History of Insurance

The earliest forms of insurance were a primitive form of commercial insurance, usually covering shipping goods since cargo was often lost or damaged or stolen by thieves and pirates. These earliest methods of reducing risk involved either the pooling of risk or transferring the risk to moneylenders or investors of expeditions.

For millennia, the primary and economical means of transport was to use waterways, but boats carrying cargo were often destroyed in rapids along the rivers. Enough cargo made it through to still make it more economical than land transport, but shippers realized that bad luck could ruin them financially. A primary way to reduce risk to individual shippers was to pool the risk amongst all of them. As early as 3000 BC, Chinese merchants pooled their risk of loss when moving cargo down the rapid Chinese rivers. In 3000 BC, merchants and traders in Sumer and Babylonia pooled their risk to prevent major losses of cargo to thieves and pirates.

Another way to lower risk was to transfer at least some of that risk to moneylenders. The great Code of Hammurabi allowed the transfer of risk from merchants to moneylenders, so that if their merchandise was lost or abandoned, then their loans to the moneylenders were forgiven. The Phoenicians and Greeks permitted shipowners and merchants to pledge either the ship or the cargo as collateral for loans, so that they can either get the loan or get a lower interest rate. Some lenders decided to assume a greater risk in exchange for charging a higher interest rate by forgiving the loan if the ship or cargo was lost. Even specialized terminology was used to describe these loans: bottomry loans used the ship as collateral whereas respondentia loans used cargo as collateral.

Sometimes the pooling of risk does not involve money. The Amish pooled not money but effort. When a barn of one member of the community is destroyed by fire, many members of the same community help rebuild the barn. Of course, the pooling of effort in a simple society like Amish society is much easier, where many members have the same capabilities of constructing what they need in life. However, in more complex societies, pooling money is much simpler and more practical.

In 1200 BC, Phoenician merchants began transferring some of their risk to the backers of specific voyages, whereby the backers would profit if the voyage was successful, but would lose their investment if the cargo was lost at sea, either from natural disasters or from pirates. in exchange for backing a voyage and to assure payment if the voyage was successful, Phoenician law allowed the lenders to confiscate the merchant's ship for nonpayment. This form of collateralized loan was called bottomry: this term likely arose because the ship's hull was called the bottom. Since substantial resources were required for voyages, and the wealth of these early nations depended heavily on trade, other settlements around the Mediterranean and in Asia also enacted bottomry laws by 400 BC.

Insurance Companies

Marine insurance is the oldest branch of modern insurance, originating with the Lombard merchants in 13th century Italy, from whence it spread to the continent, then to England. The British dominated maritime trade and also marine insurance throughout the 1800s and well into the 1900s.

Lloyd's of London

As a center of commerce and global trade, Great Britain was a natural place for marine insurance to develop, and a major insurer of voyages was Lloyd's of London. Insurance was written by individuals rather than companies where a shipowner or merchant would publish a sheet of information describing the cargo ship, and its destination and any other pertinent information. The people who accepted part of that risk wrote their names under the description of the risk and the terms the agreement. This "writing under" the agreement gave rise to the term underwriter, one who selects and rejects risks.

Groups of these underwriters often discussed terms in the coffee houses of London. One particular coffeehouse owner, Edward Lloyd, became the main meeting place because the proprietor manufactured paper, pens, and information regarding shipping available and provided information regarding available shipping, thus becoming Lloyd's of London.

Life Insurance

The 1st evidence of life insurance comes from Egypt, where in 2500 BC, stonemasons pooled their money to fund the burial of its members. Beginning in the 3rd century BC, Greece and Rome started forming benevolent societies that offered an early form of life insurance, which paid the burial expenses of its members, and sometimes provided a payment to the widows and orphans of the deceased members. During the Middle Ages, many craft guilds, especially those in England and Italy, also provided benefits to its members and their families in the event of injury, illness or death.

The success of life insurance companies critically depends on charging a premium commensurate with the mortality risk. Since early life insurance companies charge the same premium to everyone, many of them naturally failed! Edmond Halley, of comet fame, prepared a mortality table in 1693, but it was not until 100 years later that some accuracy was achieved at predicting mortality.

