Government Debts and Deficits

Like most consumers, governments also have debts, which increase annually by the amount of the deficit. Debt is a stock variable representing the amount of debt at a specific time. A deficit is an increase in the debt over a certain period, usually 1 year, equal to the total expenditures minus the total revenue collected over that time. Thus, the deficit is a flow variable because it represents the increase in debt over time.

In the United States (US), as in most countries, the national debt and the deficit are important macroeconomic variables since they can affect, or be affected by, interest rates, inflation, and total spending, which also affects economic output. As of September 2023, the United States national debt is more than $35.3 trillion! Although this is a big number, much of it is held by other government agencies, most of it by the Social Security Administration, which uses its surplus to buy US Treasuries. The remainder, $28.2 trillion, often called privately held federal debt, is held by the public and by other buyers of US debt, such as foreign governments. China is a major holder of US government debt. The interest paid annually on this debt is approaching $1 trillion. (Sources: Federal Debt & Debt Management, Budget | Congressional Budget Office)

Government Debt of This Period

- = Government Debt of the Previous Period × (1 + Interest Rate)

- + Government Spending − Tax Revenue

Deficits are of 2 types. The total deficit is the total amount of debt increase, and the primary deficit is the total amount minus the interest expense:

Total Deficit = Government Expenditures − Tax Revenue

Primary Deficit

- = Government Expenditures

- − Interest Expense

- − Tax Revenue

The total deficit is often called the budget deficit because the budget does not receive enough revenue to offset the expenditures; by contrast, a budget surplus occurs when revenue exceeds expenditures. The federal government rarely has budget surpluses. Indeed, in recent times, the federal government only had a budget surplus from 1998 to 2001. In most years, there's a budget deficit because the federal government is unwilling to increase taxes, especially on the wealthy, to cover its expenditures.

The government budget constraint = the tax revenue collected + any additional borrowing potential. The budget is constrained because any borrowing must eventually be repaid, and any outstanding debt will continue to grow at 1 + the average interest rate. Since most governments, including the United States, allow at least 2% inflation, this reduces the effective interest rate paid on the debt. So if the inflation rate is only a bit higher than that, the government pays an effective interest rate near 0. Indeed, they may even earn some revenue. The federal government could print more money to pay the debt or even to provide itself all the revenue that it needs, but the resulting inflation would harm the economy. However, the interest rate does increase the government debt in nominal dollars, which taxpayers must pay eventually. Note that, without government debt, even modest inflation could provide revenue, as seigniorage, for the government, allowing lower tax rates.

Debt Burden

Although debt is burdensome to those who borrow, it is less so for the government than for private borrowers. The government benefits from continual economic growth and from inflation since the government that prints money benefits directly from inflation. Government debt is sustainable if the debt does not grow faster than the economy + inflation. For instance, if the economy grows faster than the debt, the debt as a percentage of GDP declines. If inflation is higher, then the real value of the debt becomes less over time since it can be repaid with inflated dollars. Thus, the debt-to-nominal-GDP ratio will remain stable if the ratio stays around 1; the relative debt will decrease if the ratio is less than 1 and will increase if the ratio exceeds 1, with the rate of decrease or increase proportional to the amount that the ratio differs from 1.

This debt-to-GDP ratio can be represented by this equation:

α × (P × Y/B) = gY + π

Rearranged:

B/P × Y = α/(gY + π)

