London Interbank Offered Rate (LIBOR)

Important Note! Because LIBOR is no longer being used as an interest rate, the information presented here is for historical purposes only!

The London Interbank Offered Rate (LIBOR) was the primary rate that major banks charged each other for loans of maturities not exceeding 1 year. Banks make loans to each other because they are legally required to have a certain percentage on hand compared to their liabilities, and since this fluctuates daily with their business, they sometimes have surpluses to lend out or they have deficits that are usually eliminated by borrowing from banks with surpluses. Since most of these loans are for less than 1 year, and the interbank market for longer maturities is illiquid, and, therefore, difficult to price, the LIBOR excludes maturities exceeding 1 year.

The LIBOR was also the rate used to settle many futures, and options, and derivative contracts involving interest rates. The LIBOR was considered to be a better indication of the risk-free interest rate than US Treasuries. Although US Treasuries are considered free of credit default risk, demand — and therefore prices — are increased by these factors:

- regulations require banks to buy Treasuries;

- holding Treasuries allows banks to hold less Tier 1 capital;

- Treasuries are not taxed by the states.

Because these other factors increased the demand for US Treasuries, prices were higher — and their yields corresponding lower — than would be justified by only considering the credit default risk.

The LIBOR actually signified several rates that were calculated in 10 different currencies and set every business day at 11 A.M. London time by the British Bankers' Association (BBA) by using data from contributor banks for each currency, including:

- Deutsche Bank AG

- Royal Bank of Scotland Group Plc.

- Citigroup, Inc.

- Bank of America Corp.

- UBS AG

A panel of 8 to 16 different contributor banks were chosen for each of the 10 currencies for which LIBOR rates werew provided. Contributor banks were selected annually and were chosen based on the amount of their business conducted in a specific currency, their reputation, and on their creditworthiness. Some banks, especially the large international banks like the ones listed above, were contributors for more than 1 currency.

The rates for the different currencies were determined only by the reports from the panels — there was no currency conversion to reconcile the rates between the different currencies. LIBOR was calculated for these currencies:

- Pound Sterling (GBP)

- United States Dollar (USD)

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- Euro (EUR)

- Danish Kroner (DKK)

- Swedish Krona (SEK)

- New Zealand Dollar (NZD)

The LIBOR was 1st published in its current form in January 1, 1986 by the BBA, but began as a list of interest rates quoted by 4 banks for the United States dollar in the 1970s to serve as a basis for setting the interest rates for floating rate notes and syndicated loans outside the United States. The major impetus for calculating and publishing the LIBOR was to serve as a benchmark to settle contracts based on interest rates, including forward rate agreements, interest rate swaps, and foreign currency options.

The LIBOR for a particular currency mostly depended on the local interest rate for the currency, such as the Feds Fund rate for the United States dollar, but was also depended on the contributor banks' expectation of future rates, the profiles of the banks consulted, and the liquidity of the currency in the London cash market.

The method of calculating the average, rounded to 5 decimal places, averaged only the quotes within the 2nd and 3rd quartiles from each panel of contributing banks; the top and bottom quartiles were disregarded to eliminate distortions due to outliers, or due to misinformation, which sometimes occurred when a bank reported a rate for borrowing lower than the actual rate to hide its financial difficulties. (A bank perceived to be in financial stress would be charged a higher rate in the interbank lending market than other banks.)

Most of the rates were calculated on an actual/360 basis except for the British pound (GBP), which was calculated on an actual/365 basis. This formula calculated the interest due:

Interest Due

- = Principal × (LIBOR/100)

- × (Actual Number of Days in Interest Period)/360 (Note: 365 for GBP)

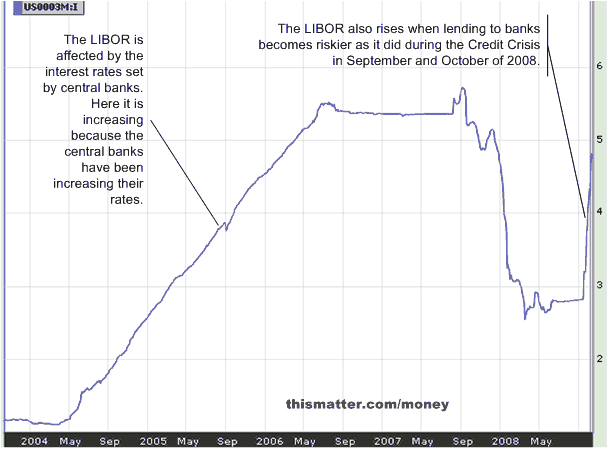

Although the LIBOR was not set by the central banks, the interest rates set by the central banks did affect the LIBOR, which generally moved together unless credit events involving banks caused them to diverge. Thus, the LIBOR remained high even as central banks were lowering their rates during the Great Recession in October 2008.

