High-Yield Bonds

High-yield bonds, often called junk bonds, pay a higher interest rate than investment-grade bonds, reflecting their lower credit rating and greater risk of default. The yield spread above risk-free Treasuries is the risk premium to compensate investors for the increased risk of default. High-yield bonds with at least a BB or a B rating are sometimes called speculative-grade bonds. The lower credit rating is usually the result of deteriorating finances, because the economy is entering into a recession, because it's a new business that doesn't have a track record, or because the company has assumed substantial additional debt, such as occurs in a leveraged buyout. However, some subordinated debt of investment-grade issuers may also get a speculative-grade rating, due to the greater credit risk of junior bonds.

Junk bonds are so-called for their higher default rate, but the loss rate is usually lower. The default rate equals the percentage of companies that default on their loan obligations. However, not all of them will go bankrupt; some will recover, and even those who go bankrupt, creditors can usually recover some amount of their investment. The recovery rate equals the percentage of the par value of the defaulted bonds that can be recovered. The default loss rate equals:

Default Loss Rate = Default Rate × (100% − Recovery Rate)

So if the default rate is 4% and the recovery rate is 25%, then the loss rate equals:

Default Loss Rate

- = .04 × (1 − .25)

- = .04 × .75

- = .03 = 3%

The risk premium earned = the total return of a bond portfolio over that of Treasuries. The total return of the bond portfolio = the interest + capital gains from sales of bonds in the portfolio minus capital losses minus losses through default. A successful investment in junk bonds requires that the risk premium earned justifies the risk undertaken. Hence, it is almost never a good idea to invest in junk bonds when their yield over Treasuries is only a few percentage points.

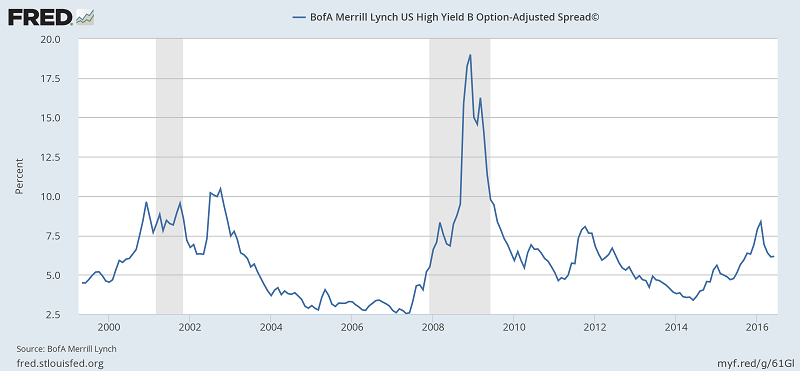

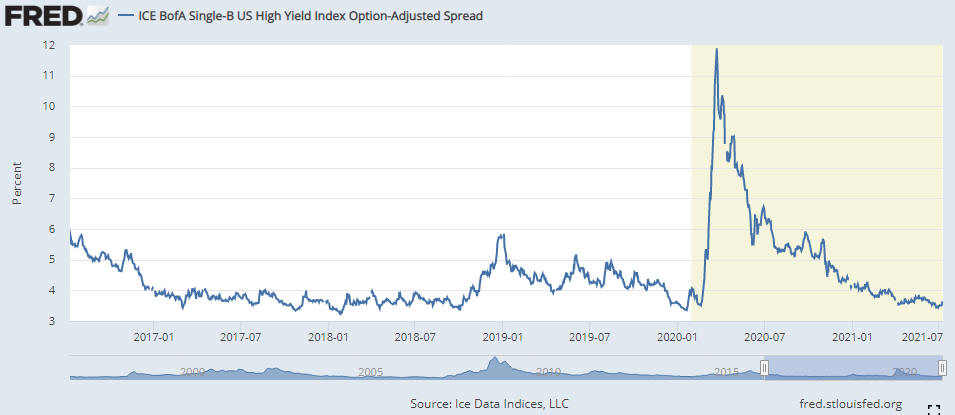

Junk Yields Increase When Credit Risk Increases

Bond prices move inversely to their yields: when bond prices increase, then their yields decline, and vice versa. So when the probability of default of junk bonds increases, their prices decline, so their yields increase, because the coupon payment represents a larger percentage of the bond price. Although yields will generally change as prevailing interest rates change, a better indicator of increasing credit risk is the ICE BofA US High Yield Index Option-Adjusted Spread, which is the difference between the yields of junk bonds and Treasury bonds of comparable maturities. Usually, this spread ranges from 3% to more than 10%. More businesses fail during recessions, so the yield spread increases then, sometimes dramatically so. Not only do investors abandon junk bonds during recessions, but they buy Treasuries in their flight to quality, so the spread increases dramatically during recessions. In December 2008, during the global financial crisis, the high-yield premium over Treasuries exceeded 2,000 basis points, 20%, and even the investment-grade corporate bond premium exceeded 600 basis points, or 6%.

