Republican Tax Policy: Redistributing the Wealth from Working People to the Wealthy

In 2010, Mitt Romney, a candidate seeking the Republican nomination for the Presidency of the United States, earned $21,661,344 and paid $3,009,766 in taxes, which is an effective tax rate of $3,009,766/$21,661,344 = 13.89% (Tales of the 1040s). By contrast, a self-employed taxpayer with no dependents — let's refer to him as Poor Richard — who made a mere $20,000 in 2010 would have had to pay:

| Self-Employment Income | $20,000 |

| Self-Employment Tax | $2,826 |

| Deduction for 1/2 of SE Tax | $1,413 |

| Standard Deduction | $5,700 |

| Personal Exemption | $3,650 |

| Income Subject to 10% Marginal Rate | $9,237 |

| Marginal Tax | $924 |

| Total Tax = SE + Marginal Tax = | $3,750 |

| Effective Tax Rate | 18.75% |

So Poor Richard must pay 18.75% of his income in taxes — that's a 4.86% higher tax rate than what Mitt Romney paid in 2010. Why is it that someone who is so poor pays a 35% higher tax rate than someone who is fabulously wealthy?

The short answer is that Poor Richard earned all his income the way most Americans make their money — by working for it! And employment income is the mostly highly taxed form of income. By contrast, Mitt Romney earned most of his money as income that qualified for the long-term capital gains rate of 15%. Indeed, maybe Mitt Romney's tax rate is even lower than this since if he received inherited income, he would not have to report that income, because it is not taxable to the beneficiary.

The inequity of the tax system arises from how income is taxed and how deductions and tax credits greatly lower the effective tax rate paid compared to the so-called marginal rate.

Effective Tax Rate

Different sources of income are taxed at different rates, but because taxpayers can use deductions and tax credits to reduce tax liability, the actual tax rate paid can differ significantly from statutory tax rates, including the marginal tax rate. The most effective way of determining the actual tax rate paid by an individual is to calculate the effective tax rate (aka average tax rate), the actual tax paid divided by the income of the taxpayer.

| Effective Tax Rate | = | Tax Paid Total Income |

Income Taxes

Income taxes are taxes on income. However, not all income is taxed equally. Working income is taxed the most, while investment and inheritance income are taxed considerably less. Most Americans earn most of their money by working, while many wealthy people earn money from investments or receive income by gift or inheritance. On working income, the worker must pay both employment taxes and a marginal tax, often called the ordinary income tax. The marginal tax rate depends on the taxpayer's income — the higher the working income, the higher the marginal tax rate. However, the marginal tax rate does not apply to long-term capital gains, qualified dividends, or inherited income.

Tax law treats capital gains as being either short-term or long-term. Short-term gains are taxed at the ordinary income tax rate while long-term capital gains are taxed at either 0%, 15%, or 20%, depending on the taxpayer's capital-gain tax bracket. Qualified dividends are taxed at the same rate.

Federal law does not impose an inheritance tax, which is a tax on the beneficiaries. Instead, federal law imposes an estate tax on the estate of the decedent, which must be paid before the estate is distributed to beneficiaries. Federal law also imposes a gift tax, which is applied at the same rate as the estate tax. Estates and gifts are treated similarly because both represent a way to transfer property from a donor to a beneficiary. Because the beneficiary need not do anything to receive the gift, bequests and gifts are collectively called gratuitous transfers, and the taxes assessed on those transfers are called gratuitous transfer taxes.

However, most people need not pay either the gift or estate tax because the unified tax credit eliminates the tax for most people. For tax years 2011 and 2012, each individual may give up to $5 million tax free, either as a gift or as a bequest. Hence, a married couple can transfer $10 million to their children tax-free. In 2013, the exemption will be $5.25 million and a new change in the law will further increase the exemption by annually adjusting it for inflation. Furthermore, the many tax loopholes, most of which have been purposely inserted by Congress for their wealthy benefactors, allow the wealthy to transfer far more income tax-free to their descendants. For instance, Mitt Romney has provided a tax-free $100 million trust fund for his 5 sons.

The Wealthy Receive Preferential Tax Treatment

The preferential tax treatment given to long-term capital gains and qualified dividends and the large exemption from taxation for gifts and bequests goes a long way toward allowing the wealthy to pay a much lower effective tax rate on their income than what most working people pay, including low-income workers.

Though the wealthy pay a higher marginal tax rate, the actual rate paid can actually be much lower than what that rate suggests, because deductions can greatly reduce taxable income, and tax credits can further reduce tax liability.

Example: Consider these 2 taxpayers, both in the 35% tax bracket.

- Joe makes $400,000 in 2011 and Martha makes $1 million.

- If the taxpayers claim only the standard deduction and their own personal exemption, Joe would owe $113,254 for ordinary income taxes, not including payroll taxes, and Martha would owe $323,254 on her income of $1 million. (See Tax Structure: Tax Base, Tax Rate, Proportional, Regressive, and Progressive Taxation to see how these figures were determined.)

- At these rates, Joe would pay an effective tax rate of 28.3% and Martha would pay an effective tax rate of 32.3%.

- Now suppose that Martha can lower her income with deductions so that her taxable income equals Joe's.

- Then she would pay the same tax as Joe, but now her effective tax rate would equal $113,254/$1 million = 11.3%.

- Note that both taxpayers are still in the highest tax bracket, but Martha pays little more, as a percentage of income, than the lowest tax bracket of 10% even though she is in the wealthiest 1% of the population.

Though the alternative minimum tax (AMT) reduces deductions for the wealthy, the AMT applies mostly to working income.

Employment Taxes

Employment taxes (aka payroll taxes), as the name suggests, are taxes on employment. Employment taxes consists of the 12.4% Social Security tax and 2.9% Medicare tax. (For tax years 2011 and 2012, the Social Security tax is 10.4%. Since this is only a temporary provision, I will continue to use the 12.4% rate since that was the rate for many years and will be the rate for 2013 and afterward.) The Social Security tax applies to all income below the Social Security taxable income cap (2025: $176,100), while the Medicare tax applies to all working income. Hence, the tax rate is 15.3% on working income below the income cap, and 2.9% on working income above that amount. The employment tax is a flat, regressive tax that places a much greater burden on low-income workers. Furthermore, for employees, there are no deductions that apply to employment taxes.

If the taxpayer is an employee, then the employer pays half of the employment tax and the employee pays the remaining tax. However, the mathematical division of the payment does not accurately reflect the tax burden on the employees because, most economists agree, low-income workers bear the brunt of the payroll tax through lower wages. (See Tax Incidence: How The Tax Burden Is Shared Between Buyers And Sellers) In other words, an employer will only pay so much for a worker. If the employer must pay payroll tax for the worker, then that is an added cost, which the employer will consider when setting the wage rate. Even workers who make only the minimum wage suffer from the payroll tax through higher unemployment, because it is well-established, that when the price of goods and services increases, the demand decreases. Furthermore, when suppliers receive less for their product or service, the supply decreases. This is also a well-established economic principle. So not only do employers pay a higher price for labor, but the laborers receive less than what the employer pays because they must pay their share of the payroll tax, so fewer people look for work or they choose to work fewer hours. This is the deadweight loss of taxation.

