Secured Property — Surrendering, Redemption, and Reaffirmation

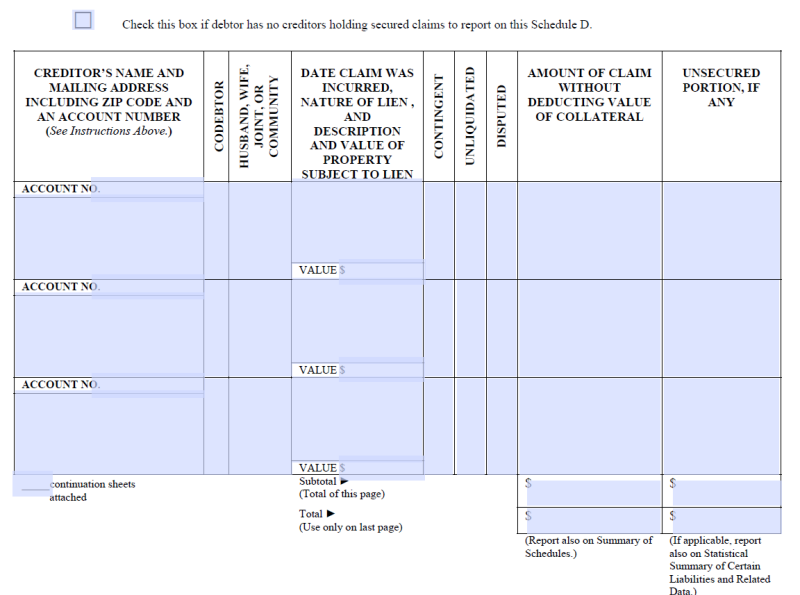

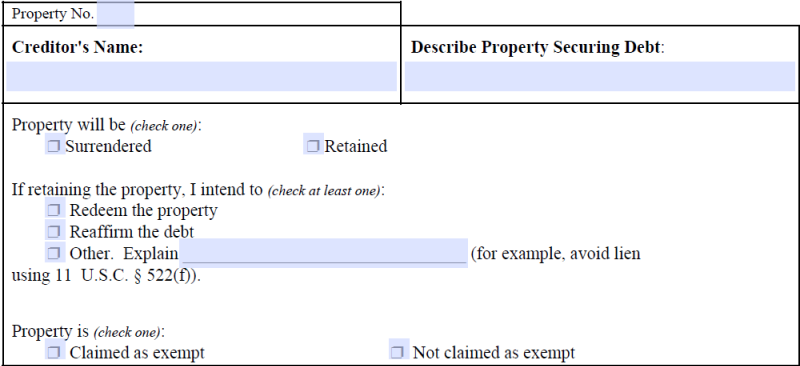

If some of your debt is secured with property, such as an auto loan, then, in your Chapter 7 bankruptcy petition, you must fill out Schedule D - Creditors Holding Secured Claims listing, among other things, the name and address of each creditor that has a security interest in your property. For each secured property, you must indicate what you want to do with that property in the Chapter 7 Individual Debtor's Statement of Intention. For each property, you must list the name of the creditor and a description of the property. Then you have to check what you want to do with it. There are 3 main choices available — all of them must be done within 30 days of your 1st creditors meeting. (Usually, there will be only 1 creditors meeting, although, rarely, it may be continued at a later date.) You can surrender the property by giving it back to the creditor, you can redeem the property, or you can sign a Reaffirmation Agreement. Secured creditors must also file a proof of claim against the bankruptcy estate, and also provide a copy of the agreement providing the security interest as well as evidence of any perfected liens on the property.

You must file your Statement of Intention and send a copy to each creditor listed and to the trustee within 45 days of your filing date.

Surrender Property

You surrender property by giving it back to the creditor. The creditor must pick it up or foreclose on it within 30 days after the 1st creditors meeting; otherwise, you can keep the property free and clear. If the property has little value, or is difficult to store or sell, then the creditor may abandon it. Your Chapter 7 discharge will relieve you of all liability for the debt, even if the creditor abandons it.

Redemption

You redeem property by paying its replacement value — not the amount owed on the debt, unless it is less — in a lump sum to the creditor within 30 days of the 1st creditors meeting. It may be possible to pay in installments, if the creditor agrees, especially if you are willing to pay a higher price than the replacement value.

However, you can only redeem property if:

- The debt is a consumer debt, meaning it was incurred primarily for personal, family, or household use.

- The property is personal tangible property, which is property that can be touched, such as furniture, appliances, and cars.

- You are either claiming the property as exempt or the trustee has abandoned it. The trustee will abandon property if your unencumbered equity minus your exemption amount for the property is less than the cost to sell the item. In such a case, there would be no money to distribute to your unsecured creditors, so the trustee just abandons it.

To know what to pay, you and your creditor must decide on the replacement value of the property. You can get a good idea of replacement costs for most items on the Internet. However, if you and your creditor cannot agree on the replacement value, then you can ask the court for a valuation hearing to determine the replacement value.

Once the replacement value is determined, then you and your creditor must sign a redemption agreement. If you agree to pay in installments, then this should also be in the redemption agreement.

The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) has added an exception to redeeming motor vehicles. If the vehicle was purchased within 910 days of your filing date, then you can only redeem it by paying the full amount of the debt, not just the replacement value.

Reaffirmation

To reaffirm a debt, you sign a Reaffirmation Agreement with your creditor in which you promise to continue making payments to keep the property, and, as with surrendering and redemption, you must do so within 30 days after the creditors meeting. The creditor must agree to the terms of the contract and, if you are not represented by an attorney, the court must approve of the agreement as well.

The Reaffirmation Agreement must comply with the following requirements added by the BAPCPA:

- the amount of the affirmed debt

- date of 1st payment

- the interest rate being charged

- the right to rescind the agreement

- court filing requirements

- a certification that the agreement poses no undue hardship on the debtor.

BAPCPA also allows lenders of auto loans to require that the debtor sign a reaffirmation agreement; otherwise, the lender will be permitted to repossess the car.

Generally, the court will not approve of a Reaffirmation Agreement, if it would create an undue hardship for you. If there is little money left over after subtracting your expenses from your income, then the court will probably not approve the agreement.

If you fail to make prompt payments, then the creditor will have the right to repossess or foreclose on the property, and sell it to pay off your debt. If the amount is less than what you owed, then you may be liable, depending on state law, for the deficiency. The debt will not be discharged.

You must file the Reaffirmation Agreement with the bankruptcy court, and if you are not represented by an attorney, you must attend a discharge hearing in which the judge will determine if you really understand the Reaffirmation Agreement and its consequences.

You can cancel a Reaffirmation Agreement by notifying the creditor either before you receive your discharge or within 60 days after filing the agreement with the court, whichever is later. However, if you received your discharge and your case is closed, then you cannot select any other option for the property, so if you intend to cancel, do so before your discharge.

The main advantage of a Reaffirmation Agreement is that it allows you to keep property that is more valuable than the debt on the property. When it would not be feasible to redeem the property because it is too valuable, such as your house or a car, then a reaffirmation will probably be the only way that you can keep the property.

The main disadvantage is that you will be liable for the debt even if the collateral loses value — even if it is destroyed completely.

If You Do Nothing

If you do not surrender, redeem, or reaffirm your secured property within 30 days after the 1st creditors meeting, then the automatic stay will be lifted, freeing the creditor to repossess it, even if you continued making payments on the loan. Hence, it would behoove you to be sure that you select one of these options by the due date.