The 1st known life insurance policy was written in England in the late 1500s. Later, groups in England started to form friendly societies that provided some insurance to its members. Workers made contributions to funds held by the society, to pay subsequent claims by its members or their families, but many of these societies went bankrupt through poor management. Consequently, the Friendly Society Act of 1793 was passed to curtail their mismanagement.

The 1st modern life insurance company was a stock company called the Corporation for Relief of Poor and Distressed Presbyterian Ministers and the Poor and Distressed Widows and Children of Presbyterian Ministers (Thank God for relative pronouns!), formed in 1759, but, at 1st, the life insurance is only offered to its members. In London, the Society for the Insurance of Widows and Orphans was founded in 1699, and charged all insureds the same premium. Naturally, it did not last very long. Only in 1762, did the Equitable Society for the Assurance of Life and Survivorship varied premiums with the age of the insured, thus helping it to become more successful.

In 1792, the Insurance Company in North America sold the 1st life insurance policies in the United States to the public. They also sold marine insurance, but British insurance companies offered lower costs and greater coverage. Additionally, not many life insurance policies were sold since there was low demand for life insurance.

During the 1800s, mutual insurance companies were formed, which were owned by the policyholders, who also shared profits.

Fire Insurance

Fire insurance began soon after 1666, when the Great Fire of London burned for 5 days, destroying 85% of the city. In 1667, a mutual society was formed by Nicholas Barbon, originally called the Fire Office, then later renamed the Phoenix Fire Office, after the mythical bird that burned, but then reemerged from its own ashes. One policy that was recorded in 1682 costing 30 shillings to insure property worth 100 British pounds for 7 years. Other fire insurance companies were formed soon afterwards, 1st in Great Britain, then later in the United States.

Fires were common during this era and for several centuries afterwards, because many buildings and their contents were made of wood, and candles and lanterns used fire for lighting, causing many fires. Additionally, major fires occurred in several growing cities that caused extensive damage, making fire insurance the most common form of insurance at this time.

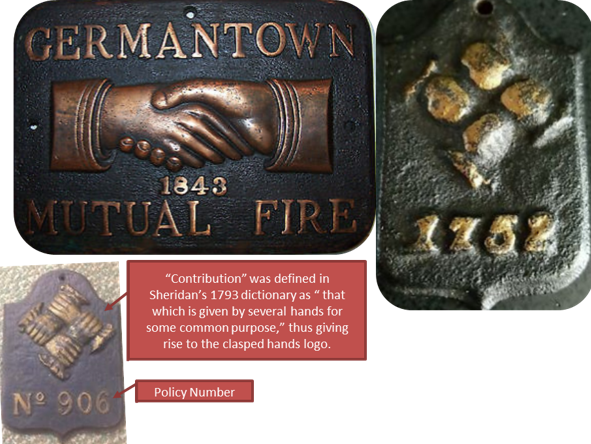

In 1752, Benjamin Franklin helped create the 1st fire insurance in the United States, aptly named the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire. At this time, Philadelphia had about 15,000 people and 8 volunteer fire companies. Fire insurance needs subscribers, so a notice was placed in the Pennsylvania Gazette in February 1752 to advertise the venture, and enough people responded by April that a meeting was held and a board of directors chosen to begin the insurance fund. Policies covered only the buildings and were issued for a term of 7 years after policyholders paid a deposit. A portion of the deposit, after subtracting a fee for the survey, policy, and fire mark, was returned to the policyholder after the 7-year period. The insurance rate was set by the board of directors, based on reports filed by surveyors who inspected the insured property.

Early insurance companies used their own fire brigades to fight fires consuming buildings of the insured. Because street numbers were not used in the early years, the buildings were identified by fire insurance marks, which were metallic plates attached to buildings, usually between the 1st and 2nd stories, so that they could be easily identified from the street level, but could not easily be stolen. The fire marks would be stamped with the company's logo and some even included the policy number. The 1st fire marks were made of lead; later fire marks were also made of cast iron, tin or copper. Reportedly, some were even made out of wood! This practice didn't last long since wooden fire marks may be consumed by the fire, along with the rest of the building.

