Mortgage-Backed Securities (MBS)

Mortgage-backed securities (MBS), also called mortgage bonds, are pools of real estate mortgages that have been collected from lending institutions and securitized by the MBS issuer, then sold to investors. Based on securitized mortgage contracts, called pooling and servicing agreements, these mortgage pools consist of mortgages classified by interest rate, maturity, property type, and risk. MBSs allow banks to remove the loans from their balance sheets, thus freeing up more money to make more loans. Unfortunately, they also allow banks to transfer credit default risk to the investors of MBSs while still profiting from loan origination fees and servicing fees. Before the Great Recession that started in 2007, the credit quality of the underlying mortgages declined, thereby precipitating the Great Recession that continued to haunt the world economies for at least 6 years afterward. Nowadays, stricter rules have made MBSs safer.

Mortgage Servicers

Usually, the bank that originated the mortgage also services the loan, for which it continues to deduct a small part of the interest payment as its fee. Sometimes, specialty firms, such as Litton Loan Servicing, act as the mortgage servicer, who collect payments from borrowers, deduct their fee percentage from the payments, and pay the rest of the monthly payment, both principal and interest, to the investors who purchased the securities, so they are also called pass-through securities. Mortgage servicers also administer the borrowers' escrow accounts, collecting and paying taxes and insurance. The servicer also follows up on any borrower defaults.

Real Estate Mortgage Investment Conduits (REMIC)

A major type of MBS are various forms of REMIC securities. Real Estate Mortgage Investment Conduits (REMICs) are corporations, partnerships, or trusts that issue mortgage-backed securities of different classes, with different principal balances, interest rates, average lives, prepayment characteristics, final maturities, and different yields and risks, thus expanding the market by creating a more diverse set of securities for investors. The legal basis of REMICs was established by the Tax Reform Act of 1986, which eliminated double taxation from these securities. Unlike traditional pass-throughs, the principal and interest payments in REMICs are not passed through to investors pro rata; instead, they are divided into varying payment streams to create the different classes of issued MBSs. The assets underlying REMIC securities can be either other MBSs or whole mortgage loans. One example of a REMIC security is the collateralized mortgage obligation.

MBS Issuers and Guarantors

MBSs can be classified by issuer or guarantor. Most MBSs are proprietary and are issued by private entities, usually banks; a large percentage are backed by the government-sponsored entities (GSEs) Fannie Mae and Freddie Mac, and a small percentage are backed by the government-owned Ginnie Mae.

Ginnie Mae: Government National Mortgage Association

In 1968, Congress established the Government National Mortgage Association, commonly called Ginnie Mae, as a government-owned corporation within the Department of Housing and Urban Development (HUD). Ginnie Mae guarantees MBSs issued by approved financial institutions where the underlying security consists of mortgages insured by the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), Department of Agriculture's Rural Housing Service (RHS) and the Department of Housing and Urban Development's Office of Public and Indian Housing (PIH). Ginnie Maes are the only MBS backed by the full faith and credit of the United States Government, so they are as free from credit default risk as Treasuries.

The main issuers of Ginnie Mae MBS are mortgage banks, savings and loans, and commercial banks. The minimum denomination is $25,000 and both principal and interest are paid monthly.

As with all MBS's, the interest rate paid to investors is lower than the interest rate of the underlying loans because servicing and guaranty fees are subtracted; investors receive the resulting net cash flow pro rata.

Ginnie Maes come in 2 types:

- GNMA 1 certificates pay principal and interest separately from a single issuer pool.

- GNMA 2 securities, based on multiple issue pools from more diverse locations, pay both principal and interest in each payment to investors.

Ginnie Mae I MBS requires all mortgages in a pool to be the same type (e.g. single-family), have equal interest rates, and be issued by the same issuer. The minimum pool size is $1 million and each mortgage must remain insured or guaranteed by FHA, VA, RHS or PIH. The 1st payment must be sent no later than 48 months before the issue date of the securities; monthly payments are sent on the 15th day of each month thereafter.

Ginnie Mae II MBS consists of multiple-issuer pools based on a greater geographic diversity of mortgages, and securitization can be based on smaller portfolios. Coupons with different yield and risk characteristics can be issued from a Ginnie Mae II MBS pool, and the issuers are permitted to charge higher servicing fees, ranging from 25 to 75 basis points (100 basis points = 1%). The minimum pool size is $250,000 for multi-lender pools and $1 million for single-lender pools. Monthly payments to investors are delayed 5 additional days because issuer payments are consolidated by a central paying agent, so the payment is made on the 20th day of each month.