Employment taxes are also assessed on self-employed workers. They must pay the entire amount, but they are permitted to deduct what would normally be the employer's share with the result that self-employed people pay about 14.1% of their income in self-employment taxes. They can also deduct 1/2 of their self-employment tax from gross income, the value of which depends on the taxpayer's marginal tax rate. The self-employment tax deduction slightly reduces the effective tax rate, but this tax deduction is more valuable for higher income taxpayers, so they pay a lower effective self-employment tax rate than lower income workers.

An unfortunate consequence of splitting the tax between employer and employee is that there are no deductions to reduce employment taxes. Business expenses reduce the employment tax liability for the self-employed, but no other deductions can reduce it further. For instance, contributions to retirement plans, itemized deductions, or personal exemptions do not reduce employment tax liability at all. So the self-employment tax rate is a hefty percentage that applies to all working income.

Furthermore, most tax credits do not lower employment tax liability. Nonrefundable tax credits can only be applied to ordinary income tax. The only tax credits that can lower employment tax liability are the earned income credit, the additional child tax credit, and 40% of the American Opportunity credit. Most people cannot claim the earned income credit since it is only available for very low-income workers. For instance, for a single taxpayer with no dependents, the earned income credit is phased out completely when the taxpayer's income reaches $13,665 for 2011. The child tax credit does not eliminate the employer's portion of the tax for employees or 1/2 of the self-employment tax for the self-employed.

As with other taxes, the wealthy have ways to reduce their self-employment tax. A common way is by forming an S corporation, which allows the self-employed to declare part of their income stream as a dividend from the corporation, and, therefore, not subject to self-employment tax, even though they are doing the same job as they would if they were an employee. Newt Gingrich, for instance, provides his lobbying services through an S corporation. Highly compensated employees can also reduce employment taxes by receiving qualified options as part of their pay package. If the options satisfy tax rules, then not only do the employees avoid paying employment tax on their gains, but those gains are only subject to the low long-term capital gains rate rather than the marginal rate.

Another option is available that applies only to a few taxpayers who work either as hedge fund managers or private equity managers, many of whom earn hundreds of millions of dollars a year. Managers of these funds typically charge a 2% management fee and a performance fee of 20% of profits earned on the investment income of the investors in the fund. The carried interest option allows these fund managers to declare the 20% performance fee as carried interest, which is not only not subject to employment taxes, but is also taxed at the low long-term capital gains rate of 15%, even though the performance fee is part of the compensation package that they earn by working for it, just like anybody else who works to earn money. It is this tax loophole that allowed Mitt Romney, who worked as a private equity manager, to pay a far lower effective tax rate than someone who earns a mere $20,000 annually.

Another exception from employment taxes is carved out for professional traders, who conduct the trading of securities as a business. Professional traders can deduct all their trading expenses and can even enjoy the tax benefits of qualified retirement accounts, but they do not have to pay self-employment tax on their profits! A casual investor cannot deduct expenses related to trading except the direct expenses of buying or selling, such as trading commissions.

Employment taxes especially burden low-income workers, but some people feel it is justified because Social Security taxes are for the taxpayers' retirement and that Medicare taxes provide medical insurance for senior citizens. But a taxpayer cannot bequeath the share of his contributions to the Social Security fund or to the Medicare fund if he should die before retirement age. Furthermore, a situation that will be far more common in the future is that many taxpayers must continue working to earn a livable income, and they must continue paying employment taxes even after they start receiving Social Security income and are enrolled in Medicare. Furthermore, anyone who earns money for 10 years that is subject to Medicare tax will receive Medicare benefits regardless of how much was paid into the fund. So if somebody worked for 10 years, then received a $1,000,000,000 inheritance, he could still collect all the Medicare benefits that would be available for somebody who paid into the Medicare fund for 40 years! No relationship exists between the amount paid into the Medicare fund and the benefits that can be received. Thus, employment taxes are just that — a tax on income. It is not the taxpayers' money, so why should employment taxes be a separate tax?

A better question is, why shouldn't employment taxes be applied to all income? After all, there is no particular reason why employment taxes should only be assessed on employment. If employment taxes applied to all income, then the wealthy could not claim deductions to reduce their tax rate as they can with the marginal tax. Furthermore, assessing employment taxes on all income would eliminate the few loopholes that can reduce self-employment tax for the wealthy, such as characterizing income as carried interest or as a dividend from an S corporation.

State and Local Taxes

State and local taxes are mostly flat taxes, and as such, burden the poor more than the wealthy. Even income taxes often only apply to working and investment income, but they often do not apply to pension income. No doubt pensions are exempt so that state workers and legislators receiving generous pensions do not have to help pay for the cost of those pensions. Most states assess sales tax on most items. Municipalities also charge a local tax, and often, this tax only applies to working income — not to inheritance nor to investment income nor to pensions. Additionally, both states and municipalities assess many business taxes, which businesses pass on to their customers as higher prices for their products and services. For instance, insurance companies must pay premium taxes on the premiums that they collect from their customers. Customers do not know about these taxes since they are not itemized in their bill. Indeed, some states forbid itemizing taxes, to prevent customers of the business from knowing that part of their cost is a tax.

Sometimes special taxes are assessed on individuals. For instance, Pennsylvania allows its municipalities to charge a flat Local Service Tax of $52 on anyone earning more than $12,000 annually. I guess the municipalities decided that if someone earns more than $12,000 annually from work, then they are rich enough to pay their tax. Is the $12,000 indexed for inflation, like the pay and pensions of state legislators? No! Is there any allowance for low-income taxpayers with children? Again, no! No doubt that this tax is assessed so that the municipalities can afford nice pensions for their workers. So, do the people receiving these pensions have to help pay for them by paying the tax? Again, no! Of course, not many outside of government employment receive such nice pensions, especially defined-benefit pensions, but people who must work for a living in the private sector will be paying for those pensions. Pension costs are increasing every year, so taxes will also increase proportionally, and no doubt most of those taxes will be either assessed on working income or assessed as a hidden tax applied to businesses.

No Deadweight Loss of Taxation on Gratuitous Transfers

Working income is the most highly taxed form of income. It is more heavily taxed than either investment income or inherited income. And yet taxes on working income have the most effect on altering peoples' behavior — and isn't it the Republicans always complaining about how tax policy distorts economic decisions?

It is work that directly increases the wealth of any economy. Investments would not yield a return if it did not ultimately put people to work to accomplish some specific objective. That is the mechanism by which investment increases the wealth of society. Indeed, during the 1980s the Republicans advertised Laffer's curve to show how higher taxes provide a disincentive for work, which is true. However, gratuitous transfers are the one thing that can be taxed that would not distort economic incentives, because no matter how high the tax rate, people will continue to die at the same rate. Indeed, the Laffer curve for inherited income increases proportionately with the tax rate.

The Republicans do not want to tax inheritance nor do many want to tax investment income. And yet, it is this income that accrues mostly to the wealthy, to the people who need it the least. They argue that to tax inheritances or estates is to tax money twice — once when the donor earns the money, then another time when the beneficiaries receive the money.