Early fire insurance companies were also frequently mismanaged. When there were no major fires, the companies would charge low premiums to attract business, but when major fires broke out, such as the Great Chicago Fire of 1871, many of them could not pay the claims. Subsequently, many fire insurance companies banded together to set rates that were adequate enough to cover potential claims.

Eventually, fire departments were supported by state municipal taxes as a more workable solution. Fire insurance based on contracts between the insured and the insurers became more common after the 1906 San Francisco earthquake, which caused many fires.

The Development of Standardized Contracts

At 1st, insurers wrote their own fire insurance contracts. The contracts were long, restrictive, cumbersome, and difficult to interpret. Moreover, moral hazard clauses and other restrictive provisions were inserted in the contracts permitting insurers to deny claims, which created its own risk since policyowners could never be sure if they would be compensated for their losses. Thus, there were compelling reasons to standardize insurance contracts.

In 1873, Massachusetts became the 1st state to adopt a standard policy for the writing of fire insurance. New York passed a similar law in 1886. One of these standardized contracts for fire was the 1943 New York Standard Fire Insurance Policy (SFP). Though no longer used, this policy had many provisions common in modern-day policies. Many basic property insurance concepts were first legally defined in the SFP, such as the principles of indemnity, insurable interest, actual cash value, and pro rata sharing of losses if the insured was covered by several insurance companies.

Using a standard policy, such as the Standard Fire Policy, has 2 major advantages.

- Loss-adjustment problems are reduced since the possibility of 2 contracts with different policy provisions are reduced.

- Standard contracts have fewer legal difficulties since their words, phrases, and provisions were interpreted repeatedly by the courts, so ambiguities are weeded out.

Insurance Regulation

Early life insurance companies were unable to accurately calculate how much reserves they had to hold to pay claims. Additionally, many people who bought life insurance could not continue the payments, so they sold their policy to others for money, thus creating a moral hazard, as it could incentivize some buyers of the policies to kill the insured, especially premiums became expensive or the insured continued to live long afterward. Elizur Wright, a mathematician, abolitionist, and the Massachusetts Commissioner of Insurance from 1858 - 1866, successfully persuaded the Massachusetts legislature to enact valuation laws that required life insurance companies to hold sufficient reserves to pay claims and, in 1861, a nonforfeiture law that required policies to provide a surrender value, so that the insured did not lose all the premiums that they paid if they could not continue to pay the premiums. Wright also developed actuarial tables and a mathematical formula that he called an accumulation formula that calculated the premium that insurance companies should charge for a given policy term and benefit.

When insurance companies were 1st starting to develop, most specialized in particular types of insurance, which is only natural since they will have greater expertise and be more familiar with loss exposures in specific industries or types of insurance. Furthermore, as states started to regulate insurance companies, monoline insurance became the law. In particular, the state of New York enacted the Appleton Rule in 1901, requiring any insurance companies operating in New York to follow their monoline requirement. Since New York was a major insurance market, most insurance companies complied with the rule. Henceforth, 3 distinct lines of insurance developed: life and health, fire, and casualty. Fire insurance companies were not permitted to write casually or life or health insurance; likewise, for casualty insurance companies. Life and health insurance companies were, likewise, restricted to their specialty.

The main reason for restricting insurance companies to particular lines of insurance was to constrain the spread of risk, particularly regarding fire insurance since many fires caused catastrophic losses that bankrupted many insurance companies. Fires were common in the 1800s and 1900s because most buildings were made of wood and fire was extensively used for lighting and cooking. It was only a matter time until major conflagrations arose, such as the New York City Fire of 1835 and the Great Chicago Fire of 1871.

A major component of insurance regulation was regulating the solvency of the insurance companies since their insolvency could ruin many businesses and individuals who depended on the insurance, leading to another reason for the monoline requirement. States found it easier to stipulate minimum capital requirements and setting minimum solvency ratios for particular lines of insurance. When insurance companies failed, it was easier to ascertain the reason for the failure of the monoline insurance company over a multiple line insurance company since there were fewer factors to consider. Additionally, as specialists in particular lines of insurance, monoline insurance companies would have more underwriting experience for particular exposures and better statistics of loss exposures in particular areas, thus leading to a more accurate calculation of a premium to charge to pay for losses and to profit.

