Qualified Terminal Interest Property (QTIP) Trusts

A qualified terminal interest property (QTIP) trust supports a surviving spouse, thus qualifying for the unlimited marital deduction, while ensuring that the remaining trust property is distributed per the decedent spouse's instructions. The QTIP trust is most often used when the decedent has children from other marriages. A QTIP trust, otherwise called an ABC trust, allows the deceased spouse's property that is over the federal estate tax exemption amount to be transferred to a separate trust — usually called Trust C — that gives the surviving spouse a life estate in the property of Trust C while delaying payment of the estate tax on the property until the surviving spouse dies. The only benefit to the QTIP trust over an AB trust is that it delays the payment of the estate tax on the amount in the trust until the surviving spouse dies and the beneficiaries of Trust C cannot be changed by the surviving spouse. Hence, the 1st-to-die spouse can be sure that his beneficiaries will receive the property.

The IRS authorized QTIP trusts in 1982. The QTIP trust cannot be terminated until the 2nd spouse dies. Any type of property can be put in a QTIP trust, but the surviving spouse has a right to demand that non-income producing property be sold to buy income-producing property.

To comply with IRS regulations for QTIPs, the trust document must specify:

- all income from the trust must be distributed to the surviving spouse at least annually;

- the spouse can demand that non-income producing property be converted to income-producing property;

- no person has the right to appoint QTIP trust property to anyone but the surviving spouse. IRC 2056(b)(7)(B)

The creation of Trust C is necessary for the restrictions on the marital deduction, which applies because, technically, the property is given to the surviving spouse to delay the payment of the estate tax, but the surviving spouse cannot change trust beneficiaries. When the trust receives property from a deceased spouse, the trust can only qualify for the marital deduction if:

- the surviving spouse is the only beneficiary of the trust during her lifetime, and she must be given either:

- unrestricted power to dispose of the trust assets when she dies, or

- all the trust income must be distributed to her at least annually during her lifetime.

Consequently, any contingency that terminates her interest before her death, such as upon remarriage, will disqualify the property for the marital deduction.

Without the marital deduction, estate taxes must be paid on the property in Trust C when the 1st spouse died. However, all QTIP trusts are structured so that the surviving spouse receives the income from the trust but is not permitted to change trust beneficiaries; otherwise, if the deceased spouse was not worried about the ultimate beneficiaries of his property, or trusted his spouse completely, there would be no purpose for the separate trust since all the property can be given to the surviving spouse without any estate tax being due.

However, one drawback is that estate taxes are eventually paid on the property value when the surviving spouse dies — not when the 1st spouse dies. This is because the property is considered the surviving spouse's — so the trust property qualifies for the unlimited marital deduction — even though she cannot change the beneficiaries of the trust. Hence, if the property value in Trust C increases substantially, then more estate tax must be paid than would otherwise be the case if the property was distributed directly to the ultimate beneficiaries when the 1st spouse died.

QTIP Election

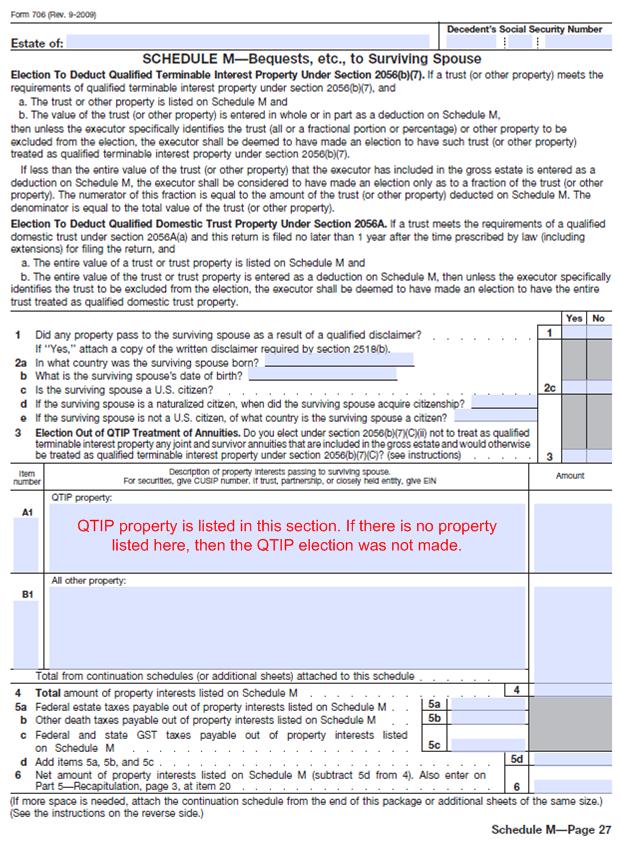

If the grantor gives the QTIP property during his life, then the grantor must make the election to treat the property as QTIP property. If the grantor wants to transfer the property at his death through a trust, then the grantor must prepare the QTIP trust document, but to delay payment of the estate tax on the QTIP property, the executor of the will must elect it on the federal estate tax return by listing the property on Schedule M, Bequests, etc., to Surviving Spouse, which is part of the Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return and deducting its value from the deceased spouse's taxable estate.

The QTIP election does allow some flexibility in estate planning, because the executor can choose not to select the QTIP election by not listing any property in the QTIP section of Form 706, to place all property specified by the trust document into the QTIP trust, or to make a partial QTIP election by specifying that only a percentage of the trust property be included in the QTIP trust.

For the partial QTIP election, only the percentage of the property listed for QTIP treatment can be specified — not specific property. The percentage that is excluded will be added to the taxable estate of the decedent. Hence, if 60% of the property is elected for the QTIP treatment, then the 40% of the remaining trust property is immediately subject to estate tax.

Under IRC §2652(a)(3), the executor can also select a special or reverse QTIP election on Schedule R — Generation-Skipping Transfer Tax of the estate tax return, which can be made independently of the other elections, that allows the donor to use his personal exemption for the generation-skipping transfer tax (GSTT) for property in the trust whose final beneficiaries are in the 2nd or a later generation. The reverse QTIP election allows the QTIP property to be treated as the decedent spouse’s property for GSTT purposes, but still qualify for the marital deduction. This allows using the first-to-die spouse's GSTT exemption for the trust property, while also allowing the surviving spouse's GSTT exemption to be used for her own property. Without the reverse QTIP election, and because the property in the QTIP trust is considered the surviving spouse's, only her GSTT exemption would be available for exempt property left to grandchildren or younger generations — the exemption that was available to the predeceased spouse would be lost.

The reverse QTIP election can only apply to a separate QTIP trust, so if the amount qualifying for the marital deduction exceeds the GST exemption, then 2 QTIP trusts must be created, one for the GST exemption, and the other for the remaining marital deduction.

If the decedent had a unified credit exemption less than the GST exemption, then taxes can be saved by allocating the amount that is covered by the unified credit and GST exemption in 1 QTIP trust; the remaining GST exemption can be applied to a reverse QTIP trust that will qualify for the marital deduction, while the rest the property will go into a regular QTIP trust that will qualify for the marital deduction.

When the surviving spouse dies, then the estate tax due on the QTIP property is paid out of the trust corpus.