However, income taxation does not work that way. Taxation is not based on how much tax is taken out of a specific dollar; it is based on the income received by an individual.

The multiple taxation argument fails because, in actuality, money is taxed over and over again. Think about it. When you work and receive wages, you pay taxes on it; when you go to the store and purchase an item, the store pays tax on it; when the store pays its suppliers, then the suppliers pay tax on it. That money is used continuously in multiple transactions at a rate of what economists call the velocity of money, and it is taxed in most of these transactions. Money is taxed over and over again because if it were not, government would soon grind to a halt. After all, you cannot hire a housecleaner or gardener and pay them and say, "Hey, don't worry about paying any tax on this because I already paid tax on the money that I am giving you." The tax system simply doesn't work that way and it never has. Indeed, isn't assessing both employment taxes and marginal taxes on employment income considered double taxation, especially since both taxes apply to the same income to the same individual? And since state and local income taxes are also assessed on working income in most jurisdictions, working income, in most states, is quadruply taxed!

So why should it be different with gratuitous transfers. The offspring of the wealthy already have many huge advantages including connections to important people and the best education that money can buy. Since the Republicans constantly argue that taxes distort economic decisions, it makes no sense not to tax inheritance since taxing inheritance will not distort economic decisions.

Another benefit of inherited income over working income is that inherited income need not be reported, so it does not increase the beneficiary's AGI, which could disqualify the beneficiary for exemptions, tax credits, or deductions or even IRA contributions, even if the taxpayer inherited millions of dollars. By contrast, if you earn more money through working and your AGI continually increases, then eventually you will lose the exemptions, tax credits, and deductions that are subject to income limits. Other tax saving strategies, such as making tax-deductible contributions to a traditional IRA, will also be eliminated.

Another reason to tax inheritance is that it can help keep the Social Security fund solvent. Republicans have been complaining for years that the Social Security fund will soon go bust, and that Social Security and Medicare should be privatized. However, a major reason why keeping Social Security and Medicare solvent will be more difficult is because many receive more money and benefits than they paid in employment taxes. Therefore, a sensible solution to mitigate this problem is to tax estates on the excess amount that the decedent collected in Social Security and Medicare over what was paid in, + interest, before any exemption is applied to the assets of the estate.

Tax Equity

Tax equity can be measured in several ways. The benefits principle states that people should pay taxes by the benefit they receive from the tax, such as the gasoline tax funds building roads and bridges. Then there is the ability-to-pay principle, which states that people should pay taxes in proportion to their ability to pay. Obviously, by this principle, the wealthy should pay more.

However, the most important factor in creating tax equity is to consider what I call the marginal utility of money. When someone makes $50,000 or less they need all their income to buy essentials, such as food, housing, and health insurance. Rich people need not worry about these things because they have far more than is necessary to purchase those items. As people make more money, the value of each successive dollar becomes worth less. This is why some rich people buy $40 million yachts that they use for 2 weeks out of the year or they pay $106.5 million dollars for a painting that Picasso painted in a single day. These are people with so much money they do not know what to do with it. But, they don't want to pay taxes! Indeed, it seems like it is a sport among the wealthy, in that they take pride on how much they are willing to pay for things, such as paintings, while reveling in how little tax they pay.

It is often argued, especially by the Republicans, that investments should not be taxed because investors take risks investing their money. However, consider the typical worker. They must go to a job which they do not like and toil at it for 8 hours a day or more and for 40 hours a week or more doing something that they do not want to do, but they do it because they have no choice. The incentive for these workers is pay, so heavily taxing pay reduces both the supply and demand for labor.

The marginal utility of money explains why the risk an investor takes is less. After all, why are investors more afraid of losing a specific sum of money than earning an equal amount? For instance, suppose an investor has $100,000 and wants to make a $50,000 investment. If he loses $50,000, then he only has $50,000 left. If he earns $50,000 more, then he has an extra $50,000, but this extra $50,000 has less value than the money that would be lost if the investment was not successful. When people have enormous sums of money, the risk of loss is especially small, because what else can they do with the money? Think about it, if you buy a Picasso painting for $106.5 million dollars, then how will you earn income on it? Your hope is that someone else will eventually pay even more than you did, but if you must take a loss, you would likely still have hundreds of millions of dollars left, because you would not have bought the painting otherwise. This is why wealthy people do not worry too much about how much they pay for things, because each of their dollars matters little to them. Poor people spend time to save money, such as clipping coupons, while the wealthy spend money to save time. Time is a valuable commodity indeed, but the poor must spend their time doing these things, because otherwise they must spend more time working to afford the essentials of life.

And what about the inequity of employment taxes? Why should employment taxes only apply to employment? There is no good economic argument as to why employment taxes cannot be applied to all income regardless of its source, especially since, as a regressive flat tax, it is a major burden on the poor and the middle class. This is beginning to change with the new net investment income tax, but it should be expanded so that working income is not taxed any more than investment income or inheritance, especially since the latter forms of income flow mostly to the wealthy.

Tax Statistics

You often hear the Republicans talk about people who pay absolutely no tax. First, this is a falsehood. The Republicans assume that if you pay no ordinary income tax, then you pay no tax, even though you're still paying the hefty employment tax. The people who pay no tax either have very low incomes or they have children, which allow them to claim the child tax credit and the earned income credit. And wouldn't people with children need every penny to make ends meet? The other group of Americans who pay little or no tax are senior citizens whose only source of income is Social Security. Since Social Security pays so little, would not these senior citizens need all the money that they receive?

One statistic that you will never hear from the Republicans is the effective tax rate paid by the 400 richest Americans that is published annually by the IRS. The average income earned by these richest Americans is on the order of hundreds of millions of dollars for the year and their average tax rate varies year-to-year between 17% and 18%. And yet, we constantly hear from the Republicans about how little tax is paid by poor people or people with children. Of course, this coheres with the Republican platform, in that they represent the wealthy, not the poor or the middle class.

And if you are easily misled by statistics, here is a sobering reminder of the statutory tax rates on income:

| Form of Income | Taxes Assessed on Income |

|---|---|

| Employment Income | Employment Taxes + Marginal Tax Rate |

| Investment Income: Interest, non-Qualified Dividends, Rents, Short-Term Capital Gains | Marginal Tax Rate |

| Long-Term Capital Gains | 0%, 15%, or 20% |

| Qualified Dividends | 0%, 15%, or 20% |

| Inheritance | 0% |

And remember:

- Deductions and tax credits can greatly reduce the effective tax rate, especially for the wealthy.

- Tax loopholes also greatly reduce the effective tax rate on the wealthy.

- Except for business expenses for the self-employed, there is no deduction for employment taxes and only a few tax credits can be applied to reduce employment taxes.

- Investment income and inherited income accrue mostly to the wealthy.