As the principal and interest are paid down in the above pools, expenses in maintaining the pools increase and their marketability decreases. To help Ginnie Mae MBS issuers, Ginnie Mae offers the Ginnie Mae Multiclass Securities Program, which allows the issuers to pool some of their MBSs into a single Ginnie Mae Platinum Trust, which issues securities based on this pool. These Ginnie Mae Platinum Securities provide MBS issuers greater operating efficiency, allowing holders of multiple MBSs to combine them into a single platinum certificate that can be traded or used in structured finance and repurchase transactions.

Fannie Mae and Freddie Mac

Freddie Mac and Fannie Mae are government-sponsored entities, which were private corporations with the same charters, Congressional mandates, and regulatory structure.

Fannie Mae was created by the United States government in 1938 with an explicit guarantee that buyers of the issued securities had the full faith and credit of the United States backing it. However, Fannie Mae became a private corporation in 1968, rendering the explicit guarantee as an implied guaranty. Freddie Mac was set up as a private corporation from the get-go when it was created in 1970.

Like Ginnie Mae, Fannie Mae and Freddie Mac do not lend money, but buy mortgages from lenders to repackage into mortgage-backed securities. Both corporations guarantee the payment of principal and interest to the registered owners of the MBS. While neither is backed by the full faith and credit of the United States government, it was generally believed that if there would be losses to investors, the U.S. government would step in to offset those losses, because both corporations were chartered by Congress to make housing more affordable for low- and moderate-income groups — a popular political objective.

During the Great Recession of 2007, both Fannie Mae and Freddie Mac started experiencing financial distress because they had guaranteed many securities based on subprime loans and they were overleveraged. Consequently, when many subprime borrowers started to default, Fannie Mae and Freddie Mac could not remain solvent without a bailout from the government, and since they were both "too big to fail", both Fannie Mae and Freddie Mac were placed under the conservatorship of the Federal Housing Finance Authority (FHFA), an agency of the United States government, in September 2008.

Fannie Mae: Federal National Mortgage Association (FNMA)

The Federal National Mortgage Association (Fannie Mae) was created to help low- and middle-income people to buy homes. Fannie Mae buys and sells real estate mortgages insured by the Federal Housing Administration or guaranteed by the Veterans Administration. It sells unsecured bonds and notes, and mortgage-backed bonds, issued at par and paying taxable semiannual interest. Fannie Mae was privatized in 1968 and its equity shares were traded on the New York Stock Exchange until it was placed under the conservatorship of the FHFA in 2008.

Freddie Mac: Federal Home Loan Mortgage Corporation (FHLMC)

Freddie Mac purchases mortgages from across the country that share similar characteristics — payment terms, interest rates, loan terms — and yet may have other characteristics that vary. Example: some mortgages may carry greater credit risk than others, based on the type of property or the credit history of the borrowers. The corporation is held in trust by the Federal Home Loan Bank System and its stock is owned by its members, which include savings banks, savings and loan associations, cooperative banks, commercial banks, credit unions, and insurance companies that are active in housing finance.

The MBS payment stream. Each month, the mortgage payments made by homeowners flow to the holders of the mortgage-backed security:

- A homeowner sends the monthly mortgage payment to a lender or loan servicer.

- If the mortgage had been purchased by Freddie Mac, the lender sends the homeowner's mortgage payment on to Freddie Mac.

- Freddie Mac passes the mortgage payment through to the holders of the mortgage-backed security, minus the fee charged for guaranteeing the timely payment to the investor, + some additional fees.

Risks of Mortgage-Backed Securities

Although, when first issued, MBSs have a stated term until maturity, mortgage holders frequently prepay to save on interest, or they may pay off their mortgages, either because they sold their house, refinanced, or simply had extra money. All prepayments are passed through to the holders of the MBSs, so the terms of MBSs can be considerably shorter than the stated term when first issued. Because the term of a MBS is variable, the actual term of the security, in contrast to its stated term until maturity or last distribution, is called the average life or average maturity, the amount of time when half of a mortgage pool's principal is paid off, which, when issued, is estimated based on previous mortgage pools of the same type.

Prepayments are more apt to happen when interest rates are falling. Thus, there is not only prepayment risk, but also reinvestment risk, because the investor will usually have to reinvest the money when interest rates are lower.

