Health Insurance Premium Tax Credit

The 2025 Tax Act (aka, the misnomered One Big Beautiful Bill Act) changes for the ACA:

- Eliminates eligibility for anyone enrolling in marketplace coverage during a special enrollment period due solely to a change in household income.

- Requires verification of household income, immigration status, and family size.

- Bronze and catastrophic plans are now treated as a High-Deductible Health Plan (HDHP), allowing taxpayers under these plans to have Health Savings Accounts.

- No-deductible telehealth plans or direct primary care (DPC) service arrangements, where primary care is offered for a fixed, periodic fee, will not disqualify plans as HDHPs.

Calamities happen by chance. Insurance is designed to mitigate the risk of economic loss from calamities by having a group of people, the insured, paying premiums to pay for economic losses suffered by the few among the group. However, if only the people at high risk for the calamity pays into the insurance fund, then it will be much more expensive. On the other hand, insurance companies want to profit. Therefore, they will attempt to eliminate high risk customers — the people who would need the insurance the most — from their insured pool. Since healthcare costs are extremely high, most people without insurance would be unable to afford the cost of healthcare, forcing those in need to declare bankruptcy or to simply not pay their bill. The government may pay the healthcare providers for the services they provided; otherwise, without government intervention, health insurance will not work for society. Those at low risk will not want to pay the high premiums, and those at high risk cannot afford the premiums. The Affordable Care Act (ACA) was designed to rectify this fundamental flaw in health insurance by forcing most everyone to pay into the system. Recognizing that most poor people cannot afford to pay health insurance premiums, the ACA also allows the government to pay subsidies, in the form of a tax credit, to those people to make the premiums more affordable.

The Affordable Care Act now allows you to be covered by health insurance that provides minimum essential coverage, which is the typical coverage provided by employers or government organizations, if the premiums are affordable and out-of-pocket costs do not exceed a statutory maximum. To help lower-income taxpayers afford health insurance, a health premium tax credit (PTC) is available to offset the high cost of health insurance. Taxpayers can elect to have the government pay the tax credit directly to the insurance company, called the advanced premium tax credit (APTC), to lower the cost of premiums as they pay it. Since the tax credit is based on household income and family size for the covered year, household income must be estimated for that year to determine the amount of the available credit. If an APTC is paid, then the Marketplace must be notified if any of these changes:

- household income

- employment status

- gaining or losing eligibility for minimum essential coverage provided by an employer or a government organization

- birth or adoption

- change in marital status

- any other changes affecting the composition of the tax family

Therefore, when filing a tax return, you must determine how much of the health insurance premium tax credit you may be entitled to, based on the income that was actually earned for that year. If an APTC was applied to lower the cost of premiums, then the APTC amount must be reconciled with the PTC amount that you were actually entitled to. If the applied tax credit was less, then the remaining credit can be used to lower tax liability, or even increase a refund; if the applied tax credit was greater, then you may have to pay additional taxes, depending on the actual discrepancy.

The premium tax credit (PTC) is available to any taxpayer with income ranging from 100% to 400% of the federal poverty line (FPL) of the previous tax year when open enrollment began. Taxpayers or their families with incomes below the applicable FPL do not qualify for the credits since it is presumed that they will qualify for other government assistance, primarily Medicaid. To qualify for the premium tax credit, these requirements must be satisfied:

- a qualified health plan — bronze, silver, gold or platinum plan — was obtained from either the Health Insurance Marketplace or 1 of the state exchanges

- catastrophic insurance or other insurance that does not meet the minimum coverage requirements are not considered qualified plans

- no other employer or government health plan is available

- income is at least 100% but less than 400% of the federal poverty line of the previous tax year

- The poverty level used is listed in the Instructions for Form 8962.

- Alaska and Hawaii have slightly higher incomes for poverty levels.

- A temporary provision, which expires after 2025, may allow a credit for household incomes exceeding 400% of the federal poverty level if the cost of the benchmark plan exceeds 8.5% of household income.

- The 2025 Tax Act did not extend this provision.

- the taxpayer cannot be claimed as a dependent by another

- the taxpayer cannot file a tax return as married filing separately unless they are a victim of domestic abuse

The tax family includes all members of a household who is either a spouse or a claimed dependent. The PTC depends on household income, which is the sum of the modified adjusted gross income (MAGI) of all members of the tax family whose income exceeds filing requirement income thresholds.