Automatic Economic Stabilizers

The United States was afflicted with the Great Recession, from which it only slowly recovered. To stimulate the economy, the Federal Reserve lowered the targeted interest rate to the 0% to the 0.25% range, but the economy still was not growing significantly. So, the Fed resorted to quantitative easing: buying longer-term Treasuries and mortgage-backed securities to raise their prices and reduce their interest rates and to shore up banks holding large amounts of the mortgage-backed securities, which had a higher risk than what was previously believed since many were backed by subprime mortgages. The Fed creates money by buying Treasuries and other securities on the open market from their primary dealers. However, it has not helped as well as it was hoped. And why should it? Banks will not lend to people who have no jobs and were already loaded with debt since they represent a substantial credit risk. Hence, lower interest rates was not a solution. When the Fed buys Treasuries to increase the money supply, it bids up their prices, allowing the wealthy to sell their Treasuries for a higher price than they would get otherwise (because the price of debt instruments varies inversely to the prevailing interest rate). If that newly created money was used to lower the payroll tax for poor people, then that would stimulate the economy much more, because the poor would spend the money right away. Taxing the poor less would serve as an automatic stabilizer, because they would spend it quickly, directly stimulating the economy. Indeed, shortly after the Social Security Act was passed in 1935, the economy was starting to pull out of the Great Depression of the 1930s. However, the first Social Security payment was only made in 1940. When the government started collecting the Social Security tax in 1937 from both employers and employees, the reduction in the money supply caused by the collection propelled the economy back into a recession. Only World War II finally lifted the economy out of depression. (By the way, the Republicans also opposed Social Security back then, for the same reason that they now oppose the Affordable Care Act, because it will lead to increased taxes on the wealthy. It didn't turn out this way, but that is what they feared back then.)

Another serious drawback of increasing the money supply is that it increases prices for some products, which reduces demand. Prices increase because:

- Increasing the money supply decreases the value of the currency compared to commodities and other currencies, the prices of commodities and imported goods increases. The major import where price increases hurts the working class the most is oil since oil is used to produce many products but also because it is a major component of gasoline, which most people must buy to get around in America. This reduces their buying power, thus reducing demand.

- To protect against inflation, the wealthy use their new money to buy assets, which frequently creates asset bubbles. Since many of these assets are used to produce other products, these products increase in price, which reduces demand.

So reducing interest rates does not effectively stimulate an economy that suffered from giving too many loans to too many people who could not afford to repay them. After all, there can be no stimulation of the economy unless people spend money — that's obvious. If you have a business and you have no customers, then it doesn't matter how cheap credit is, you would not borrow to develop a product or service that no one is buying or no one can afford nor would lenders lend money to businesses that cannot sell anything. This is why it makes sense to reduce taxes on lower income people rather than trying to lower the interest rates.

I think that Irving Fisher got it right in his 1933 paper called "The Debt-Deflation Theory of Great Depressions", which argued that depressions were caused by the transfer of wealth from debtors, who spend more money which would stimulate the economy, to wealthier creditors, who spend less due to their wealth. This is the primary reason why it is taking so long to climb out of the current recession — not due to President Obama's policies, as the Republicans have charged, but because consumers, businesses, and governments loaded up on debt during the Bush years. Now, instead of spending, they must pay it back. Of course, Irving Fisher was talking about debt and credit, but that same effect also occurs with taxes since a heavier tax burden on the poor and middle-class withdraws more money from the people who spend it to live. Think of it this way: how does spending over $100 million on a painting stimulate the economy?

The Politically Advantaged and Disadvantaged

Over the centuries — indeed, over the millennia — a small group of people have continually sought to take advantage of the population through politics. In the past, the people who were willing to use violence to get what they want were often successful in confiscating the riches of their society. Looking, over the years, at various lists of the richest people in the world, I often wondered why many of the richest people in the world often lived in poor countries. I now realize that it was because they were in a position to appropriate the riches of the country to themselves even while the rest of the nation lived in poverty. For instance, the people of Cuba, North Korea, and Iran are veritable economic slaves to their political masters. Recently, people in several Middle Eastern countries have sought to emancipate themselves from this economic slavery, in what has been dubbed the Arab Spring, by using the only means that works against a government that seeks to profit from them but to offer them little in return — violence. After all, violence is what allows politicians and armies to dominate a population and to profit from them. Anyone willing to use violence can rule a country if the people cannot oppose it. Of course, in today's economies, they could start a business and become rich, but dictators do not know how to do that. They know how to use violence, or the threat of violence, and so that's how they appropriate their wealth. In these countries, the common people have no choice but to use violence in return or to suffer indefinitely.

In the United States and other developed countries, more civilized methods are used, but it still causes considerable inequality. Instead of violence, the wealthy use their money to influence politicians, and the Republican Party benefits from that influence. That is why taxes on investments and gratuitous transfers are so low — it is a way to give big tax breaks to the wealthy without giving them to poorer people.

With their influence, the wealthy can also profit from the many tax loopholes that Congress has added for them. As already mentioned above, Newt Gingrich, a contender for the 2012 Republican nomination, used an S corporation for his consulting business. This allows him to save on the Medicare tax that would otherwise apply to his income because he can receive part of his income as dividends from the corporation, which are not subject to employment taxes. Indeed, if he did not make so much money, he would also save considerably on Social Security taxes, but since Gingrich makes well over the Social Security wage base limit, he doesn't have to worry about that — just the people struggling to make ends meet. Of course, many professionals use an S corporation to reduce employment taxes, but that option is not available for most employees since they must have a business. And yet, for professional organizations, they are doing the same work as an employee or a sole proprietor.

When the Republicans say "No new taxes!" what they really mean is no new taxes on the wealthy. The wealthy got a good deal under the George W. Bush administration and that is why they made a promise — not to the American voters — but to the lobbyist Grover Norquist not to raise any taxes. However, the only reason why they say they will not raise taxes at all is so that they could protect the tax benefits that the wealthy received under President George W. Bush. They can't really say no new taxes on the wealthy, because then it would be obvious what their real concern is, but since we purportedly live in a democracy, it would not be politically viable for the Republicans to admit that they just want to protect the wealthy from their fair share of taxes.

Nonetheless, that did not prevent the Republicans in the House of Representatives to balk when they were asked, in 2012, to extend the 2% reduction in Social Security taxes so that people would have more money to spend, to stimulate the economy. They finally relented after realizing that their political viability may have been threatened by the fact that they were not willing to vote for a tax decrease for ordinary Americans. But their hearts would've pitter-pattered if President Obama had asked them to vote to eliminate the taxes on investments and estates.

Look at it this way. The Republicans do not want to tax inheritance or investment income, income that mostly accrues to the wealthy. What that means, perforce, is that they want the entire burden of income taxes to be on working income, the very money that most people need to buy life's essentials! Furthermore, these people must pay regressive sales and excise taxes on many of their purchases, thereby increasing their tax burden even more since these taxes will constitute a greater percentage of their diminished disposable income. Moreover, many states assess flat taxes that are a fixed percentage of income, regardless of the income, and many municipalities within the state even charge a lump sum tax, which is especially regressive. Sometimes, low incomes are exempted, but the exemption is small. For instance, in Pennsylvania, most of its municipalities believe that if you earn $12,000 annually, you are rich enough to pay their tax.