However, even if there is no prepayment, the amount of income from interest will continually decline over the term of the security, because the principal is reduced with each payment, and thus, there is less principal earning interest.

The main advantage of mortgage-backed securities is that they have more attractive yields for their risk since these securities have property as collateral. Investors also receive payments every month instead of the semi-annual payments issued by most bonds.

However, for any investor wanting to sell his MBS in the secondary market, a major disadvantage of an MBS is its negative convexity. Convexity is the relationship of the change in the security's price in the secondary market to the change in prevailing interest rates. Generally, there is an inverse relationship between interest rates and bond prices. When interest rates rise, bond prices drop, when they decline, bond prices increase. The price of a bond that exhibits negative convexity will rise less than a bond with normal or positive convexity when interest rates decline, but will drop more when interest rates rise. Thus, there is a greater interest rate risk with MBS than with other bonds. However, this risk is only real if the investor wants to sell the MBS in the secondary market.

Negative convexity is easy to understand if you remember that the greater the risk of any bond, the greater the yield that the bond must pay to entice investors, and that yield is inversely proportional to the bond price. Mortgage-back securities exhibit negative convexity because, when interest rates fall, prepayment risk increases, and when interest rates rise, then default risk increases for those mortgage holders who have variable interest rate loans. This causes MBSs to rise slower when interest rates fall, and to fall faster when interest rates rise. This also causes greater volatility than a bond with a comparable term and interest rate.

Managing Default Risk: Subordination, Overcollateralization, and Excess Spread

Some defaults are expected, and the main methods to absorb those defaults without affecting bondholders — and to receive their investment grade rating — are subordination, overcollateralization, and excess spread. Subordination is the issuance of MBSs as different classes, called tranches, with different risks and prepayment flows — the lower tranches receive the highest yield, but are the first to suffer losses. Principal repayments are used to retire the top tranche first, then succeeding tranches in order of seniority. These MBSs are called collateralized mortgage obligations. Over-collateralization is the maintenance of a higher principal balance on the mortgage loans over the principal balance in the outstanding MBSs. Since the eventual payment of principal is passed to the holders of MBSs, defaults would prevent some bondholders from receiving their principal if there was no overcollateralization. Excess spread is the interest rate difference between what is received from the mortgage holders minus the loan servicing fees, and what is paid out to the MBS bondholders. Some excess spread is used to cover defaults, and some is saved for future defaults by increasing overcollateralization, frequently by paying off some of the senior bonds. Subordination and overcollateralization are most often used for MBSs based on prime or jumbo mortgages, and excess spread is used for MBSs with underlying subprime and Alt-A mortgages, where interest rates from the underlying mortgages are higher, allowing more profits from the credit spread.

Subprime Loans and the Real Estate Bubble

Although overcollateralization and excess spread are effective in absorbing some defaults, their effectiveness depends on the expected default rate. If losses exceed expectations, then some bondholders will suffer losses, as occurred during the Great Recession of 2007 - 2009 with the proprietary MBSs that included subprime loans, which are loans to less creditworthy people. The very low interest rates prevailing at this time and the very high rate of mortgage fraud along with low or nonexistent down payment requirements have created a real estate bubble, in which the price of real estate was rising much faster than people's income. Mortgage fraud included the falsification of documents by inflating income or stating less then the true amount of the borrower's debts. The number of mortgage fraud cases reported by the FBI increased from less than 10,000 in 2003 to more than 30,000 cases in 2006. It was easy to commit mortgage fraud, because many of these loans were stated income loans: the borrower would simply certify their income by signing the loan documents. Although lenders verified the source of the income, many did not verify the amount. Many mortgage brokers helped in the fraud since they were compensated based on how many loans they originated. Many lenders accepted the subprime loans because they had a higher interest rate, and they could pass the risks on to the buyers of the MBSs.

Many borrowers defaulted because the interest rate on their variable rate loans rose, making the monthly payments unaffordable. Furthermore, the prices of their homes fell, which prevented refinancing for better terms. And, of course, the falling home prices resulted from falling demand due to rising interest rates and stricter lending. Many homes were worth less than the amount owed on the mortgage.

Consequently, the credit rating agencies lowered the ratings of many MBS issues, and several large hedge funds have gone under from the defaults.

