Market Sentiment

Sentiment is defined as a general view or opinion. Market sentiment is defined as the general view held by the public regarding the financial markets. Because many investors consider market sentiment to be a prognosticator of future stock prices, investors want to know the current market sentiment to guide their investment decisions. Some investors will invest more if they consider market sentiment to be positive. Contrarians, by contrast, invest less when market sentiment is deemed to be positive and invest more when market sentiment is negative, they act contrarily to the market.

Market sentiment is the basis of all technical analysis. It is market sentiment that causes prices to diverge from what fundamental analysis would dictate to be the intrinsic, or true, value of an asset. It forms the patterns of charts and quantifies the indicators. Without market sentiment, there would be no bubbles or financial crises, since the price of everything would be determined by fundamental factors, not by what the market is doing.

Market sentiment is the emotions and the feelings of the market participants about the market and the economy. Investor psychology and behavioral finance are the study of how emotions move the market. The Efficient Market Hypothesis (EMH) postulates that prices are determined by fundamental factors, but reality shows otherwise. How else to explain the stock market bubble of the 1990's or the real estate bubble that followed a few years afterward? Although fundamental factors do ultimately rein in excess confidence or pessimism, greed and fear of the uninformed investors have a large effect on prices most of the time.

To illustrate, consider the stock market bubble. As stocks rise, stockholders become overjoyed as their wealth increases, which causes them to buy even more. They tell their friends, show them their portfolios, and talk about what they will do with their newly found wealth. As their friends hear this, and see in the news that the stock market continues its upward trend, then they, too, want to invest, for if they don't, they will have missed a great opportunity, what is commonly called the fear of missing out (FOMO). When they invest, they bid stock prices ever higher, and as it rises higher, even more people pile in. Both the greed for more money and the FOMO drives prices far higher than can be justified by the fundamentals of the underlying businesses. At the peak of the market, optimism is at a maximum.

But the market peaks because the overconfident people have no more money to invest, no more money to keep the stock market rising. As Joseph Kennedy noted at the end of the 1920's, when the shoeshine boy starts giving stock tips, it's time to get out. Why? Because even the shoeshine boy has already invested. There is no other pool of investors to keep the market propped up. When the market stops rising, then people become fearful that they will lose their wealth, so they start taking out their money. As stocks are sold and money is withdrawn, the stock market starts declining rapidly; people become ever more fearful and withdraw even more. Pessimism takes hold of the market, for who can know where the bottom is. And as more people withdraw their money, the bottom falls even faster and lower, until at some point, most of the money of uninformed investors has been withdrawn. Informed investors realize that the market has been oversold, and thus, start buying, preventing the market from falling further.

Market sentiment is often explained as a measure of crowd behavior, how people behave under the influence of other people. People have a strong tendency to conform to the crowd, and, thus, will think and act differently in crowds than they would as individuals uninfluenced by others. Hence, people develop common ideas and common goals and start doing the same things. So when the crowd is buying, most others join in; likewise when they are selling.

It is this market psychology that forms the basis of contrarian investing — selling when the masses are buying and buying when they are selling. Contrarian investing could not exist if the efficient market hypothesis were true, since prices would only be determined by fundamentals. Contrarian investing can only exist because prices, more often than not, are determined by market sentiment.

As a measure of the expectations of the crowd, market sentiment is best used as an indicator for the general markets, not for specific securities. And because crowd expectations are varied and virtually impossible to quantify, market sentiment falls into 2 basic categories: bullish sentiment and bearish sentiment. So sentiment indicators are most often used with other indicators and signals to determine when to buy and sell.

Informed and Uninformed Market Players

To explain these market dynamics, the market is conjectured to be primarily composed of 2 groups: informed players and the much larger group of uninformed players. The informed player is considered the professional, who understands the valuation of assets according to fundamentals, but the uninformed players have little or no understanding of asset valuation, and, thus, it does not guide their buying and selling decisions.

There are also liquidity players, market participants who buy or sell, not because of market forecasts, but because of organizational objectives or because they need the money, as when a pension fund needs to make payments to retirees or a mutual fund needs to sell to pay for redemptions, However, liquidity players are not thought to have a significant effect on prices most of the time, because their actions, motivated by individual needs, are not concerted.