Beginning in the late 1940s, states started to allow multiple-line insurance companies for property and casualty insurers. This allowed insurance companies to expand their market since it was more convenient to deal with 1 company that sold both property and casualty insurance. However, the legal barrier between life and health insurance and the property and casualty insurance endured.

There was also a question of whether the federal government or the states had constitutional jurisdiction over regulating insurance companies. In 1869, the United States Supreme Court ruled for state regulation of insurance. Thereafter, state insurance departments were created by several states to regulate insurance within their borders. However, in 1944, the Supreme Court reversed itself, asserting that the federal government had jurisdiction over insurance because most forms of insurance were sold across state lines, and thus was more properly categorized as interstate commerce, which is within the jurisdiction of the federal government. However, 1 year later, the federal government enacted the McCarran-Ferguson Act, returning the regulation of insurance to the states, but with federal oversight.

The Beginnings of Modern Insurance

By the 1800s and 1900s, society and industry were becoming far more complex, thus giving rise to many other forms of insurance. For instance, the 1st auto insurance was sold in 1897. During the 1920s, the sales of auto insurance greatly increased as the number of vehicles increased.

Casualty insurance 1st appeared in the mid-1800s to sell insurance offering protection against accidents to railroad passengers. The Travelers Insurance Company wrote its 1st policy in 1864. Boiler explosions were also common during this time, so companies started selling boiler insurance in 1886. Employers liability insurance followed in 1886, elevator and public liability insurance in 1889.

Health insurance also largely began in the 1900s, especially as healthcare became more specialized and expensive. As factories and other industries started to use more machinery, many people were injured on the job, giving rise to workers compensation in 1910. Also in the 1900s, many social insurance programs were enacted, including the Social Security Act in 1935 and Medicare in 1965.

Before 1950, many state laws required insurance companies to specialize in particular kinds of coverage, but later, insurers were permitted to offer package policies that combined various forms of coverage, such as homeowners insurance and liability. Later, to increase competition, other types of companies besides insurance companies, such as banks, were permitted to sell insurance.

The Conglomeration of Financial Services

Before the 1900s, the major financial services consisted of banking and insurance. However, during the early years, these 2 major fields of financial services were largely separate, because without modern technology, they were difficult to manage profitably. Additionally, to protect the solvency of early banks, with limited exceptions, the National Banking Act of 1864 prohibited banks from underwriting or selling insurance. The National Banking Act was amended in 1916 to allow banks located in towns with fewer than 5000 inhabitants to sell insurance.

After the stock market crash of 1929, many banks failed, causing the failure of many other businesses. To limit the spread of contagion, Congress passed the Glass-Steagall Act of 1933 that prevented businesses from owning any combination of banks, insurance companies, or security brokerages. Regulations loosened a little with the Bank Holding Company Act of 1956 that allowed banks to own insurance agency affiliates through a holding company.

The Financial Services Modernization Act (FSMA) of 1999, sometimes called the Gramm-Leach-Bliley Act (GLBA), finally allowed businesses to own the 3 broad categories of financial services. Likewise, Europe also allowed conglomerates of financial services. In Europe, the combination of banking and insurance was called bancassurance.

Insurance companies originally opposed the FSMA, but the United States Supreme Court ruled that the Office of the Comptroller of Currency (OCC) had authority over the insurance activities of federal banks, not state insurance regulators.

The FSMA also allowed national banks to sell insurance nationwide and allowed a holding company to own both banks and insurance companies. Even before the FSMA, insurance companies were permitted to create or acquire thrift institutions, who were regulated by the federal Office of Thrift Supervision (OTS). However, during the 2007-2009 Great Recession, the overlap of regulations between the OCC in the OTS was severely criticized, because it allowed banks to choose the more lenient regulator, leading to a competition of less regulation between the federal agencies. This allowed banks to take greater risks to potentially earn higher profits, which caused many banks to fail during the Great Recession.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) abolished the OTS and transferred the regulation of thrifts to the OCC while the Federal Reserve regulated financial holding companies. The additional restrictions imposed by these new developments, including capital requirements, regulations limiting consolidation, and restrictions on other activities caused the insurer-thrift association to decline. The union of banking and insurance was also reversed in Europe when their banks incurred large losses during the Great Recession.