- α = deficit as % of nominal GDP

- B = government debt

- P = nominal price

- Y = real GDP

- gY = long-run GDP growth rate

- π = long-run inflation rate

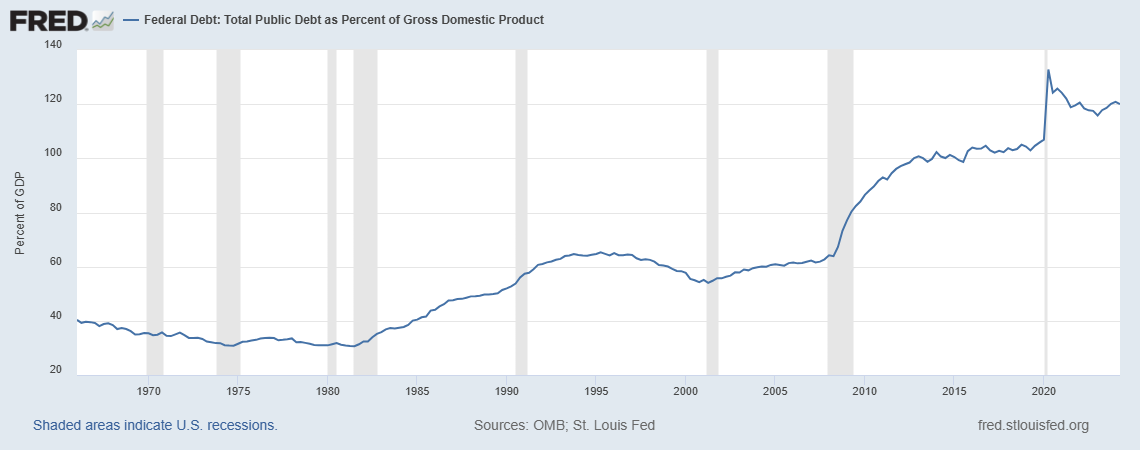

The national debt, as a share of GDP, reached the highest previous level, at 110%, by the end of World War II. It reached a low of 25% in 1975, then increased to 50% by 1995, but fell to 32% in 2001, after the economy grew substantially and taxes were increased on the wealthy by President Clinton. But the national debt exploded when George W Bush cut taxes for the wealthy, then again, when taxes were cut for the wealthy by the Republican Party in 2017. The national debt also greatly increased due to the wars with Iraq and Afghanistan, as well as government stimulatory spending under President Obama during and after the Great Recession. Covid 19 increased the federal debt even more, by a large margin!

As of October 2024, the national debt has exceeded the highest level established previously at the end of World War II.

The Macroeconomic Effects of the National Debt

A household cannot continually increase its debt. Increasing its debt allows the household to increase its spending, stimulating the economy. However, eventually, the household must repay its debt, which lowers spending. Of course, the debt of 1 household will not influence the economy since its spending constitutes only a tiny part of the economy. However, federal government debt matters much more.

Because the federal government is the largest borrower, its massive borrowing can have a crowding-out effect, either by reducing funds available for consumers and businesses to borrow or by increasing the interest rate of available funds. This leads to reduced spending by both consumers and businesses and to reduced investments of capital by businesses. This, in turn, will cause economic decline, reducing government revenue and exacerbating the debt problem.

Although, as a borrower, the government benefits from the continual, if uneven, growth of the economy, and from its ability to print money, as with households, a large debt limits the ability of the government to respond to economic disruptions, such as a major recession. If the federal government decreases expenditures to decrease its debt, the decreased expenditures will contract the economy, and the money multiplier effect will cause it to contract further, resulting in less tax revenue, especially if the decreased expenditures are primarily targeted toward the poor or the middle class, such as cutting back on welfare, food stamps, Medicare, and Social Security, or projects that provide many jobs. The detrimental effect on the economy is greater because the poor and middle class have a larger marginal propensity to consume: they spend more of their income than wealthier people, who are more likely to save a larger proportion of their income. So, cutting back on social benefits will depress the economy more than raising taxes on the wealthy.

Increasing inflation to pay the debt will decrease the credit status of the federal government, making it more expensive to borrow more money, lower confidence in the currency, and increase the negative effects of rampant inflation. Because foreign governments buy a major portion of the United States debt, they would quickly stop lending if they thought the US government would repay its debt by printing money.

Of course, the government could increase taxes, but this would decrease the disposable income of the taxpayers, who would respond by spending less, which would also have a contractionary effect on the economy. However, this contractionary effect would be proportional to the marginal propensity to consume. The marginal propensity to consume = the proportion of income spent rather than saved. Poor people have a much higher propensity to consume than wealthy people because the poor need all their money simply to survive, while wealthy people have everything they need. Thus, the most effective way to pay down debt with minimal harm to economic growth is by increasing taxes on the wealthy without increasing taxes on the poor and the middle class. The effectiveness of this tax policy has been amply demonstrated by historical events.

During President Clinton's tenure as President of the United States, in the late 1990s, the economy boomed, even though President Clinton increased taxes on the wealthy. Only during the last 3 years of his presidency did the United States government have a budget surplus. When George W. Bush became president, he decreased taxes, but most tax cuts went to the wealthy. Even with the tax cuts, the economy declined from 2001 to 2003. Then the economy started to grow quickly. This growth occurred because the poor and the middle class greatly increased their spending, spending more as it became ever easier to get credit, especially to buy real estate. This, in turn, caused real estate prices to zoom, which further increased the spending power of households, by using their increased equity to borrow even more money for other things. Credit was easier to get because banks were transferring their credit default risk to the buyers of mortgage-backed securities, while they profited from origination and mortgage servicing fees. This motivated banks to give credit to as many people as possible because that maximized their income from fees while minimizing their risk from defaults by selling their loans.

As with all economic booms fueled with debt, economic growth ended, then sharply declined because people had to repay their debt by cutting their spending. This, in turn, caused businesses to lay off people since they had no business, further decreasing spending. Consequently, real estate prices declined sharply, leading to many foreclosures and bankruptcies. Meanwhile, government debt was increasing as it financed 2 wars while receiving less revenue due to the tax cuts.

When Barack Obama became president, he followed the Keynesian policy of stimulating the economy by decreasing taxes, especially for the poor, and by increasing expenditures. The Affordable Care Act also increased taxes on the wealthy. Subsequently, the economy grew, leading to the longest economic expansion in history. Of course, that was a good time to increase taxes to pay down the federal deficit.