Since the uninformed masses are a much larger group, they also have more money, and, thus, are a more important determinant of market prices. However, it would be wrong to assume that only uninformed players buy when prices are high and sell when they are low. For instance, in 1995, after the stock market had already risen considerably since 1990, it was still destined to continue rising over the next 5 years. If informed players didn't buy during this period, then they would have missed many profitable opportunities. Indeed, if they had sold short, thinking that assets were overpriced compared to fundamentals, they would have suffered substantial losses. Hence, because market sentiment seems to be more important in the pricing of securities than fundamentals, a trader who accurately forecasts market sentiment will be more successful than one who only considers fundamentals. In this way, even informed players are swayed by the crowds.

Market Sentiment Indicators

The price move of any security is due in part to market sentiment. When there is little or no news about a security, then market sentiment may be the biggest factor in any price moves in the short run. Even when important news about a particular company or security is published, the resultant price moves are often enhanced or diminished by whether the market is bullish or bearish at that time.

There are many attempts to accurately gauge market sentiment and so there are many different kinds of sentiment indicators — only a few are presented here. While some sentiment indicators, such as volume indicators, can be used for individual securities, most market sentiment indicators are based on broad market data.

Some older market indicators are based on the idea, right or wrong, that uninformed traders usually make the wrong decision, buying at market tops and selling at market bottoms. For example, an old sentiment indicator is based on odd-lot trading statistics, which measures the number of shares of stock being bought or sold in odd lots, which are less than the 100 shares composing a round lot. Based on the odd-lot theory that most of these buyers are presumed to have little money to trade and are, therefore, presumed to be the least sophisticated market players, and so they buy when the optimism has peaked, and they sell when pessimism has peaked and the market has bottomed out. Informed traders see odd-lot buying as a sell signal and odd-lot selling as a buy signal, so they do exactly opposite of what the uninformed traders are doing, which is why many of these sentiment indicators are also called contrarian indicators.

However, the odd-lot theory has not been a very good indicator, probably because most odd-lot buyers are not traders, but are buying for the long term and only when they have the money, and, thus, are not good indicators of market sentiment. Somewhat more reliable, since short sellers are traders, is the odd-lot short sale ratio, which is the number of odd-lot short sales divided by the number odd-lot sales. Presumably, a higher odd-lot short sale ratio indicates a market bottom.

Another sentiment indicator considered more reliable is the put/call volume ratio, the ratio of the total number of puts to the total number of calls traded in 1 day. A put is an option that increases in value if the underlying security decreases in value. So you would buy a put if you expected that the price of the underlying security will decline in the near future. A call is an option that increases in value as the underlying security increases in value, so you would buy a call if you expected the price of the underlying was expected to go up soon. The put/call volume ratio is a contrarian indicator, because it is generally at a maximum at market bottoms. Hence, it would seem that uninformed players buy puts when the market has already declined.

Another popular measure of market sentiment is market volatility, the amount that prices of an index or security at a particular time deviates from the mean price as measured over a specified time period. The greater the volatility, it is reasoned, the greater the anxiousness of the traders, and traders feel more anxious when the market is declining or at the bottom than when it is rising. Low volatility implies that the uninformed traders are complacent and therefore is a sell signal while high volatility is more frequent at market bottoms when uninformed traders are most pessimistic about the market. Here, the contrarian buys.

The most common volatility indicator is the CBOE Volatility Index (Symbol:VIX), which measures the implied volatility, rather than the historical volatility, of the S&P 500 index. Other measures of implied volatility include options for the NASDAQ Composite Index (VXN) and S&P 100 Index (VXO).

