bills were cut on one side as a wavy line, and these bills could only be redeemed for specie at a government office if the wavy line matched a standard held at the office. The problem with the wavy line solution is that the bill may become used enough that it would no longer fit the pattern.

Benjamin Franklin had another solution, whose company printed paper money for Pennsylvania, Delaware, and New Jersey. In 1739, he printed bills that deliberately misspelled Pennsylvania, based on the assumption that any counterfeiters would correct the spelling. (Of course, there is no current information on how many colonialists thought of Franklin's money as counterfeit because Pennsylvania was misspelled, since there was probably an expectation even then that the government would be more competent.)

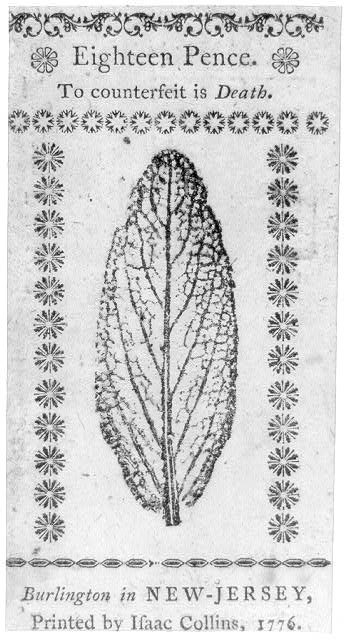

Another Franklin innovation that helped to thwart counterfeiters was his ability to print leaves and other intricate patterns, which were difficult to reproduce using blocks of lead. In 1737, Franklin invented the process of printing intricate details of nature, by using a copperplate press for transferring the image onto the paper money bills. An image of a leaf was often used because it had complex veins that could not easily be copied by counterfeiters. This process was 1st used in 1737 on a New Jersey note.

The Issuance of Paper Currency by Colonial Governments Ends

The issuance of paper currency by colonial governments ended when the 1787 Constitutional Convention passed resolutions forbidding state and national legislatures from issuing their own paper money. Instead, paper money would be issued by banks that were chartered and regulated by the government, even though they were private businesses. Additionally, the Continental Congress also started to issue its own currency — called naturally enough, continentals — to finance the Revolutionary War.

![Eighteen pence. No. 6886 THIS BILL by Law shall pays current in New Jersey, for Four Penny-weight and Nine Grains of SILVER. John Smyth, [?] Printed on June 22, 1756.](../images/18-pence-1756.jpg)

Benjamin Franklin 1st developed a technique to engrave intricate patterns based on nature, such as the intricate veins of leaves, to make it more difficult to counterfeit.

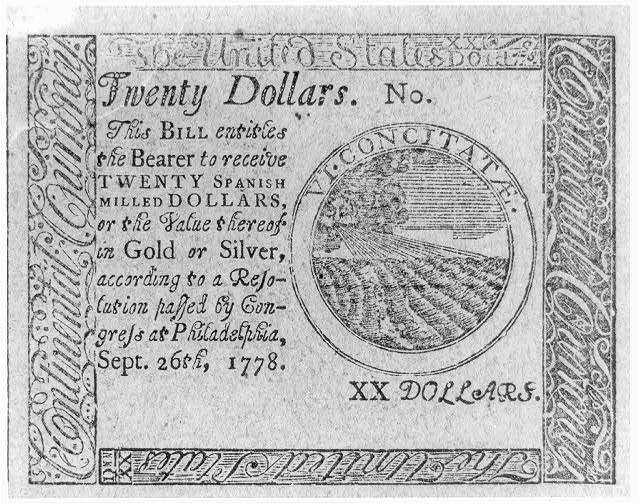

![Colonial currency, with the following inscription: "Twenty dollars. Printed by Hall and Sellers, 1778. [Philadelphia]"](../images/colonial-20-dollar-bill.jpg)

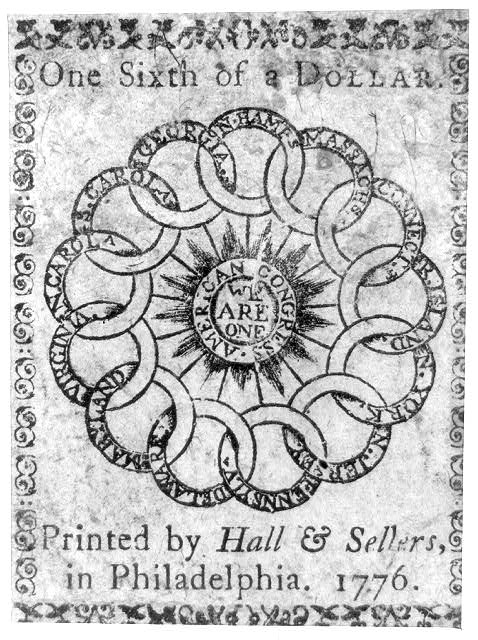

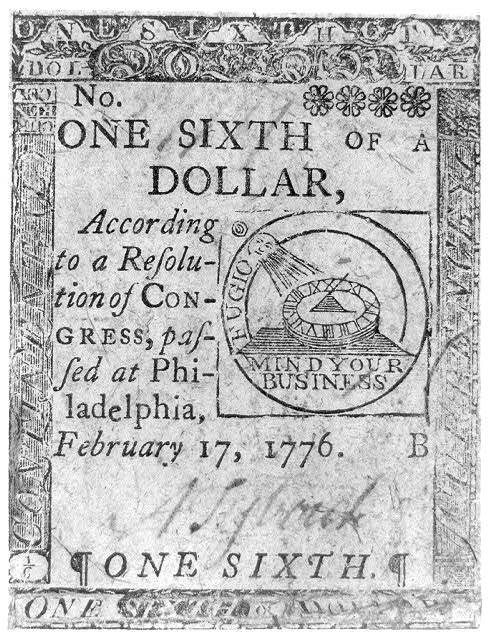

Verso of bill showing emblem of 13 states linked as a circle. Center of circle has the text "American Congress, We Are One". This currency was designed by Benjamin Franklin, who also printed much of the currency during the colonial period, including the continentals. The obverse side of this bill had an aphorism that was also published in Benjamin Franklin's Poor Richard's Almanac: "MIND YOUR BUSINESS". Benjamin Franklin printed Pennsylvania's currency from 1731 through 1749, and with his partner David Hall, from 1749 to 1764. He also printed some currency for Delaware and New Jersey. When Benjamin Franklin returned to London in 1764, he sold his interest to Hall.