Types of Junk Bonds

Junk bonds are characterized by how the junk status was achieved (original issue or deteriorating finances) or by special provisions in the bond indenture, especially regarding the payment of interest.

Fallen Angels

Fallen angels are bonds that were issued with an investment-grade rating, but, with the deteriorating finances of the company, the bonds were downgraded to a BB rating or less. Many of these companies are near bankruptcy or in default. The key to profiting from fallen angels is to determine the amount that could be recovered in a liquidation or reorganization. If the company is upgraded by a credit rating agency, then the prices of its bonds will increase.

Another way to profit from fallen angels is when credit rating agencies downgrade a bond to below investment grade, forcing many money managers to sell those bonds because they are forbidden to own junk debt. This rapid selling depresses prices to less than the price of bonds with similar ratings, so investors buy these fallen angels to profit from the return to equilibrium.

Prior to 1977, most junk bonds were fallen angels, because bonds were not issued with less than an investment-grade rating.

Original Issuers of Junk Bonds: Story Bonds

Drexel Burnham Lambert pioneered the marketing of original-issue junk bonds. As junk bond traders, Drexel Burnham Lambert knew there was a market for fallen angels, so why wouldn't there be a market for original-issue junk. Although the issuers of original junk bonds must pay a higher yield than on investment-grade bonds, the yield was still lower than what many businesses had to pay for bank loans, if they could even get a bank loan. Hence, many of these businesses, sometimes called venture-capital situations, growth market or emerging market companies, were willing to issue original-issue junk bonds. To lower the yield, these bonds were often sold with optimistic financial projections and a description of how that would be achieved — hence, the nickname, story bonds.

Leveraged Buyouts (LBOs)

In a leveraged buyout, a group of investors or a firm usually borrow money from a bank to pay a premium for the existing shares of a company from its shareholders to take it private. The money is initially borrowed from a bank as a source of bridge financing until it can issue junk bonds after taking over the company. The proceeds of the junk issue are used to pay off the bank loans. The company's outstanding bonds may become fallen angels due to the debt burden and the resulting lower credit rating. To protect bondholders, many new issues of bonds have change-of-control covenants, which allow the bondholders to sell the bonds back to the company for par value or some other stipulated value if there is a change of control of the company.

Clawback Provisions

Sometimes the junk bond issuer will deem itself to have a better future than would otherwise be indicated by its current low credit rating. Hoping to soon prosper, some issuers add clawback provisions to the bond's indenture that allows the company to buy back the bonds, generally within 3 years of issuance, if the source of the funds is from a primary or secondary stock offering. The percentage of bonds that can be retired using clawback provisions ranges from 20% to 100% with bondholders typically receiving about 110% of par value for the early retirement.

Junk Bonds with Special Provisions

Because many issuers of junk bonds are financially distressed and are hoping for a better financial future, the indentures of many of these issues provide other ways to pay interest: by deferring paying cash interest, paying less initially, or making it optional. The period of no or low interest payments typically ranges from 3 to 7 years. Afterwards, the companies hope to have enough cash flow to pay interest and principal. Some bonds may also have an equity kicker — an attached warrant to buy stock in the company, if the company does better.

These bonds are typically issued when interest rates are high, and they are often used by private equity firms to buy companies using leverage. Using these special bonds allows these firms to offload much of their risk to the investors of these bonds. So, beware!

Deferred Interest Bonds (DIBs) and Pay-in-Kind Debentures (PIKs)

Junk issuers issue 2 special types of zero-coupon bonds: deferred interest bonds and pay-in-kind debentures. Often called zeros because they are sold at a discount, they pay interest plus the principal.

- Deferred interest bonds (DIBs) pay interest only after a specified time, usually 5 years. Some DIBs pay interest only at maturity, in addition to the principal payment.

- Pay-in-kind debentures (PIKs) gives the issuer the option of either paying the interest as cash or as more PIKs for a specified duration generally ranging from 5 to 10 years. After this, if the company is not in default, the coupon payments are in cash.

