Money Demand and Money Velocity

An economy works best when inflation is low and predictable, but to control inflation, one needs to understand what causes it. Over the long run, inflation is largely determined by how much the money supply increases over increases in real GDP. In the short run, inflation also depends on the velocity of money, which inversely depends on the demand for money. This can be seen from the equation of exchange (discussed in the previous article):

M × V = P × Y = Nominal GDP

- M = Quantity of Money

- V = Velocity of Money

- P = Nominal Price

- Y = Real GDP

Therefore:

| MV | ||

| P | = | |

| Y |

Likewise, price changes are caused by changes in these factors:

%ΔM + %ΔV = %ΔP + %ΔY

%ΔP = %ΔM + %ΔV − %ΔY

So, in the short term, if the velocity of money and the real GDP are considered constant, then changes in price result from changes in the money supply:

%ΔP = %ΔM

Demand for Money

Everybody wants money. But when economists and bankers talk about the demand for money, they are not talking about the demand for wealth. Instead, they are talking about how much individuals and firms want to be liquid, how much money they want to hold for future purchases or investments. Liquidity is the ability to make payments, which = the amount of cash being held by individuals or firms + any assets easily convertible to cash for little or no fees and with no loss of value. Thus, the demand for money can also be called a liquidity preference. Money is a generic term, which is anything that can be used as a means of payment. However, when discussing the demand for money, economists and bankers are talking about MZM money.

The Federal Reserve defines 3 major classes of money. M1 money consists of cash in the form of currency and coins, traveler's checks, demand deposits, and checkable deposits. M2 money consists of M1 + savings deposits, certificates of deposit of less than $100,000, and money market deposits. Because technology has blurred the distinction between M1 and M2 money in terms of liquidity, a new category of money has been created to reflect the increased liquidity of most types of M2 money. MZM money, which is money with zero maturity, consists of currency and coins + all financial assets redeemable at par on demand, including traveler's checks, demand deposits, other checkable deposits, savings deposits, all money market funds, but not time deposits. In other words, MZM money is M2 money minus time deposits.

The demand for money is the proportion of one's wealth that is held as a means of payment or as assets that can easily, inexpensively, and with little risk of loss of value easily be converted into a means of payment. Even though money held in savings accounts or in money market funds earns some interest, in this context, they are not considered investments, because they do not earn much interest, and there's little risk for loss. People use these accounts to earn some interest while maintaining liquidity, thus satisfying the demand for money.

For instance, it is often advised to save at least 6 months of living expenses, in cases of emergencies or a job loss. Such savings would probably be held in a savings account or a money market fund, because it can quickly be converted into a means of payment without incurring transaction fees and with little risk. On the other hand, the amount of money invested in bonds or stocks does not satisfy the demand for money, because, although they can quickly be sold for cash, the sale incurs transaction costs, but more importantly, they may be sold at a loss, if the money is needed at a certain time.

The Demand for Money and the Velocity of Money Are Inversely Related

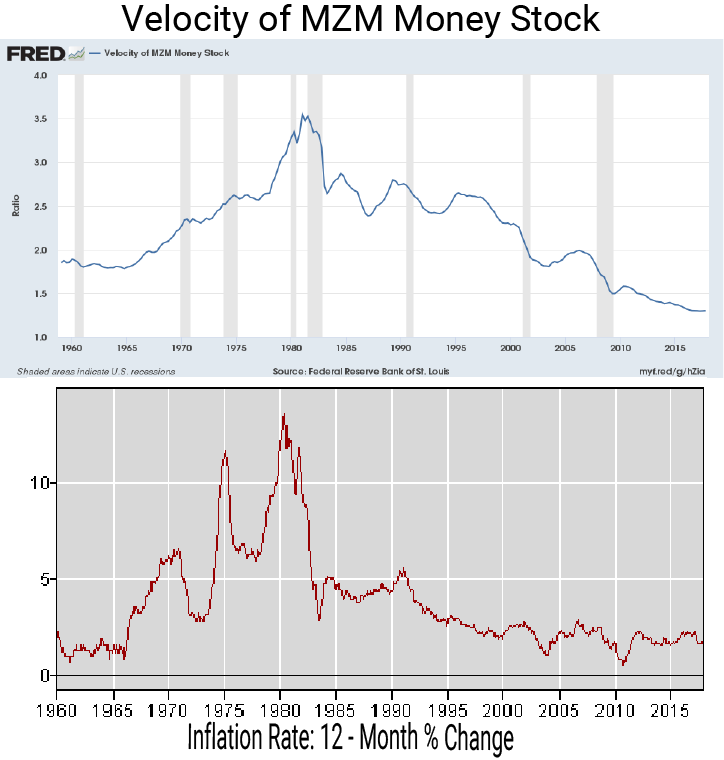

Over the long-term, the link between money growth and inflation is strong, but money velocity is not constant over the short term, so some short-term inflation may be caused by an increase in money velocity. Although the velocity of money cannot be measured directly nor is it predictable over the short term, it is determined by both the demand for money and the supply quantity of money. An increased money supply will lower money velocity, while a decreased money supply will increase money velocity, all else being equal. But, in the short term, the money supply is considered constant.