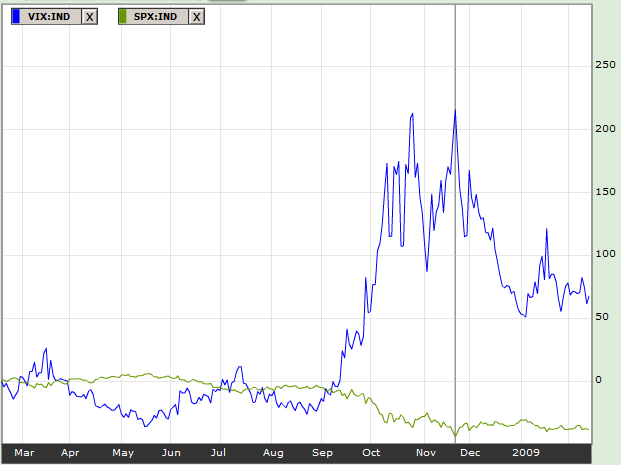

Here are 2 graphs showing how the VIX indicator reacted before and during the Covid-19 epidemic compared to the S&P 500. What, exactly, does the VIX measure? According to CBOE, which calculates the index, it purports to measure how much the S&P 500 index will fluctuate in the next 30 days according to the market. In other words, it measures the expected volatility of the S&P 500 in the next 30 days. The VIX is calculated by using the midpoint of bid/ask quotes on S&P 500 index options. Only SPX options with more than 23 days, but less than 37 days, to the Friday SPX expiration are used to calculate the VIX. Because the VIX depends on the bid/ask quotes of SPX options, it can be no more accurate than the people’s bid and ask prices. Do these people know the future any better than anyone else? It doesn’t appear to be the case. As an example, the following charts show the VIX versus the S&P 500 for 2 different time periods, in 2020, when the Covid-19 epidemic caused market volatility and from August 2018 to the end of 2019, when the S&P 500 declined toward the end of the 2018 but then rose for most of 2019. In most of these cases, the S&P 500 index declined before the VIX increased, so the VIX does not seem to do anything more than measure changes in the S&P 500 index, especially declines. When the S&P 500 index declines, then the VIX increases, and if the S&P 500 index declines quickly, then the VIX spikes, but usually during or after the decline.

Breadth Indicators

The breadth of the market is the number of securities participating in a market trend. Greater breadth helps to confirm either a bullish or bearish trend. Popular breadth indicators are the advance/decline ratio and the new highs/new lows ratio.

The advance/decline ratio is the number of advancing issues, which are stocks that closed higher today than in the previous trading session, divided by the number of declining issues, which is the number of stocks closing lower than in the previous trading session.

The new highs/new lows ratio is the number of issues reaching 52-week highs divided by the number reaching 52-week lows.

When the breadth indicators are moving in the same direction as the market, then this is considered a confirmation of the trend. A divergence of the breadth indicators and the market is a sign that the trend may be changing. A bullish divergence occurs at a market bottom when the number of declining issues or new-low issues is decreasing even if the index is still declining, whereas a bearish divergence occurs at a market top when the number of advancing issues or new-high issues is declining from previous trading sessions.

Volume Indicators

Since market sentiment is the sentiment of the masses, it makes sense that tracking volume could be useful in divining market sentiment or the sentiment about a particular security. One sensible way of tracking sentiment is by noting the volume on uptrends or downtrends. High volume serves as a confirmation of the trend. Price moves based on low volume have much less significance.

Volume spikes, where volume suddenly increases by 2 or more times the previous average, may indicate important news about a company or security, so it would be prudent to check the news. When price moves are based on important news, then a new trend may be forming or the current trend may be enhanced and prolonged.

Another volume indicator is the on-balance volume (OBV), which is the cumulative total where the volume is added on the days that the price closes higher and subtracting volume on the days when the price closed lower. Oftentimes, but not always, the OBV reaches a maximum a few days before the price peak, and reaches a minimum a few days before the price bottoms out. Hence, the OBV indicator detects accumulation by buyers or distribution by sellers. Accumulation is a buy signal, while distribution is a sell signal.

Some traders refine the volume data by considering by what percentage the high close or low close is away from the midpoint, which is calculated by adding the high price and low price for the day and dividing it by 2. Then the volume added or subtracted is adjusted by how much the day's close deviates from the midpoint.

Are Sentiment Indicators Accurate?

There are many sentiment indicators, and an almost infinite variety of ways of interpreting them. Any indicators should be used with other indicators and even fundamental analysis. How well any of these indicators work is hard to measure, but these seemed to be well established and are often reported in the financial presses. The problem with trying to measure market sentiment is that a small percentage of the population holds most of the wealth. Therefore, it is what they think that matters, not what the hoi polloi think.