- KKR, the private equity firm, used PIKs to acquire RJR Nabisco in 1988.

These bonds have an extremely high credit risk and are often issued by private equity firms when interest rates are higher. Although this debt is senior to stocks, it is subordinated to all other loans and bonds previously issued by the company. Because no payment will be received until sometime well into the future, an investor must evaluate the company's prospects until that time. Could it earn enough cash to pay off all its loans and senior bonds with enough left to pay its junk zeros? If not, the investor could lose some or all of the investment.

Step-Up Bonds and Extendible Reset Bonds

Step-up bonds pay an initially low coupon rate, but after a specified duration, the coupon rate is stepped up.

The extendible reset bond has its coupon rate reset so that the market price of the bond = its par value or some percentage of it. The coupon rate may be reset periodically, such as annually, or for a specified number of times, which may only be once. The reset interest rate is set by the opinions of at least 2 investment banks.

The extendible reset bond differs from a floating-rate bond in that the interest rate is not specified relative to an index or some other fixed-rate security, such as a Treasury, but is set by opinions sought from investment banks based on prevailing interest rates or what credit spread the market requires, to maintain bond prices in the secondary market at par value.

The issuer of the extendible reset bond hopes to lower the yield that the issuer would otherwise have to pay by accepting some of the interest rate risk and the credit risk of the issue. While the floating-rate bond offers some protection against interest rate risk, the extendible reset bond also offers some protection against credit risk since if the issuer's credit rating declines, it must pay a higher coupon rate even if prevailing interest rates decline. However, with the low credit rating of the issuer and its inability to pay high rates for lack of cash flow, its bond prices often cannot be maintained at par level, resulting in lower prices.

High-Yield Bond Funds

A less risky way to invest in junk bonds is to invest in funds specializing in such securities. To avoid the negative connotation of junk, such funds usually refer to themselves as high-yield bond funds. High-yield bond funds have high yields, of course, but they can also profit from credit rating upgrades of their bonds. Additionally, the value of the fund can be preserved by selling bonds expected to be downgraded or a profit can be made by selling the bonds short.

Many junk bonds come with special indenture provisions: income bonds, reset notes, payment-in-kind bonds, convertibles, putable notes, extendable bonds, credit-sensitive bonds, and bonds with warrants. The details of these provisions must be examined so that risk can be assessed and so that the value of the bond portfolio can be predicted based on changes in the bond market.

A special type of high-yield fund is the Chapter 11 fund, consisting of companies that are either in bankruptcy (usually Chapter 11 — hence, the name) or sufficiently stressed that bankruptcy is likely. Profit is made if the company undergoes a successful reorganization. Sometimes a chapter 11 fund is set up as a hedge fund, so that a few investors can invest in specific companies where they can have significant influence on the reorganization. Vulture funds invest in the securities of bankrupt firms only.

Success in Chapter 11 funds generally depends on the management's ability to analyze the creditworthiness of the businesses, the feasibility of the reorganization plan, or trying to divine the best scenario from which a company can emerge from bankruptcy.

Great Recession Lowers Price of Junk Bonds

During the Great Recession of 2008, bond yields increased dramatically while the yields of safe Treasuries declined to almost zero — at one point the interest rate on a T-bill was actually negative from the massive flight to quality!

Consequently, junk bonds were selling for prices yielding 12% more than Treasuries with comparable maturities. Junk bonds dropped 23%, paying 74.5¢ to the dollar in the secondary market on average, which some companies, such as Charter Communications, Inc., Freescale Semiconductor, Inc., and Yankee Candle Company, saw as a buying opportunity to buy back their junk bonds to reduce interest costs.

Source: Bloomberg.com

Tip: Only Buy Junk Bonds When the Junk-Treasury Spread is Wide

When the JTS is narrow, it is unlikely that junk bond prices will increase unless prevailing interest rates are already high. But if prevailing interest rates drop, they usually do so because the economy is entering into a recession, which causes more businesses to fail, thereby increasing credit risk, which, in turn, will cause junk bonds to decline. On the other hand, if the spread is wide, then it is more likely that an investment in junk bonds will be profitable, if the issuing businesses do not go bankrupt. This increased likelihood exists for several reasons:

- since it is already wide, the spread has a greater chance of narrowing

- the credit rating of the issuer has a better chance of improving if the credit rating is already low

- a handsome profit can be made if the full par value is paid when the bond matures

Needless to say, due diligence is required before investing in these bonds, and only a small portion of your portfolio should be invested in them.