Modified Adjusted Gross Income (MAGI)

- = Adjusted Gross Income

- + Nontaxable Social Security Benefits

- + Tax-Exempt Interest

- + Excluded Foreign Income

The coverage family is all members of the family enrolled through a qualified health plan, and who are not eligible for coverage by employer-provided insurance or government insurance that meets the minimum coverage requirements. Only members of the coverage family are entitled to the PTC.

Example: Tax Family, Coverage Family, and Calculating Household Income

You and your spouse have 2 children who you claim as dependents and are covered by the Children's Health Insurance Program (CHIP). Both children have part-time jobs, each earning $5000 annually. You earned $20,000 for the year and your spouse earned $30,000. You are not eligible for employer-sponsored or government health coverage, so you enrolled in a qualified health plan through the Marketplace; your spouse is eligible for employer-sponsored coverage. Therefore, your tax family is you and your spouse and your 2 dependent children. Your coverage family consists only of you because only you do not qualify for other health insurance providing minimum essential coverage. Since you are the only member of the coverage family, only you will be entitled to the PTC. Your PTC household income = your MAGI of $20,000 + your spouse's MAGI of $30,000, for a total household income of $50,000. Your children's income is not included, because their income does not exceed the filing requirement income threshold.

The tax credit can be paid directly to insurance companies to lower the monthly premiums or received when the tax return is filed, which will either increase a refund or lower the balance due. The PTC is a fully refundable credit, meaning that even if tax liability is 0, the taxpayer will receive a refund.

Income, for purposes of calculating the PTC, can be reduced by contributing to a retirement plan, such as a 401(k), 403(b), or a traditional IRA.

A Great Tip to Increase Your Premium Tax Credit

PTC depends on your MAGI, which can be lowered by making contributions to a retirement plan. The more you contribute, the more it will lower your MAGI, which will increase your credit, or even allow you to claim the credit, if your income would otherwise be too high.

Sometimes, MAGI can be lowered by tens of thousands of dollars. For instance, if you are at least 50 years of age and self-employed and contribute to a solo 401(k) plan and a traditional IRA, then you could contribute more than $30,000, thereby lowering your MAGI by that same amount. So even if you are single and earn $70,000 annually, you could still claim the credit!

Premium Tax Credit

The PTC is not based on the chosen plan — it is based on the second lowest cost silver plan (SLCSP) in the Marketplace that applies to the coverage family.

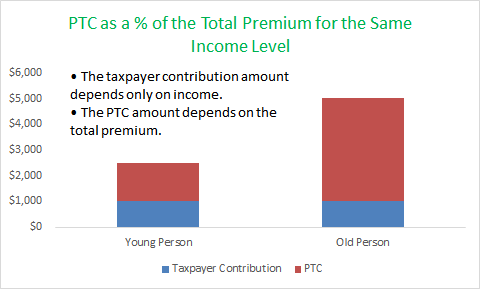

The total premium tax credit is the amount you are entitled to receive. Insurance companies are permitted to charge up to 3 times the premium for older adults as for younger. However, contributions are the same for the same income level, but the PTC is more for older people than for younger people, to compensate for the higher premiums.

Form 1095-A, Health Insurance Marketplace Statement

If health insurance was purchased through the Health Insurance Marketplace, then you will receive a Form 1095 – A, Health Insurance Marketplace Statement by early February before the tax filing deadline, showing coverage details, including the covered period, the premium, and the amount of the advanced premium tax credit. Form 1095-B reports coverage provided by an employer and Form 1095-C reports purchases outside of the Health Insurance Marketplace. If the information on Form 1095-A is incorrect, then contact the Marketplace, not the IRS.

Form 8962, Premium Tax Credit

Most people who purchased insurance through the exchanges received subsidies in the form of the APTC. The subsidy amount was based on estimated income but it must be reconciled to actual earnings for the year. As already noted, the PTC also depends on household income, the size of both the tax family and the coverage family. Therefore, the discrepancy must be reconciled on Form 8962, Premium Tax Credit (PTC), which must be filed if:

- any family member received an APTC

- an APTC was received for someone who they thought would be claimed as a dependent but was not claimed and no one else claims that person as a dependent

- a family member bought insurance in the Marketplace but wants to claim a PTC that was not advanced.