The velocity of money is the frequency that one unit of currency is used to purchase domestically produced goods and services within a given duration, i.e., the number of times a dollar bill is spent to buy final goods and services per unit of time. (To avoid double counting, economists only measure the prices of final goods and services, since the prices of intermediate products and services are included in the final prices.)

By definition, money velocity increases when money is spent more frequently for final goods and services per unit of time. Additionally, money velocity can be increased indirectly by increased investments. Although an investment is not a purchase of a final good or service, it does stimulate such purchases by lowering the interest rate, since it is well-established that — all else being equal — lower interest rates stimulate aggregate demand, which is the total demand for all goods and services produced by an economy.

How increased investments can reduce the interest rate can best be illustrated with bonds. Because bond yields are inversely proportional to bond prices, an increased demand for bonds will raise their prices, thus lowering their yields. Companies can issue bonds at lower yields, decreasing their demand for loanable funds, thereby propagating the decrease in interest rates throughout the economy. Likewise, purchases of stock can also lower market interest rates, because companies that obtain funding by issuing stock will have a lower demand to borrow money.

Hence, a lower demand for money increases money velocity in 2 ways: an increase in spending and/or an increase in investments. Likewise, higher demand for money will decrease spending and/or investments, which decreases the velocity of money. Therefore, any factors that cause people to hold money will decrease the velocity of money, while factors that increase spending or investment will increase the velocity of money. Therefore, the demand for money is inversely related to the velocity of money. To understand how the velocity of money changes, one must understand what changes the demand for money.

Under most economic models, over the long-term, inflation depends on how much the growth of the money stock exceeds real GDP. The supply of money is the only factor that politicians can control, at least directly. Real GDP and the velocity of money cannot be controlled legally or politically.

So to control inflation by targeting the money growth rate, a central bank must know what influences the demand for money and how changes in monetary policy rules will influence that demand.

The Effect of Lower Interest Rates Will Depend on Debt Load and Economic Conditions

The increase in aggregate demand with lower interest rates will depend on the debt load of consumers and firms and on economic conditions. While lower interest rates do stimulate aggregate demand, with all else being equal, the magnitude of this effect will depend on debt loads and economic conditions. High debt loads will decrease the stimulatory effect of lower interest rates, because debtors will be reluctant or unable to increase their debt load. Furthermore, they must decrease spending and investments to pay their debt. Likewise, when economic conditions are poor, consumers and firms will be reluctant to increase spending or to increase investments, because of the increased risk. This is best illustrated by the prolonged period for the economy to emerge from the Great Recession of 2007 to 2009, despite record low interest rates. Consumers and firms were deeply in debt, so their creditworthiness had declined dramatically. Additionally, because banks wanted to avoid more losses, their lending requirements became stricter. Thus, few people could take out loans, even if they wanted to. Furthermore, because people didn't have money to spend, firms were also unwilling to borrow, since they already had excess capacity due to their depressed economy. So, at the start of the Great Recession, lower interest rates had a much lesser effect in stimulating the economy, which is why the after effects of the recession lasted so long.

Determinants of the Demand for Money

The primary factors affecting the demand for money are the:

- inflation rate,

- price levels,

- nominal interest rates

- expectations about interest rates,

- nominal income,

- real GDP,

- transfer costs,

- faster transfers

- preferences, and

- technology.

Inflation may increase or decrease the velocity of money, depending on which factors are more prominent. Low inflation increases demand for money because higher prices requires more money for a given amount of goods and services. But higher inflation also increases the holding costs of money. For instance, if the inflation rate is 10%, then the cost of holding money is -10%. So when inflation is high, people will either spend it or invest it before the money loses value. This is particularly true in hyperinflation environments. Hence, higher inflation rates increases the velocity of money, which increases inflation even more. As with inflation, higher price levels will also increase the demand for money.

Because money is used as a means of payment, a higher nominal income tends to increase the amount of money people desire to hold, since wealthier people buy more expensive products and services and have a higher level of expenditures. Because incomes increase with real GDP, the demand for money will also increase with increases in the real GDP.