The Best and Biggest Government Handout: Lower Tax Rates on the Wealthy

The Republicans have been constantly complaining about the Democrats' attempt to redistribute the wealth from the rich to the poor. Of course, Republicans will complain about this — they want to continue to redistribute the wealth from working people to their wealthy benefactors, as has been the policy of the United States since the inception of the income tax in 1913. Though marginal tax rates have been much higher in the past, plenty of tax loopholes allowed the wealthy to reduce their effective tax rate. Nonetheless, the tax code effectively redistributes the wealth from working people to the wealthy. Indeed, it can be considered a huge handout to the wealthy. This is easier to see with a hypothetical example:

Suppose that there were just 2 groups of taxpayers, Group A and Group B, who were both taxed at 50% of their income. Now suppose that Group B convinces Congress to lower their own taxes so that they pay an effective tax rate of 25%. Since the government needs all the revenue that it has been receiving, it will need to increase Group A's taxes to compensate for the lower tax rate on Group B. Is this not redistributing the wealth from Group A to Group B? So, if the rich are paying a lower effective tax rate than working people, is this not a redistribution of wealth from working people to the rich?

Now let's change the above scenario slightly. Instead of lowering the effective tax rate on Group B, Congress decides to collect its taxes from both groups, but then just gives half of the money collected from Group B back to Group B. Note that this has the same effect as the above scenario — Group B keeps more of their money. But in this scenario, isn't Group B receiving a handout from the government? But instead of food stamps or welfare, Group B is getting the greatest benefit possible — money, which, for some individual taxpayers, may be millions of dollars!

Now consider a real tax example: in 2014, a taxpayer works to earn $5.34 million, while another taxpayer receives $5.34 million as an inheritance. The taxpayer who worked must pay about 1/3 of his income in taxes, or $1.75 million, while the taxpayer who received the inheritance pays 0. So here is a real example that conforms to the actual tax code, where the beneficiary receives the equivalent of a $1.75 million handout from the government — this is to a single individual! And Republicans complain because some people receive about $133 per month in food stamps?

But wait a minute! Wasn't Mitt Romney secretly recorded as saying that 47% of Americans will vote for Barack Obama because they depend on handouts from the government, because they don't take responsibility for themselves? And yet, isn't forcing lower income people to pay higher effective tax rates than wealthy people a handout to the wealthy? And wouldn't more of those lower income people take greater responsibility for themselves — to not be so "dependent on the government" — if so much of their hard earned money was not taxed away by the government? Indeed, is not the amount of these handouts to the wealthy in the form of lower effective tax rates far more valuable that any handouts to welfare mothers, to Social Security recipients, or to combat veterans who risk their lives? And if the poor were permitted to keep more of their money, wouldn't that money be far more valuable to them than it is to the wealthy? So why do we let this continue?

Consider this: in actuality, there is a tax assessed on gifts and estates. The reason why, as of 2014, the 1st $5.34 million is not taxed is because each taxpayer is given a unified tax credit, adjusted annually for inflation, that, in 2014, was equal to $2,081,800! Imagine that! A credit of over $2 million given to individual wealthy taxpayers, who do not need the money, but the Republicans cry when families receive food stamps or when people receive the premium tax credit so they can afford health insurance. In their Tax Cuts and Jobs Act, passed at the end of 2017, the Republicans have recently more than doubled this credit so that it is now worth more than 4 1/2 million dollars, allowing more than $11 million to be passed tax-free from a taxpayer's estate to his heirs.

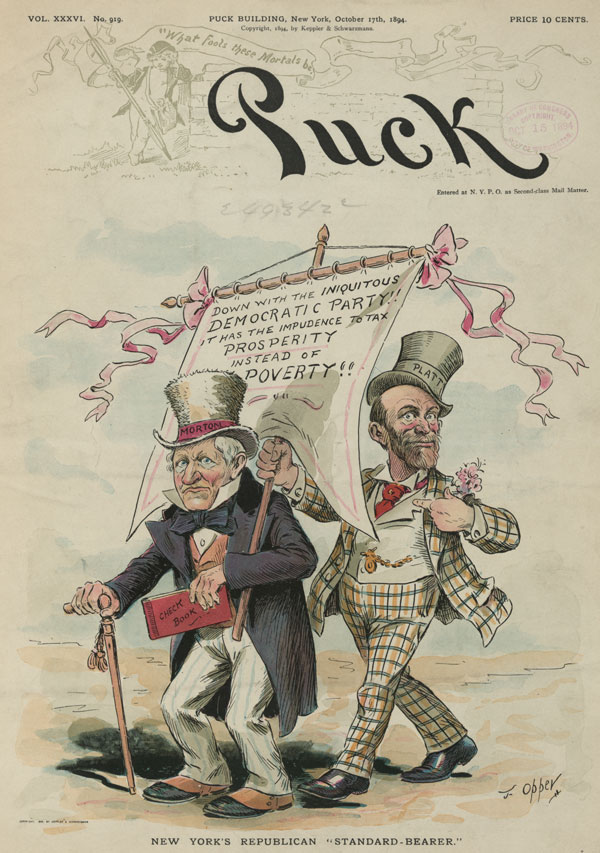

The Republicans have a long history of favoring the wealthy at the expense of the poor, as can be seen in this 1894 chromolithograph, showing Levi P. Morton with cane, holding a "Check Book", and his left arm around a standard that states "Down with the Iniquitous Democratic Party!! It has the Impudence to Tax Prosperity Instead of Poverty!!", and Thomas C. Platt who has his right hand on the standard and is pointing to himself. Morton was a wealthy businessman, United States Senator, and vice president of the United States under President Benjamin Harrison, 1889 -1893.

- Published by Keppler & Schwarzmann, 1894 October 17

- Opper, Frederick Burr, 1857-1937, artist

- Source: New York's Republican "standard-bearer" / F. Opper. | Library of Congress

Which Way Does the Money Trickle?

In the 1980s, the Republicans were promoting supply-side economics, arguing that the wealthy should be permitted to keep more of their money, because the money would eventually trickle down to the poor. Well, it doesn't really work that way, but the Republicans will present any argument that you are willing to buy. Whether the argument is true or not doesn't matter. What matters is if the Republicans can bamboozle you into accepting their arguments, so that they can get your vote.

I have a proposal. Give the money to the poor and let it trickle up to the rich! After all, that's how it actually works, isn't it? The poor receive more money, which they use to buy goods and services from businesses, and since businesses are mostly owned by wealthier people, the money actually trickles up to them. But how does the reverse work? When they receive money, the wealthy pay over $100 million for a painting by a dead artist. How does that improve the economy? Or they invest in hard assets to protect their wealth against inflation, thereby increasing the prices of those assets, thereby increasing the prices that poorer people must pay for goods. Or they can invest the money in businesses. But as any business owner will tell you, it is hard to profit from a business when you have no customers, which has been effectively demonstrated by the Great Recession.

Reducing the $16 Trillion Deficit

The financial crisis of 2008 plunged the United States and the rest of the world into what was called, for its severity, the Great Recession. Economies run on their own cycle, regardless of who is president, because most factors affecting the economy are beyond their control. When recessions do occur, it takes time for them to reach bottom and to recover, and the deeper the recession, the longer it takes to recover from it. When Obama became president, the economy was still contracting, only reaching bottom in the middle of his term. The United States is currently on an upswing and it will continue to improve whether Obama or Romney is elected. President Obama, for the most part, has done the right thing. He needed to increase the deficit because no one was spending any money. Many were in debt, and it takes time to pay off that debt, as anyone knows, and if they are paying off debt, then they cannot spend money for discretionary products and services, which is a major reason why the economy contracted and why it is only slowly recovering. Furthermore, businesses will not invest or hire if they have no customers, and if they are not hiring, then the economy contracts even further. Hence, Obama had to increase the deficit to stimulate the economy.