Covered Bonds

Covered bonds are bonds collateralized by commercial or residential real estate mortgages, or by public sector assets, but they are safer because the bonds are covered not only by the collateral, but also by the lenders of the mortgages. Covered bondholders have a claim not only against the assets, but also the lenders in the case of default. Even mortgage-backed securities issued by European lenders are safer because Europe has stricter lending requirements, generally requiring at least a 20% down payment and verification of income. However, covered bonds are only issued in Europe; Germany and Denmark are the largest issuers. Covered bondholders have priority over the collateral over all others if the issuer goes bankrupt. Covered bonds are safer because they have strict legal requirements — specifically, they must satisfy the requirements of Article 22(4) of Directive 85/611/EEC, Undertakings for Collective Investment in Transferable Securities (UCITS). For their safety, European investment funds are legally allowed to hold 25% of their assets from a single issuer — other assets have a 5% limit. Most buyers of covered bonds are funds and asset managers, savings and co-operative banks, central banks, insurers, and pension funds. The issuance of covered bonds in Europe is larger than the issuance of MBSs there: $2.5 trillion compared to $1.1 trillion.

Some History of MBSs during the Great Recession

The Beginnings of the 2008 Credit Market Meltdown

9/30/1999 - Fannie Mae Eases Credit to Aid Mortgage Lending

Per this New York Times article, Fannie Mae was under pressure from the Clinton administration to extend credit to minorities and low-income borrowers who would not otherwise qualify for credit to extend home ownership to more minorities. So Fannie Mae started buying mortgage-backed securities based on subprime mortgages from banks.

During the Residential Boom, Almost Anyone Could Get a Mortgage

The biggest problem with asset-backed securities (ABSs) based on loans is that the loan originators passed the credit default risk onto buyers of the ABSs, and, thus, had more incentive to originate loans to collect servicing and origination fees. This New York Times article, Building Flawed American Dreams, documents the lowering of credit standards to originate more loans:

- Creative efforts were used to extend homeownership to low-income applicants.

- Homeownership rose from 64% in 1994 to 67.4% in 2000, with major increases in homeownership among Hispanics and African-Americans.

- Loan applicants only needed to show 3 years of stable income instead of the 5 that was previously required.

- Lenders were permitted to use their own appraisers instead of using those from a previously required government-selected panel, which led to inflated appraisals.

- For government-insured borrowers, lenders did not need to interview loan applicants face-to-face nor did they have to have physical branch offices in the loan applicants' community.

- Some people got loans with nothing down and no closing costs.

- Some homebuilders, who also become lenders in the lucrative mortgage market, were fined by Housing and Urban Development (HUD) for overstated or incomplete documentation of income for borrowers, and for charging excessive fees. September 2004 lending audits conducted by HUD found that 1 in 8 of Countrywide's loans were based on incomplete documentation and verification.

No Market in the Secondary Mortgage Market

- Alternative Mortgage Instruments (AMI)

- These mortgages, commonly called Alt-A mortgages, include any mortgages that are not fixed-rate, amortizing loans. The most common example of an AMI is the adjustable-rate mortgage.

With the fallout from the subprime mortgage market, investors hesitated to buy mortgage-backed securities. Only loans conforming to the standards of Ginnie Mae, Fannie Mae, and Freddie Mac could be sold. Even Alt-A mortgages, most of which are more creditworthy than subprime, were difficult to sell unless they were rated AAA.

Mortgage rates rose because lenders couldn't resell their loans in the secondary market, forcing them to carry their loans, leaving less money to lend out for additional loans. Thus, limited supply increased mortgage rates, causing home prices to fall further.

Mortgage rates increased substantially for nonconforming, rising from about 102% of the loan value to 104%. Because conforming mortgages had a limit lower than many houses in the most expensive areas of the country, it was more difficult to get loans for more expensive real estate, leading to lower prices.

The Origins of the Subprime Mess

4/9/2008 - So why did the subprime mess occur? Because many people were overstating their incomes to qualify for mortgages they couldn't afford. And how did they get away with this? Because many lenders didn't bother to verify the borrowers' income when they could have easily done so.

While many in the lending industry have stated that they were duped by fraud, it turns out that most suffered from their own complacency. Per this New York Times article, A Road Not Taken by Lenders, at least 90% of the borrowers had to sign an IRS Form 4506-T, Request for Transcript of Tax Return, allowing the lenders to verify the income of the borrowers with the Internal Revenue Service, but many lenders did not bother to check, even for stated income loans where the borrower did not have to provide any documentation proving income — hence, the alias for stated income loans, liar loans.