The information from Form 1095-A used in Form 8962, Premium Tax Credit includes:

- the annual premium charged by the insurance company

- the annual premium of the second lowest cost silver plan (SLCSP)

- the total APTC paid to the insurance company for the year.

This information is then used on Form 8962 to calculate how much of the PTC you are actually entitled to, based on household income, and how much of a refund, if any, you will get or how much you must pay, if the APTC was excessive.

The net premium tax credit calculated on Form 8962 is transferred to Schedule 3, Additional Credits and Payments of Form 1040, then to the Payments section of Form 1040. However, if an excessive amount of the APTC was paid, then that additional tax is transferred to Schedule 2, Additional Taxes of Form 1040 and to the Tax and Credits section of Form 1040.

The 1st step is calculating household income as a percentage of the federal poverty level (FPL), which must be less than 400%. For instance, if the applicable poverty level is $13,590 and earnings = $14,000, then earnings = 103% (=$14,000/$13,590, this percentage is rounded down rather than up, per the Instructions for Form 8962) above the poverty level. With this information, you look at the table for the Form 8962 instructions to find the decimal fraction corresponding to the percentage of income over the poverty line, which ranges from 0% for anyone earning less than 150% of the poverty level to 8.5% for those earning 400% or more of the poverty level. This is then multiplied by the household income to calculate the annual contribution amount, which is subtracted from the SLCSP to yield the annual maximum premium assistance. The annual PTC allowed will be the smaller of the Annual Maximum Premium Assistance or the total enrollment premium charged by the insurance company. The total of the payments advanced to insurance companies during the course of the year are then subtracted from the allowable PTC to yield the fully refundable premium tax credit that was not used to pay for insurance premiums.

APTC Repayment Limits

If an excessive amount of the APTC was paid, as calculated on Form 8962, then you will have repay some or allthat excess, depending on filing status and the percentage that your income exceeds the poverty level:

| Income (as a % of FPL) | Single | Other Filing Status |

|---|---|---|

| 2025 | ||

| Income < 200% | $375 | $750 |

| 200% ≤ Income < 300% | $975 | $1,950 |

| 300% ≤ Income < 400% | $1,625 | $3,250 |

| Income ≥ 400% | No Repayment Cap | |

| 2024 | ||

| Income < 200% | $375 | $750 |

| 200% ≤ Income < 300% | $950 | $1,900 |

| 300% ≤ Income < 400% | $1,575 | $3,150 |

| Income ≥ 400% | No Repayment Cap | |

| 2023 | ||

| Income < 200% | $350 | $700 |

| 200% ≤ Income < 300% | $900 | $1,800 |

| 300% ≤ Income < 400% | $1,500 | $3,000 |

| Income ≥ 400% | No Repayment Cap | |

So if you were married, and your joint income was less than 200% of the federal poverty level, then your maximum repayment will be $750 in 2024 or 2025.

The requirement that income be between 100% and 400% of the federal poverty line has 2 exceptions:

- people who were estimated to have income in the required range, but who ended up with less than 100% FPL at year-end

- lawfully present immigrants with incomes less than the FPL who are also ineligible for Medicaid through their immigration status.

There is also an alternative calculation if you got married and for which an excessive APTC was paid for an individual in your tax family. This alternative calculation, detailed in the Form 8962 instructions, may yield a lower required repayment amount.

Requirements for Using the Alternative Calculation for the Year of Marriage

- Both you and your spouse were unmarried at the beginning of the year.

- You are married by year-end.

- You are filing a joint return with your new spouse for the tax year.

- No one in your tax family was enrolled in a qualified health plan before your 1st full month of marriage. (So if you are married in mid-April, then your 1st full month would be May.)

- An APTC was paid to someone in your tax family during the year.

The Inflation Reduction Act of 2022 (H.R.5376) was signed into law on August 16, 2022.

The favorable PTC provisions under ARPA, which were to expire after 2022, now apply to tax years 2023 to 2025, requiring households to contribute 0% to 8.5% rather than 1.92% to 9.12%, resulting in higher PTCs for health insurance bought in the marketplace. Credit may be available for household incomes exceeding 400% of the federal poverty level, if the cost of the benchmark plan exceeds 8.5% of household income.

However, no provisions allow for waiving excess advance PTC repayments or for adjusting the PTC for unemployment benefits, as was possible during 2021 and 2022.