Nonetheless, this has not prevented the Republicans from repeatedly criticizing Obama for increasing the deficit, even though their plan of slashing both spending and taxes does not make much sense, so Romney has not provided any details about his deficit reduction plan before the election. Obama had to increase the deficit because only the federal government was in a position to spend money to stimulate the economy. The necessary borrowing has increased the deficit dramatically, but without the stimulatory spending, the United States would have plunged into a deeper recession. It would not have been so bad had Bush not borrowed money so that he could give big tax breaks to the wealthy. Borrowing money should only be done to handle a financial crisis, not to give handouts to the wealthy, who already have much more than they need.

Are the Republicans serious about the deficit? Apparently not. It has been widely publicized that the Republicans have said that they are not willing to increase taxes by $1 even if it reduced the deficit by $10. Plainly, the Republicans main objective is to protect the wealthy from their fair share of taxes, not to decrease the deficit. They have some concern about the deficit since they know that if it increases too much, the wealthy will be called upon to pay their fair share.

Indeed, the top 1% of the wealthy earn almost 20% of the gross national income. That's more than $3 trillion annually. If they were forced to pay at least 50% of that income in taxes, the $16 trillion debt could be eliminated by just the tax on the upper 1% in 11 years. Even paying 50%, these 1%-ers will still have plenty of money to buy whatever they want or need, and it would only be just, considering the lower statutory rates on their income and the many tax loopholes they have exploited. Anyone really serious about reducing the deficit would certainly look to the wealthy to help pay down the debt.

Many tax experts agree that Romney's plan is unrealistic, so at some point, if he were to become President, he will have to raise taxes. But how will he do that? The wealthy have spent enormous sums of money for his election to protect their big tax breaks. Therefore, there will be tremendous pressure on Romney to not increase taxes on the wealthy, so if it does become necessary to raise taxes, he will almost certainly try to raise them on the lower-income people.

The lower-income people will also suffer from spending cuts, because not only do tax cuts to the wealthy not stimulate the economy, but the spending cuts that would be instituted by Romney would have a contractionary effect on the economy since it would eliminate many jobs.

The upshot of all this is that regardless of how much spending is slashed, if the wealthy do not pay more, then poorer people must pay more than they would otherwise have to. Now that the deficit is slightly over $16 trillion, attempting to reduce it without the wealthy paying more will be a long slog.

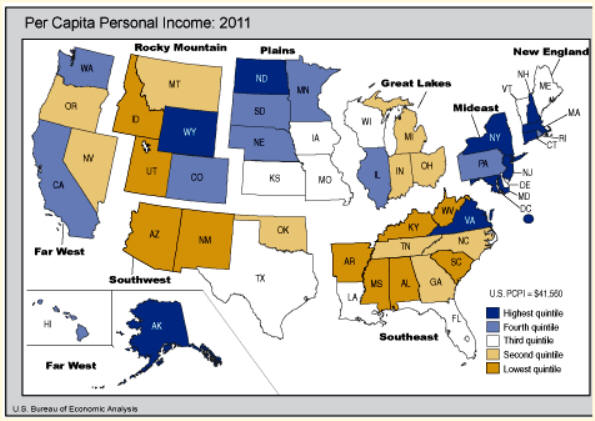

By contrast, all the states in the top quintile of income are democratic states except for North Dakota, Wyoming, and Alaska, which have sparse populations and rich natural resources, so jobs in these states often pay higher wages to compensate for the inhospitable climate.

A Simple, Fairer Tax System

Technology will make it easier for a few individuals to make ever more money, and it seems that the Republicans want to ensure that they keep more and more of their wealth at the expense of everyone else. Though trying to ensure a fair government is a long shot, a good way to start is with the tax laws since those laws affect almost everyone. It is why the rich are getting richer and the middle class and the poor struggle to make even small gains. Of course, both Democrats and Republicans are responsible for the tax laws, and no doubt the tax laws, especially regarding inheritance, are so because most members of Congress benefit from them. Many members of Congress come from wealthy families and even if they are not wealthy when they begin office, they will become wealthy by being a member of Congress. So, many of them have received or will receive a large inheritance and they will have a large inheritance to bequeath.

A simpler and fairer tax system would be a marginal tax on all income. This differs from the Republican proposal for a flat tax system in that it would apply to all income, including investments and inheritance. By assessing a graduated marginal tax on all income, most loopholes can be closed, the poor would have more money to spend, which would stimulate the economy continually, even during recessions, and the poor would be less dependent on what the rich like to call "government handouts".

There have been various proposals for a more equitable tax system. Some have argued for a value-added tax (VAT), which is prevalent in Europe. However, the VAT, like sales and excise taxes, is regressive, in that it puts a greater burden on the poor. The Republicans have argued for a flat tax, but, alas, one that applies only to working income. Surprise! Furthermore, the flat tax, as proposed by the Republicans, would not apply to employment taxes, and it would lower the top rate on wealthy people. Surprise again!

I propose a marginal tax that applies to all income, regardless of its source, and that the tax be the only tax on income — no separate employment taxes. After all, that would be double taxation! And aren't the Republicans against that anyway? And is it fair that people who must work past retirement age should have to continue paying employment taxes while other people collecting fat pensions only have to pay the ordinary income tax? And many states and municipalities tax work, but not pensions. Eliminating employment taxes would reduce the cost of labor to employers and increase the money received by the suppliers of that labor, thereby motivating more people to work while eliminating the deadweight loss of employment taxes. Instead, Social Security and Medicare should be paid out of the general tax revenue. Everyone should receive the same amount of Social Security, so that nobody falls through the cracks, and if people want to do better, then they can do so through private retirement accounts.

I think all deductions should be eliminated except for those expenses that are ordinary or necessary to produce income or to help low-income families. I also believe that the estate tax should be replaced with an inheritance tax since the rate on the inheritance tax can be proportional to the beneficiary's income. Under this system, the wealthy really will pay a larger percentage of their income in taxes, and the poor will have more money available to buy the essentials of life. Furthermore, the poor will be the automatic stabilizers of the economy since they must continually spend money to live.

The main concern of the Republicans is for the wealthy, but many Democrats also pass legislation beneficial to the wealthy or to other special interests, such as lawyers or unions. Unfortunately, we do not live in much of a democracy since we are often forced to choose between extremists chosen by the parties' primaries, reducing the general election to a choice of the lesser of 2 evils. However, taxation is something that affects all of us, and I believe that the tax system in the United States is very unfair, so this should be the main concern of most taxpayers, and it would be if most of them better understood how the tax system works.