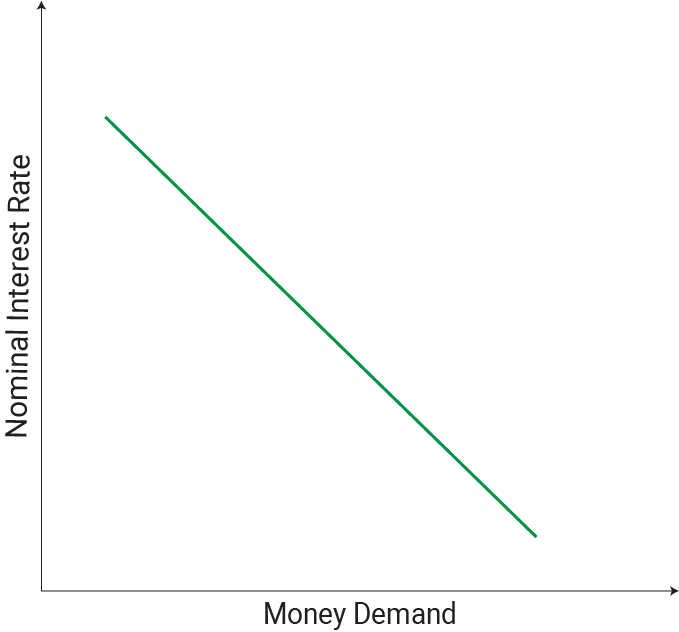

Higher interest rates reduces the demand for money by increasing the opportunity cost of holding money, which is the interest that could be earned if the money was invested. So if the interest rate is 5%, then the cost of holding money is the 5% that could have been earned in interest. Expectations of a higher interest rate will increase the demand for money, since interest-paying securities decline in price when interest rates rise.

Preferences may also change with economic conditions. When the economy is good, people tend to hold less money by spending more or investing more. When the economy is declining, people feel more anxious, which increases their demand for money. This is sometimes called a precautionary demand for money, which is money held for emergency expenses. Since people with higher incomes generally have higher expenses, they tend to hold more money for emergencies. The precautionary demand for money will also be greater with greater uncertainty about the future. For instance, if you feel insecure about your job, you will tend to hold more money because of increased unemployment risk.

Technology that provides liquidity, such as credit cards, reduces the demand for money, since these payment substitutes provide a means of payment without the need to hold money. Likewise, lower transfer costs and faster transfers between accounts will lower the demand for money.

Transactions and Portfolio Demand for Money

Money can be spent or invested, so the desire to hold money is to make a future purchase or investment rather than buying or investing now. The main benefit of holding money is that it provides the holder flexibility, so what it is ultimately used for does not matter. Nonetheless, some economists distinguish between the transactions demand for money and the portfolio demand for money.

The transactions demand for money is the demand for money intended to be used for a future purchase. Likewise, the portfolio demand for money is money held for future investments.

The portfolio demand for money increases with wealth and portfolio risk and decreases with increased portfolio returns, lower risk, or lower opportunity costs. In other words, the portfolio demand for money is influenced by the same factors that influence the demand for bonds. People with greater wealth want to invest more, since they have most of the goods and services that they want, while higher investment risks will cause people to invest less, since there is a greater chance for loss. By contrast, greater portfolio returns and reduced risk decreases the demand for money, since there is an opportunity cost of not investing, and vice versa. For instance, when bonds pay 2% interest or less, people tend to hold more money in their checking accounts, because it is more liquid and the opportunity cost of earning interest from bonds is low. Additionally, the risk from bonds is low, but not 0, so a low interest rate may not compensate for the risk. If interest rates are high and risks are low, then people will want to invest more. If interest rates are expected to rise in the future, then people will hold more money, because rising interest rates causes the value of bonds and other interest-paying financial instruments to fall in value. Stocks also tend to decline with higher interest rates.

Central Banks Target Interest Rates Rather Than Money Growth to Control Short-Term Inflation

Since the factors that influence the demand for money are difficult to measure directly, central banks use statistics to predict how changes in monetary policy will affect the demand for money. Nonetheless, because the demand for money and, therefore, the velocity of money, fluctuates considerably over the short term, the link between money supply and inflation is weak over the short term. Hence, by targeting money growth, interest rates fluctuate with the velocity of money. Because a stable interest rate helps to stabilize the economy, but money growth causes interest rates to fluctuate, central banks target interest rates rather than money growth as a means to control short-term inflation.