Lenders gave 2 reasons for not submitting the 4506-T form: too costly and too time-consuming. The verification cost $20 and takes about 1 business day, so the lenders' reasons aren't credible.

Why wouldn't a lender spend $20 — a cost that would be passed to the borrower anyway — to secure a loan in the hundreds of thousands of dollars? Because the lenders intended to sell the loans — and the risk of default — to investment banks to securitize and sell to investors as mortgage-backed securities, CDOs, and SIVs. Meanwhile the lenders profited from upfront fees, such as loan origination fees, points, and servicing fees. The more loans they made, the more money they made.

Fannie Mae and Freddie Mac Placed under Regulatory Conservatorship

9/7/2008 - To prevent turmoil in the financial markets, Fannie Mae and Freddie Mac were placed under a regulatory conservatorship by the Federal Housing Finance Agency (FHFA), transferring all the rights and powers of the companies' directors, officers, and shareholders to the appointed conservator. The companies' management were also replaced, and both companies were prevented from lobbying the government. Mr. Paulson, then Treasury secretary, said that having a public corporation serve a public function is incongruous and cannot continue in its current form, and therefore, the 2 companies must eventually be public or private companies.

Principal and interest payments on debt continued, but dividends to shareholders were stopped. Fannie Mae and Freddie Mac held or guaranteed about 50% of the country's mortgages, and were forced to shrink their portfolio by 10% annually starting in 2010 to more manageable levels. Each month, these companies bought billions of dollars worth of mortgages, and either sold them to investors or kept them in their portfolio.

In exchange for the bailout, the government received warrants to purchase up to 80% of the stocks of both companies for less than $1 per share. The Treasury receives new preferred senior stock paying 10% annually + an unspecified quarterly payment. The Treasury Department created a Secured Lending Credit Facility that lent money to Fannie Mae or Freddie Mac if they could not borrow enough in the market to continue buying MBSs.

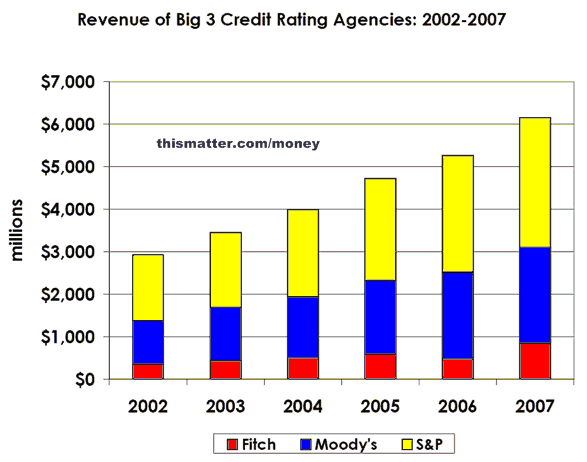

Credit Ratings for Profit

10/22/2008 - Rating Companies Put Profits First, Critics Testify - Testimony from top executives and former executives of the credit rating agencies — Moody's Investor Service, Standard & Poor's, and Fitch Ratings — before the House Oversight and Government Reform Committee revealed that the credit rating agencies relaxed their standards to get business since the originators of structured securities generally chose the rating agency with the lowest standards of credit assessment. The executives explained their faulty rating of mortgage-backed securities by not anticipating the sharp drop in home prices or the restrictive lending environment that followed, and because the credit ratings were based on historical data and other assumptions that seriously underestimated the risk.

The SEC reported that there were conflicts of interest at the firms and that they violated their own procedures to grant top ratings to mortgage bonds since top ratings were necessary to sell the bonds to banks, insurance companies, and fiduciaries, such as pension funds.

Is the testimony from the executives of the credit rating agencies credible? It was clear to many for some years that there was a real estate bubble growing — after all, when real estate prices are rising much faster than people's incomes, how long can that continue? The bubble was created because lending standards had declined — some would say had passed out of existence — allowing just about anybody to get a loan. Loan originators didn't worry because they were able to pass their credit default risk to the buyers of the MBSs. But since lending standards were declining, then how could the credit rating agencies rely on historical data when lending standards were much more stringent?

The Bloomberg article above reports that there were employees who were aware that these MBSs were far riskier than their credit ratings implied. Documents from S&P quoted one employee from the structured finance division as saying "It could be structured by cows and we would rate it." Another employee said it all: "Let's hope we are all wealthy and retired by the time this house of cards falters."

Actual testimony: https://oversight.house.gov/story.asp?ID=2250