The Republicans advance many arguments to try to justify the status quo, but all these arguments are specious. They argue that high taxes kill jobs. That's true, high taxes on lower income people do kill jobs, but not high taxes on the wealthy. President Bill Clinton raised the top marginal tax rate to 39.6%, and yet, the economy boomed from 1994 to 2000. They argue that taxes on investments will reduce investments. They will, somewhat. But what about taxes on work? Doesn't that reduce the incentive to work? Remember, only work increases the wealth of society. Investments can only increase the wealth of society if it puts somebody to work — otherwise it would have no effect. Furthermore, the wealthy will still continue to invest, because what else will they do? If they hold cash, it will lose value through inflation.

Right now, the United States is deeply in debt. George W. Bush received a budget surplus from President Clinton and proceeded to plunge the country into debt so that big tax breaks could be given to the wealthy. Of course, 2 wars added to this debt, but the country would've been much better off without these tax breaks. These tax breaks allowed the rich to become ever richer while lower income people become poorer.

The Republicans propose to drastically reduce spending, but not on the military. They want to eliminate Social Security and Medicare and replace them with private systems. They want to get rid of the Affordable Care Act, which the Republicans have dubbed as Obamacare, because they realize that it would lead to higher taxes on their wealthy benefactors. Of course, many people, especially those with pre-existing conditions, cannot afford healthcare otherwise, but the Republicans don't care about those people — they only care about the wealthy.

The Republicans have made it clear that they will not increase taxes on the wealthy no matter what. Not only will they not increase taxes on the wealthy, but their objective is to lower them, but they will still claim that they will eliminate the huge deficit. How will they do that? They haven't revealed any details since the plan is unrealistic anyway, but it involves eliminating as many payments and tax breaks to the poor and middle class as possible, and at some point, they will seek to increase taxes on the 99%. How else will they do it?

As the Republican nominee for President, many people are requesting to see more than the 2 years of tax returns from Mitt Romney that he has so far released. Mitt Romney doesn't want to release any more tax returns and he has filed an extension for his 2011 returns, which is a convenient way to delay showing Americans how little he pays in taxes. He says that the fuss about his taxes detracts from the real issues affecting the economy. But I would say that the hefty taxes that most people must pay are the most important issue today since it has a direct impact on their standard of living. And as I have argued above, letting poorer people keep more of their money would have a much greater stimulating effect on the economy than any other scheme contrived by patronizing politicians. Romney says that people are not interested in his personal taxes. Well, I can tell you what Americans are really interested in: How is it that a man who makes tens of millions of dollars annually legally pays a lower effective tax rate than someone whose income is only slightly above the poverty level? That's the real question!

Conclusion

There is a reason why the Republicans are called conservatives, because they want to maintain the status quo. The tax system has always favored the wealthy, even when marginal tax rates were very high, because there were plenty of tax loopholes that either greatly reduced the effective tax rate or even eliminated taxes for many of the wealthy. Since the wealthy are getting a pretty good deal under the current tax system, many of them want to continue that system.

And what about the many people who cannot afford medical insurance, a decent place to live, or even food? The Republicans don't care about them — they never have! If the Republicans throw a few crumbs to the middle class, or even to the poor, it is only to get their vote so that they can remain in office, where they can vote against the economic interest of most of those who put them in office. There is an old saying that you cannot fool all the people all the time. In politics, you don't have to. Evidently, it is good enough to fool most of the people most of the time!

Republican tax policy can be easily summarized. Income has only 3 types: working income, investment income, and gratuitous transfers. The Republicans believe that neither investment income nor gratuitous transfers should be taxed. Therefore, Republicans believe that working people should pay all the income taxes. And that is the Republican tax policy in a nutshell.

2017 Update

I am writing this on April 1, 2017. The Republican Party now has full control of the government, with control of both houses of Congress and with Donald J Trump President. Their main objective is tax reform, where they want to eliminate the estate tax and the alternative minimum tax and they want to reduce the top marginal tax rate from 39.6% all the way down to 33%. They also wanted to repeal the Affordable Care Act, but so far, they have failed. Most Republicans wanted to simply repeal the ACA, to repeal the ACA taxes, including the 3.8% Net Investment Income Tax and the 0.9% Additional Medicare Tax, where most of the burden fell on the wealthy.

If the wealthy get big tax breaks, the revenue must be made up by increasing taxes on another group since it makes no sense to give big tax breaks to one group, then increasing other taxes on the same group to pay for it. Hence, more of the tax burden is shifted onto the working class since it makes sense to pay for tax breaks for the wealthy by increasing taxes on the non-wealthy. The only other option is to increase the deficit, a limited option since the government is already more than $25 trillion in debt. George W. Bush increased the deficit to pay for tax breaks for the wealthy (and to finance 2 wars), so the government was also already so deeply in debt when the Great Recession occurred. If Bush did not increase the deficit, then then the country would've been in a much better position during Barack Obama's presidency to stimulate the economy.

The Republicans wanted to pay for the repeal of the ACA taxes by rolling back the Medicaid expansion and eliminating the subsidy payments that enabled 24 million Americans to afford health insurance. Since major tax breaks benefit the wealthy, Republicans will pay for this tax by increasing taxes on the non-wealthy, through a border adjustment tax (BAT), which will increase the price of many goods and services. Hence, this is just yet another scheme to redistribute the wealth from working people to the wealthy. Many Republicans oppose the border adjustment tax, because it will be detrimental to their pet projects and to many businesses. Nonetheless, the Republicans will push the BAT because they need to pay for these tax breaks.

Republicans need to rationalize this redistribution by rationalizing that it is really for the public good. Hence, they are trying to sell the BAT by insisting it will increase jobs because the BAT will tax imports but not exports. Considering the complicated nature of the economy nowadays, with many individual components manufactured in many different parts of the world, the BAT will increase prices for many products. Furthermore, increasing prices will depress the economy since it will make it more expensive for the poor and middle-class to buy goods and services. Consequently, they will cut back, thereby shrinking the economy. Moreover, it is ludicrous to think that other nations will not respond with their own tariffs on our exports, thereby reducing exports and its associated jobs.

The Republicans argue that the BAT will not increase prices so much because the dollar will become stronger, thereby reducing the cost of the imports. But, whether that is true or not, it doesn't explain why all the tax cuts should go to the wealthy. Why not use this increased tax revenue to lower taxes on poor people so they can afford health insurance?

Consumption taxes have the same effect as higher income taxes: the economy declines because products and services are more expensive. Consumers will cut their spending, causing businesses to lose business.

The poor need more money. That the poor should receive the tax breaks instead of the wealthy is also buttressed by the fact that the Republicans are against abortion, or so they say. That's 1 of the hot button issues that they support so that they get votes. I'm sure that many Republicans do oppose abortion, but many, including the big donors, do not care, or even support abortion, but they do support the Republican party for the lower taxes on the wealthy. Nonetheless, most people know that children cost money, and many simply cannot afford to have children. But the Republicans do not want to help the poor, not even to care for their own children. The other reason why the poor should get the tax breaks is because that's what stimulates the economy the most. Tax breaks to the wealthy don't do anything for the economy, as evinced by the economy during the administrations of Bill Clinton and Barack Obama. Both presidents taxed the wealthy more heavily than the Republican administrations have, but the economy boomed anyway. It is also well established in economics that poor people spend money that they receive faster than richer people. This also makes intuitive sense since poor people need to spend their money, whereas rich people already have most of what they want, and if they wanted something else, they would still have sufficient wealth pay for it, even with higher taxes. Hence, not only would it help the poor, but it would also improve the economy, which will even benefit the wealthy since money trickles up faster than it trickles down!