Simplified Summary for Calculating the Premium Tax Credit

- Form 1095 – A, Health Insurance Marketplace Statement is sent by February of the next year to those who used the Marketplace and will report:

- annual premium charged by the insurance company

- annual premium of the second lowest cost silver plan (SLCSP)

- annual total of the advance payment of the PTC to the insurance company

- On Form 8962, Premium Tax Credit (PTC), you will need information on both the actual premium you are entitled to and the amount of your refund, which will be based on the premiums charged by the insurance company, the APTC payment to the insurance company during the tax year, and the income earned by your household:

- Calculate PTC Household Income by adding the MAGIs of all tax family members whose income exceeds the filing requirement threshold.

- Income as a Percentage of Poverty Level = Household Income/Applicable Poverty Level

- Use this percentage to find the applicable poverty level and the applicable Decimal Fraction in Form 8962 Instructions (ranges from 0.000 to 0.085)

- Annual Contribution Amount

- = Household Income

- × Decimal Fraction

- Annual Maximum Premium Assistance

- = Annual Premium Amount of SLCSP

- − Annual Contribution Amount

- Annual PTC Allowed

- = Lesser of

- Premium Amount Charged by Insurance Company

- Annual Maximum Premium Assistance

- = Lesser of

- Refundable PTC

- = Annual PTC Allowed

- − Annual Advance Payment of PTC

| Information Reported on Form 1095 – A, Health Insurance Marketplace Statement (Sent to Marketplace participants by early February, before the tax filing deadline.) | ||

|---|---|---|

| Actual Annual Premium Charged by the Insurance Company | $5,000 | |

| Annual Premium of the Second Lowest Cost Silver Plan (SLCSP) | $5,200 | |

| Annual Total of the Advance Payment of the PTC to the Insurance Company | $4,560 | |

| Figuring the PTC on Form 8962, Premium Tax Credit | ||

| Household Income | $15,000 | |

| Applicable Poverty Level | $11,490 | |

| Income as a Percentage | 131% | = Household Income/Applicable Poverty Level |

| Decimal Fraction | 0.02 | Find this in Form 8962 Instructions based on Income Percentage |

| Annual Contribution Amount | $300 | = Household Income × Decimal Fraction |

| Annual Maximum Premium Assistance | $4,900 | = Annual Premium Amount of SLCSP − Annual Contribution Amount |

| Annual Premium Tax Credit Allowed | $4,900 | = Lesser of (Actual Premium Amount Charged by Insurance Company or Annual Maximum Premium Assistance) |

| Refundable PTC | $340 | = Annual Premium Tax Credit Allowed − Annual Advance Payment of PTC |

Shared Policy Allocation

If you receive a Form 1095–A that lists people from your tax family and from another tax family, or if the form does not accurately represent your tax family, then enrollment premiums, SLCSP premiums, and/or the APTC must be allocated to correct the amounts. These allocation rules apply if the Marketplace was not notified of changes in your tax or coverage family. Often, policy amounts must be allocated for divorce or because you claimed an APTC for a child living with your ex-spouse who claims that child as a dependent, or because your ex-spouse claimed an APTC for a child that you claim as a dependent. An allocation may also be necessary because a married couple filed separately instead of jointly. Multiple allocations may be necessary if family circumstances changed more than once during the year.

Divorced spouses can agree to any allocation they wish, but if no agreement is possible, then the allocation percentage is 50% to each, meaning that spouse can claim only 50% of the enrollment premiums, SLCSP premiums, and the APTC listed in their Form 1095 – A, Health Insurance Marketplace Statement.

An allocation may also be necessary if the spouses were married at year-end but file separate returns. If you or someone in your tax family was enrolled in the same policy as your spouse or some other individual in your spouse's tax family at any time during the tax year, then the allocation percentage is 50% to each spouse.

A married spouse filing separately can only claim the PTC if she files as single or head of household and the separate filing was because she lived separately from her spouse or due to domestic abuse or spousal abandonment. Unless one of these exceptions apply, a spouse filing separately cannot claim the PTC and must repay any APTC paid on his behalf.

Another allocation situation arises if the taxpayer indicates to the Marketplace that 1 or more people would be claimed as dependents but were claimed by someone else, instead. In these cases, the 2 taxpayers can agree to any allocation percentage, which may vary by the month, but the percentage must apply to enrollment premiums, applicable SLCSP premiums, and the APTC.

Detailed instructions for shared policy allocations are found in the Form 8962 instructions.