However, when the Republicans gained control of the federal government in 2017, they decided to increase the deficit further to fulfill what their major donors had demanded: to provide major tax breaks to the wealthy. To prevent a Senate filibuster by the Democrats, the Republicans limited the increase in the deficit to $1.5 trillion. Although they gave some tax breaks to the poor and middle class, the major tax breaks went to the wealthy. Furthermore, the tax breaks to businesses were made permanent, while most tax breaks for individual taxpayers will expire after 2025. This tax plan was structured this way to conform to the procedural requirements of avoiding a Senate filibuster since the Republicans did not have the 60 votes necessary to pass bills that could not be filibustered.

As of January 2025, the economy is very strong, so strong that inflation has persisted since 2022, much of it caused by supply chain disruptions during the Covid-19 pandemic and the Russian-Ukrainian war. But despite the strong economy, the federal deficit continues to grow rapidly. With high interest rates on US Treasuries, with the federal debt surpassing $35 trillion, the annual interest payment is approaching $1 trillion! And with Donald Trump's re-election, the Republicans want to extend the tax breaks they enacted in 2017, increasing the federal debt faster, to ever greater heights!

Here are some interactive FRED graphs, along with some recent figures:

- Federal Debt: Total Public Debt (GFDEBTN)

- Q1 2025: $36,214,310,000,000

- Q3 2024: $35,464,674,000,000

- Federal Debt: Total Public Debt as Percent of Gross Domestic Product (GFDEGDQ188S)

- Q1 2025: 120.86728% of GDP

- Q3 2024: 120.81586%

- Federal Surplus or Deficit [-] as Percent of Gross Domestic Product (FYFSGDA188S)

- 2024: −6.28002% of GDP

- 2023: −6.11543%

- Federal Surplus or Deficit [-] (FYFSD)

- 2024: −$1,832,816,000,000

2024 figures are not final as of this writing, but you can clearly see that the deficit increased by almost $2 trillion dollars so far in 2024!

Since the economy always cycles, what happens when the economy starts declining? The wealthy will continue to enjoy their tax breaks, but most other people will suffer from increased unemployment, increased debt, and the government will suffer from increased debt and lower tax revenues. In that case, the government must increase the deficit even more and/or print more money to grow the economy again. Or increase taxes on the wealthy!

How to Convert Budget Deficits into Budget Surpluses

If all income were taxed like work, the US government would have plenty of money. In fact, most governments would have plenty of money if all income were taxed like work. A primary reason why governments have deficits is because people are taxed at different rates.

Whenever politicians talk about reducing the deficit, they usually focus on expenses, not the forfeiture of income, such as the unified tax credit, which allows wealthy heirs to avoid paying millions of dollars in taxes. Unlike Social Security and Medicare, the unified tax credit is not funded by a separate tax for this benefit. Instead, they are funded by higher taxes on work.

Indeed, the only time the US government had a budget surplus was during the latter years of the Clinton administration when the exclusion amount of the unified tax credit was less than $675,000. In 2025, the exclusion amount was $13,990,000! Since most heirs have 2 parents, they would benefit from 2 unified tax credits, allowing them to inherit almost $28 million without paying a single penny in federal taxes. Even many states do not tax gratuitous transfers.

The big problem with forfeiting income is that government expenses do not decline just because revenue is being forfeited. Instead, the money must be collected from somewhere else. This is primarily why income earned from work is the most highly taxed form of income.

The problem with cutting expenses is that it reduces the disposable income of many people because most of the expenses are reduced by reducing money given to lower-income people. For instance, Republicans at the start of 2025 proposed cutting $2.3 trillion in Medicaid, which provides medical care for poor people, and $274 billion from the Supplemental Nutrition Assistance Program (SNAP), which helps low-income families to buy food.

Because lower-income people have a higher marginal propensity to consume, cutting expenses by reducing government payments to these groups will depress the economy, which lowers tax revenue. On the other hand, increasing taxes on the wealthy will not hurt the economy if lower-income people have money to spend.

Some Republicans have suggested a national sales tax to reduce the deficit. But like all consumption taxes, sales taxes hurt lower-income people much more than upper-income people, and they also lower disposable income. This is primarily why economic growth in Europe is less than in the United States because Europe heavily taxes both work and consumption.

Politicians often argue that lowering taxes helps stimulate the economy, but lowering taxes on lower-income people stimulates the economy the most, since they have the highest marginal propensity to consume. Reducing taxes on the wealthy does little to stimulate the economy, especially if taxes are reduced by not taxing some forms of income, such as gratuitous transfers.

So, a simple way to increase tax revenue in the United States is to abolish the unified tax credit, the home sale exclusion, and other exclusions from income. Also, increase preferential tax rates, such as the tax preference given to long-term capital gains and the carried interest earned by hedge funds and private equity managers.

How soon will this happen? Never! As Voltaire mentioned more than 250 years ago, government was designed to benefit some people at the expense of others, and some of those people run the government. So, most people are taxed more, so some people can be taxed less!

In general, the art of government consists of taking as much money as possible from one class of citizens to give to another.— Voltaire