And if the Republicans are against abortion, then they should help the poor more than the rich. People need to provide for their children, for if they do not, for want of money, then many of those children will resort to crime, which often happens in the ghettos of the United States; not every child, but many of them, enough to cause a great deal of misery for people who must live in those areas, causing a greater expense for cities. Just to give you a good idea of the difference between the wealthy and the poor, consider the Child Tax Credit and the unified credit. There is a work requirement for the Child Tax Credit so that parents who do not work or do not have sufficient income cannot claim the full amount of the credit. On the other hand, there is absolutely no work required for the unified tax credit, even though the credit itself is worth millions of dollars and, unlike the Child Tax Credit, is adjusted annually for inflation.

Republican tax policy increases taxes on the poor and the middle class, making it very difficult for them to afford the necessities of life, including health insurance. The main reason why the Republicans couldn't get the ACA repealed is because some Republicans were concerned about people losing their health insurance, while others thought that it was not a strict repeal but an Obamacare-lite plan. The healthcare credits that they were offering would have been totally inadequate for people who were between 50 and 64 years old, because their premiums would've skyrocketed to about $15,000 annually, making it unaffordable for many, even with the $4000 tax credits Republicans were offering.

Consider these contrasting concerns. The Republicans often argue there should be no estate tax to protect farms and businesses, so that the heirs need not sell them to pay the tax. Of course, the tax code already has provisions allowing the heirs to pay the tax over 14 years. And they can just hire lawyers and figure out how to pay the tax. After all, is that not how they avoid or evade many taxes? And, of course, there is always life insurance! But, as the 2017 Republican administration has demonstrated, many Republicans don't care if people have health insurance! They are more concerned about rich people keeping their big farms and businesses in the family. That poor people don't have health insurance, well, that doesn't concern them. Some are concerned, which is partly why the repeal of Obamacare has not passed yet, but many more conservative Republicans don't really care about whether poor people or their children have health insurance or not; their concern is strictly with the wealthy. As the old George Carlin joke goes, the Republicans don't want you to have an abortion, but once the kid is here, he's on his own.

Another thing to note is that Paul Ryan wanted to get rid of all these taxes on the wealthy, because, as he has argued, they are job-killing taxes. However, both Bill Clinton and Barack Obama increased taxes on the wealthy and both times the economy boomed. During the George W. Bush administration, the economy faltered, though there was a boom from 2004 - 2007 that was fueled by debt, where the money supply was increased by giving credit to people who would have difficulty paying back the loans. Naturally, any boom fueled by debt must end badly, as it did. So, Barack Obama improved the economy by increases taxes on the wealthy and by providing a credit to the poor so that they can afford health insurance, which stimulated the economy because then they could afford medical products and services, which has a multiplier effect on the economy. Though the economy continues to do well, certainly through no effort of Donald J Trump and the Republican administration since it is much too early for them to have any significant effect on the economy, my prediction is that once their tax policies are implemented, then the economy will decline, just as it usually does under Republican administrations, as evinced by the past.

So why do the Republicans persist in their policies and their specious reasoning: corruption. The Republicans depend on major financing from big donors who want lower taxes on themselves, so the Republicans do not care whether it would be in the best interest of the economy to lower taxes on the poor; their only concern is with the wealthy. Every election cycle, the Republicans get large sums of money from big donors, and the main concern of these big donors is to have lower taxes on themselves: they don't care about the poor or the middle class. Since the Republicans took their money, they are therefore beholden to them, so they must do what they want, not what is in the best interest of society or the economy. We ask people who join the military to be willing to give up their lives for their country. Is it too much to ask politicians to give up some of their donations for the good of their country? Evidently, it is!

April, 2018

The Republicans claim to be deficit hawks. It is always the excuse they give when they want to cut Social Security, Medicare, and Medicaid, so-called entitlement spending. Why the Republicans consider Social Security and Medicare entitlements baffles me since people who work pay a high percentage of their income in employment taxes, and they must pay those taxes all their working lives, even if they start collecting Social Security and qualify for Medicare, while they continue to work. By contrast, the wealthy didn't pay anything for their big tax breaks, except for their generous donations to the Republican Party. However, unlike employment taxes, donations to the Republican Party do not help finance the government or finance the lavish tax breaks given to the wealthy.

At the end of 2017, the Republicans passed a major tax overhaul, giving most of the benefits to wealthy individuals and big businesses. This came as the economy peaked, when taxes should have been raised so that the federal debt could be lowered, so that when the economy enters a recession again, as it always does at some point, the government will be in a better position to weather the recession. When the Great Recession began in 2007, the federal debt was already humongous, because the 1st order of business for George W. Bush, as it is with most Republicans, if to enact tax breaks for the wealthy, which helped undermine the fiscal position of the United States as it took on 2 wars, and then had to battle the Great Recession. Obama had no choice but to increase the deficit further, not to give tax breaks to the wealthy, which is why the Republicans passed the tax reductions, but to improve the economy, so that most people can start working again and stop suffering. The 2017 tax reduction package was passed because the Republicans argued that it would stimulate the economy which would pay for the tax rate decrease. Most people understood that that was not the case, and as time passes by, it is becoming even more apparent that the deficit will increase even more than they imagined.

The so-called deficit hawks, such as Paul Ryan, who was Speaker of the House during this time, argued that the United States must reduce spending for entitlement programs to reduce the deficit. But actually, that is not true. As I have already argued, the deficit could also be reduced by increasing taxes on the wealthy, because as Bill Clinton demonstrated, you can increase taxes on the wealthy and the economy can still grow. This is because the propensity to consume is inversely proportional to wealth, so giving tax breaks to the poor and the middle class stimulates the economy much more than giving tax breaks to the wealthy. The poor need all the money that they can get, so they spend it all, while the wealthy already have most of what they want or need. And if the tax breaks to the wealthy are paid for by increasing taxes on the poor and middle-class — or by decreasing payments to the poor or middle class, such as cutting Social Security and Medicare — than the negative effect of putting the tax burden on the lower classes will far exceed any benefit to the economy by giving even more tax breaks to the wealthy than they already have.

When the only argument that the Republicans present to reduce the deficit is by cutting entitlement spending, then their real concern is not really with the deficit, their real concern is that not enough wealth is being transferred from the poor and middle classes to the wealthy, so that they can become even richer than they already are, and, in turn, can transfer some of those riches to the Republican Party. If they were really concerned about the deficit, they would have raised taxes when the economy is so strong. That they didn't indicates that their real concern was giving more tax breaks to the wealthy.

And why should economic growth pay for tax breaks indefinitely, especially for permanent tax breaks. The economy always moves in cycles, moving up and down continuously. So, what happens when the economy is down? Well, I guess the rich will continue to enjoy their tax breaks. Meanwhile, the federal government grows further and further into debt, which will require more aggressive solutions later.