TED Spread

Important Note! Because LIBOR is no longer being used as an interest rate, the TED Spread has been discontinued. The information presented here is for historical purposes only!

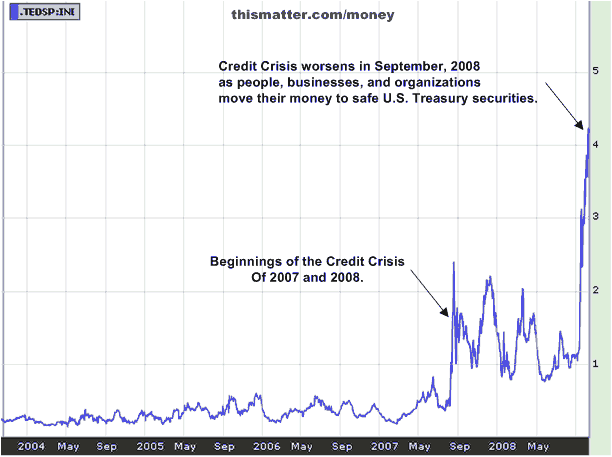

The TED spread is the difference, or spread, of interest rates paid on 3-month United States Treasury bills (T-bills) and the 3-month LIBOR for the United States dollar (USD), which is what banks pay to borrow USD. The term TED spread originates either from the phrase Treasuries over Eurodollars, which are U.S. dollars (USD) deposited in banks outside of the United States, or, a more likely source of the name TED, is T-bill over ED, which is the ticker symbol for the Eurodollars futures contract that is traded on CME Globex. The LIBOR for borrowing in USD is called the Eurodollar interest rate. The TED spread generally indicates confidence in the banking system — a narrow spread indicates confidence while a wide spread indicates generalized fear, and usually results from a flight to quality. For instance, the TED spread averaged 41 basis points for 3-month maturities from 1990 to July, 2007, but during the Great Recession of 2008, the spread had widened to 464 basis points, which is the highest spread in recent times. Other times when the spread had widened considerably was after the stock market crash on October 20, 1987, when it averaged 300 basis points and after the implosion of Long-Term Capital Management LP in 1998, when it reached 160 basis points.

Screen clipping taken: 10/10/2008, 5:17 PM

There is also an active futures market, where traders hedge or speculate that the TED spread will widen or narrow within the timeframe of the contract.