https://www.bloomberg.com/apps/cbuilder?ticker1=US0003M%3AIND

Screen clipping taken: 10/14/2008, 1:07 PM

LIBOR Rate-Fixing Scandal

Since the LIBOR was not set, but rather was a reported average of what large banks were charging and paying each other for each currency in recent transactions — or, if there have not been any recent loans of the reported currency and term length, then the banks gave their opinion as to what they would have charged — no government or any of their agencies, including their central banks, had any direct control over the LIBOR rate. During the credit freeze of September 2008, banks were reporting their opinions since there was little interbank lending to go on. Banks feared lending to other banks because lenders didn't know which banks were holding toxic subprime mortgages or derivatives based on subprime mortgages, and which banks had sold credit default protection through credit default swaps to holders of toxic assets, which is what led to the Great Recession that began in 2007.

Many financial contracts and variable interest rates were pegged to the LIBOR, which, on December 31, 2007 had a notional principal of $393 trillion (USD). Many corporate loans were based on the 3-month LIBOR and half of all subprime mortgages issued 2004 – 2006 had adjustable rates pegged to the LIBOR. Hence, when the LIBOR jumped, as it does in any general credit event affecting banks, the cost of loans increases significantly for both businesses and consumers, limiting both capital and consumer spending, potentially driving economies into a recession. For instance, the LIBOR jumped when Bear Stearns collapsed on March 17, 2008, and during the several credit events that occurred in September 2008, such as when Lehman Brothers declared bankruptcy on September 15, 2008. Many banks also suffered major losses when Freddie Mac and Fannie Mae were taken over by the government, reducing the value of the banks' stock in these corporations to near zero, which further increased the risk of interbank lending, and therefore the LIBOR.

Another problem that became apparent was that some of the banks were giving false opinions as to what they believe the interest rate should be so that they could profit on trades — most involving derivatives, whose profitability was based on those interest rates. Some of the bankers formed bidding rings, to align their LIBOR estimates with one another, which they easily verified since the BBA published the individual estimates by the banks. A proposed solution to this problem was to allow more banks to submit estimates and to not publish the individual estimates. (See Libor Interest Rate Riggers.)

Another reason why some bankers submitted lower rates from what they were actually paying is because higher rates indicates that the bank is in financial stress. For instance, Barclays Bank was submitting the highest bids in 2007, causing the media to speculate that Barclays was in financial trouble, so Barclays started submitting much lower bids to remain within the range submitted by other banks. Moreover, Barclays had no Chinese wall between the derivative traders and the banking officials who were submitting their LIBOR estimates, allowing some collusion between the 2 groups to maximize profit.

On September 28, 2012, the Financial Services Authority (FSA) — the financial regulatory authority in Great Britain — stated that the BBA would no longer be administering the LIBOR. Instead, the rates would be provided by a financial data provider, such as Bloomberg or Reuters or from a regulated exchange.

The regulator in the United Kingdom that oversees the Libor says that it will be discontinued after 2021, especially since the Libor is not accurate, and because the scandal revealed how easily it could be manipulated by bankers.

Secured Overnight Financing Rate (SOFR)

After the LIBOR scandal, the Secured Overnight Financing Rate (SOFR) replaced the LIBOR in the United States. The SOFR is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

To prevent manipulation, the SOFR was designed by the Federal Reserve to be based on actual transactions in the repo market on the previous business day rather than on opinions. SOFR is published weekdaily by the Federal Reserve Bank of New York and reflects the cost of overnight borrowing and lending in the U.S. Treasury repo market, which is a much bigger market than the interbank lending market that was the basis for the LIBOR. The SOFR is now considered the best indicator of the risk-free interest rate.